- Hyperliquid now controls 17% of global perpetual futures interest.

- HYPE token has surged 4x since April, momentum building fast.

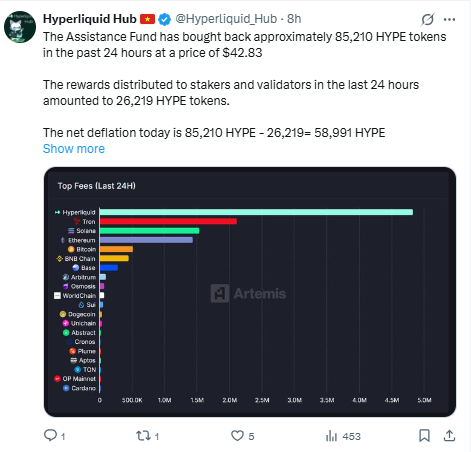

- Buybacks outpace emissions, creating a deflationary trend for HYPE.

In the cryptocurrency ecosystem, Hyperliquid (HYPE) has been gaining attention recently with its record-breaking growth and rising market influence. Sharing his opinion over the token, Ryan Watkins, co-founder of Syncracy Capital, shared in his podcast that Hyperliquid is quickly positioning itself as a real competitor to giants like Ethereum and Solana.

A Quiet Rise to the Top

Earlier this month, Hyperliquid hit record highs in nearly every category, which includes, trading volume, user growth, revenue, deposits, and open interest in its perpetual swaps market. Moreover, it gained more market share from centralized exchanges than ever before.

Watkins also stated his surprise on how the rise of Hyperliquid is not just challenging for other blockchains but also for centralized exchanges like Binance, OKX, and Bybit.

As of press time, Hyperliquid now holds 17% of global open interest for perpetual futures trading, an area dominated by these big exchanges. According to Watkins’ estimates, the potential market for Hyperliquid could reach $500 billion, which includes spot and derivatives trading, Layer-1 blockchain infrastructure, and additional financial applications built on top of its base layer.

A Healthier Market Structure?

HYPE has been one of the strongest-performing assets in recent months, gaining nearly 4x since its April low. The token is currently testing its uptrend support and the key resistance zone around $47–$48. If it breaks above this level, a big price rally could follow, as momentum is steadily building.

Related: The SEC Accidentally Gives Out “Buy the Dip” Watchlist for Altcoins

Over the last 24 hours, the platform’s Assistance Fund repurchased over 96,000 HYPE tokens at around $43.92. However, only 26,159 tokens were distributed to stakers and validators, resulting in a net deflation of 70,171 tokens for the day. This trend suggests over 2.1 million tokens could be burned monthly and over 25 million annually, making HYPE deflationary compared to Solana’s inflation.

Currently, the Assistance Fund holds over 27 million HYPE tokens, worth around $1.18 billion. With 92.78% of the platform’s revenue going into buybacks, and the HyperEVM launch ahead, Hyperliquid is coming out as a strong contender in the evolving crypto space

Related: Ethereum Faces Breakout Moment as Top Analyst Eyes $10K Bull Market Target

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.