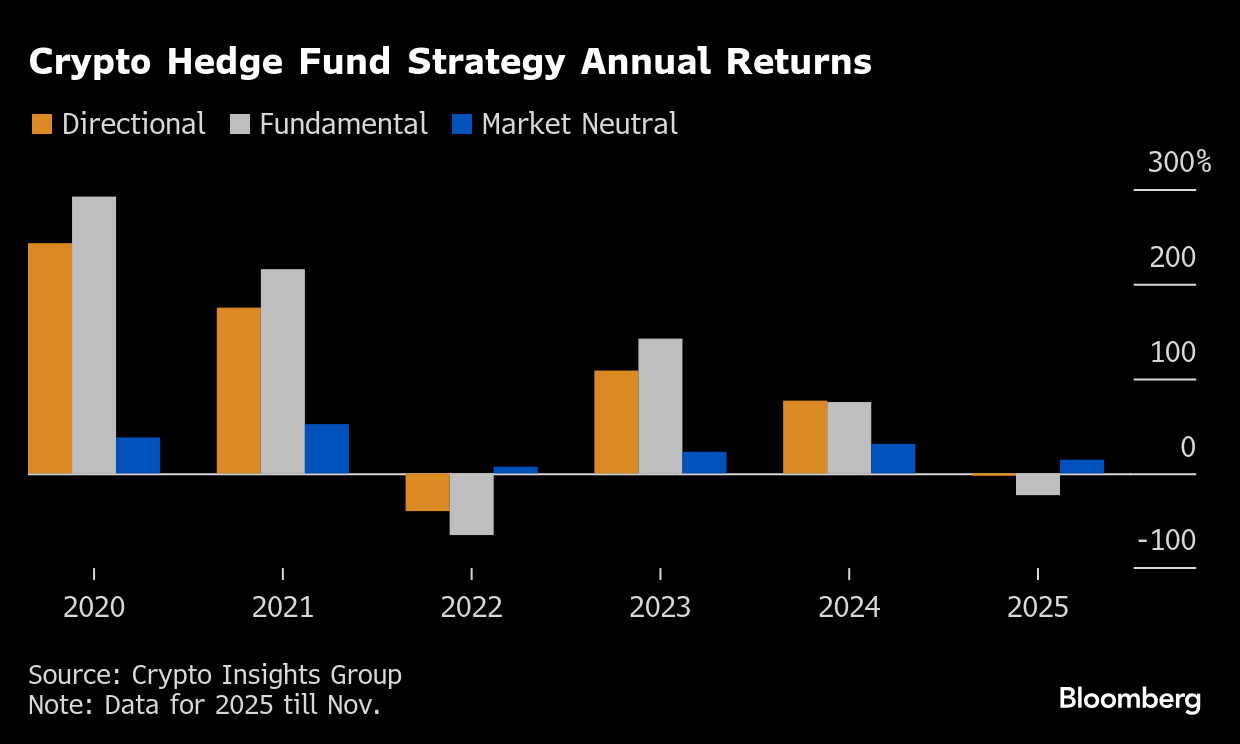

- Directional crypto hedge funds slumped 23% in 2025, marking the worst year since the 2022 crash.

- The $2B Oct 10 ADL event and basis trade decay wiped out arbitrage gains for institutional funds.

- Market-neutral funds managed a 14.4% return by staying hedged against 2025’s thin liquidity bursts.

With less than two weeks to the end of 2025, crypto hedge funds are about to record their worst annual performance since 2022. Professional managers tracking market momentum and underlying fundamentals have seen their returns spiral into negative territory through November.

In a sharp split from the broader rally, only market-neutral strategies managed to eke out gains, fueled by a move toward risk-hedged vehicles as the “easy money” era of crypto arbitrage vanishes.

Explainer: The Three Faces of Crypto Hedge Funds

To understand this market shift, traders must be able to find the difference between the three primary strategies currently active in the space:

- Directional Funds: These Beta managers bet on specific price movements. In 2025, these funds were trapped by aggressive whipsaw moves that punished those seeking to profit from price swings.

- Fundamental Funds: These VC-style managers select assets based on technical utility and team strength. These funds were hammered in 2025 as altcoins bled against Bitcoin’s dominant market share.

- Market-Neutral Funds: The Arbitrage specialists. These managers seek profit regardless of price direction by using the Basis Trade; buying spot assets and selling futures to capture interest rate spreads. They are the lone survivors of the 2025 cycle.

The Basis Trade Decay: Why the $126K Bitcoin Peak Failed Managers

Bloomberg’s investigative data reveals a stark reality: 2025 was supposed to be a breakout year fueled by White House support and institutional entry.

Instead, it became a liquidity trap. While Bitcoin hit a record $126,000 in October 2025, the price action occurred in thin liquidity bursts. This made it nearly impossible for institutional funds to enter or exit positions without massive slippage.

Which proves why the historically lucrative basis trade evaporated. As Wall Street firms moved deeper via ETFs, spreads tightened, and the double-digit monthly returns once enjoyed by early crypto funds are now a memory.

This basis trade decay is a primary reason why directional funds are down 2.5% and fundamental-focused funds have plummeted by 23% through November 2025.

On the other hand, the market-neutral crypto hedge funds reported annual returns of about 14.4% through November 2025.

Macro Blows: S&P 500 De-coupling and the $2B Flash Crash

The sector-wide slump was ignited by a cluster of macro headwinds that caught managers off-guard.

- The S&P 500 Split: Unlike 2024, crypto moved away from tech stocks in late 2025. While the S&P 500 hit record highs (up 16% YTD), crypto struggled with “fatigue” and low volume.

- The October 10 Auto-Deleveraging (ADL): The October 10-11 crypto flash crash that wiped out over $2 billion in a single move heavily influenced the losses of both directional and fundamental crypto hedge fund managers. This ADL event, worsened by the escalating U.S.-China trade war forced fund managers into a painful liquidation spiral.

- The DC Gridlock: Regulatory uncertainty remains a primary bottleneck. The U.S. Senate’s failure to pass the Clarity Act has chilled institutional demand.

As Cardano founder Charles Hoskinson noted, the crypto issue has been politicized ahead of the 2026 midterm elections, thus delaying the expected crypto supercycle in 2025 to potentially next year.

Related: Hoskinson Blames TRUMP Token Timing for Clarity Act Stall in Senate

What Does this Mean for 2026?

According to a report from Crypto Insights Group, 2026 will present an environment to crypto hedge funds that is less about initiating exposure but more about deciding which strategies enhance higher inclusion.

“By the end of 2025, digital asset investing felt more accessible to institutions and more demanding at the same time. Regulation expanded access, while allocator behavior established higher standards. Active management in 2026 will be shaped by who’s prepared to meet those standards,” the report concluded.

Related: Why Bitcoin’s Old Cycle Timing Failed in 2025 and What Replaced It

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.