- Bitcoin drops below $90,000 as ETF outflows and liquidations pressure markets.

- More than $400 million in crypto positions are liquidated in a day, mostly long positions.

- Ethereum, XRP, Solana, and BNB extend month-long losses amid weaker institutional demand.

Crypto decline on Friday extends to Saturday as a combination of rising U.S. Treasury yields, institutional outflows, and another round of liquidations sent the market into a deeper pullback.

Major assets, including Bitcoin, Ethereum, XRP, Solana, and BNB, extended their month-long declines as risk sentiment weakened across digital assets.The broader crypto market cap shed more than $80 billion in hours, with a total 2.7% decline in the past day. In response, crypto market sentiment fell into fear territory.

ETF Flows Show a Significant Drop

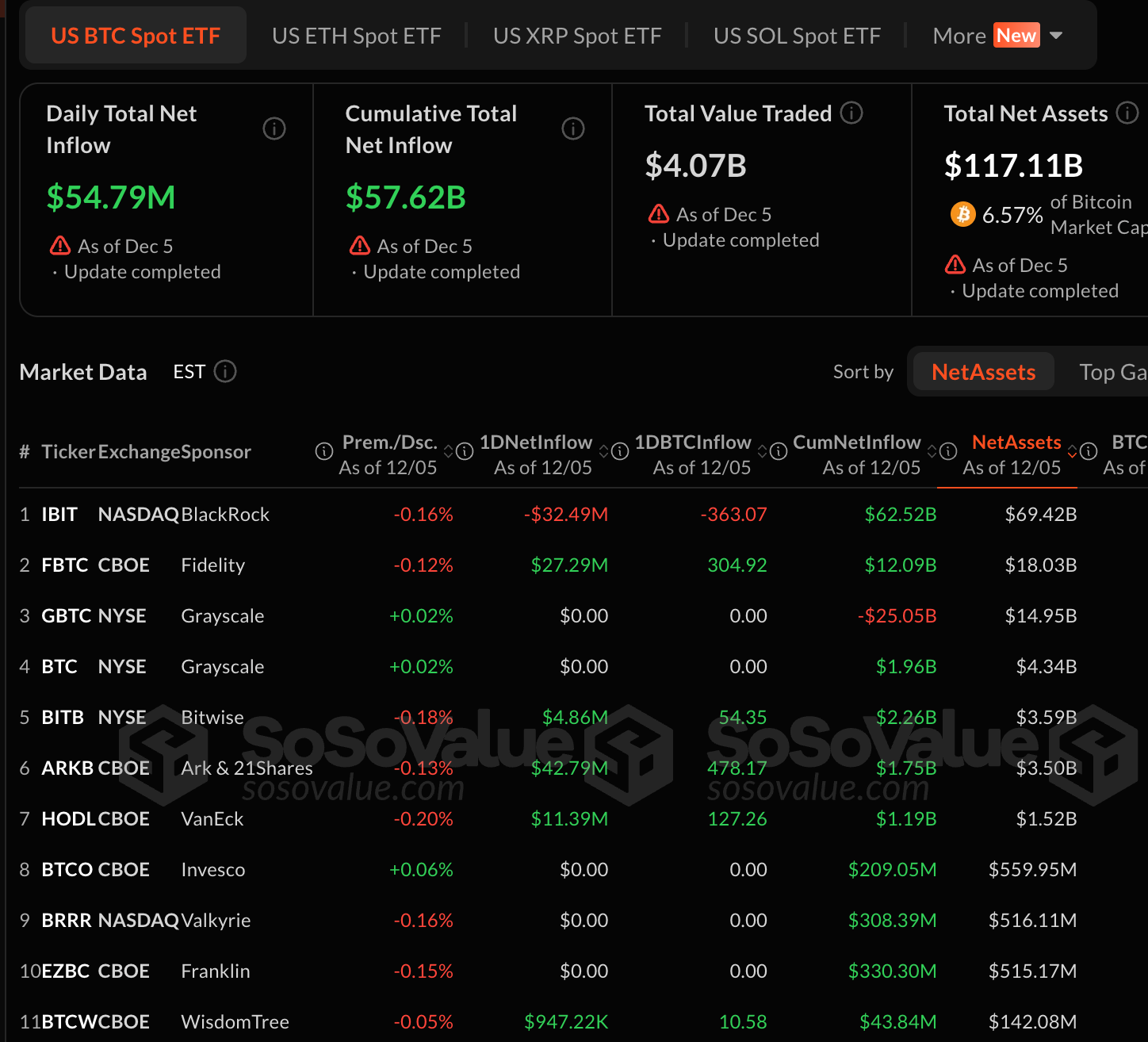

SoSoValue’s ETF flow data captured a dramatic two-day swing that helped define the market mood. Thursday, December 4, saw Spot Bitcoin ETF outflows totaling approximately $194.64 million, the largest daily outflow since November 20.

That withdrawal materially increased selling pressure and coincided with a sharp intraday move lower for Bitcoin.

Related: Bank of America Authorizes 15,000 Advisors to Pitch Bitcoin; CIO Sets ‘1-4% Allocation’ Standard

On Friday, December 5, flows turned mildly positive with a daily net inflow of $54.79 million. However, the recovery was modest relative to the prior day’s exodus and insufficient to reverse the selling momentum.

Cumulative inflows remain substantial at $57.62 billion, and total net assets across Bitcoin spot ETFs stand near $117.11 billion. Yet, the inflow curve has effectively flattened in December, signaling waning institutional conviction.

Ethereum and Solana See Outflows

Similarly, Ethereum ETFs saw more than $50 million in outflows earlier in the week, while Solana products registered $32 million in redemptions. The combined reduction across major ETFs added meaningful sell pressure to an already fragile market structure.

Meanwhile, at the close of business on Friday, Solana ETFs welcomed $15 million in new investments, while Ethereum ETFs recorded another $75 million in sales.

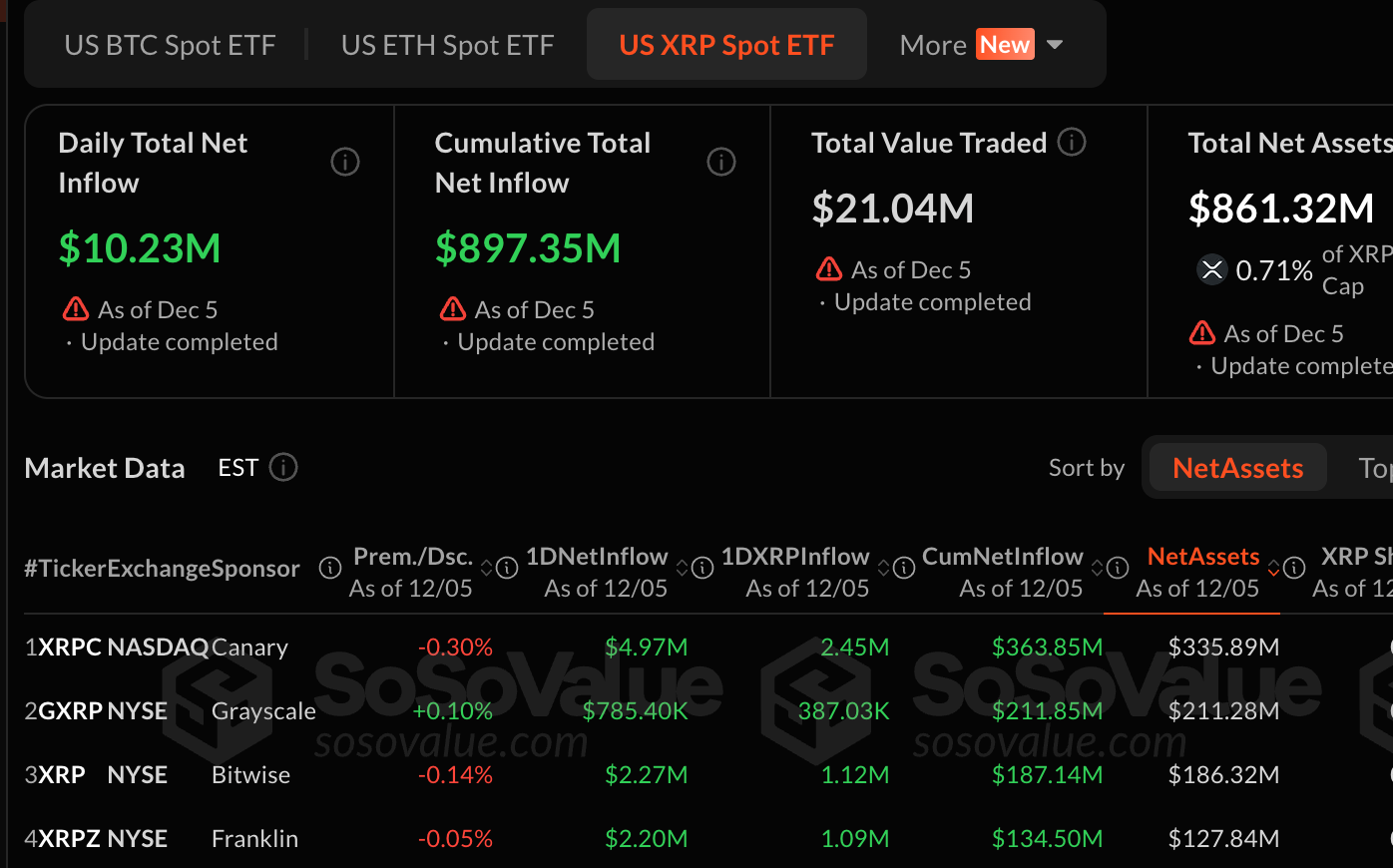

XRP Bucks the Trend

Interestingly, XRP ETFs have defied the outflow trend seen across other crypto ETFs. The products have continued to attract new investment every trading day since their launch. On Friday, new inflows worth $10.3 million came in from Canary Capital, Bitwise, Grayscale, and Franklin. Total inflows now stand at $897 million.

However, these continued investments have not benefited XRP’s price. The coin is trading in the red at $2.04, threatening to lose the $2 support level.

Liquidations Accelerate the Decline

Meanwhile, the ongoing downturn deepened as leverage unwound. Per CoinGlass, more than $411 million in crypto positions were liquidated in the past day, affecting 132,442 traders.

Most of the liquidation value came from long positions that were forced to close after Bitcoin lost support near $90,000. A single liquidation worth $8.5 million was recorded on Hyperliquid, underscoring the concentration of risk in perpetual futures markets.

Bitcoin Slips Below Key Levels

As of this press time, Bitcoin trades at $89,732.53, down 2.6% in the past 24 hours and 13% lower over the past month. The asset touched a five-day low near $88,000 after failing to stay above the $92,000–$94,000 range.

Ethereum is at $3,039.30, down 4.0% on the day and 10% for the month. Similarly, XRP trades at $2.05, falling 1.8% in the past day and 12% in the past month.

Other major altcoins also see a decline. Solana sits at $133.15, down 4.1% on the day and 16.5% for the month. Also, BNB trades at $884.12, down 2.2% over 24 hours and 7% for the month. Several other altcoins, including APT, HYPE, PUMP, PEPE, WLD, and AVAX, also recorded deeper intraday losses.

Bond Market Moves Add Macro Pressure

U.S. Treasury yields added another layer of stress. The 10-year yield jumped 4% on Friday to its highest level since Nov. 14 and posted its strongest weekly rise since June.

This came even as the latest PCE report showed inflation growing in line with expectations, fueling calls for a rate cut at the December Federal Reserve meeting. However, elevated headline PCE readings and widening fiscal concerns signaled that long-term borrowing costs may remain high into 2026.

Related: Kevin O’Leary Declares Altcoins Are Dead, Calls Bitcoin and Ethereum the Only Survivors

Market participants now look toward upcoming central bank meetings, ETF flow trends, and leverage metrics to determine whether crypto stabilizes or faces deeper downside in the weeks ahead.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.