- On-chain data analysis shows ENA whales have been accumulating aggressively in the recent past.

- Ethena’s recent strategic partnerships and stability of USDe amid market turmoil have influenced the ENA price.

- Technical analysis shows ENA price is in the early stages of its macro bull market.

As the crypto market recorded heavy liquidation of long traders, amounting to nearly $1 billion, Ethena (ENA) rewarded its buyers. The utility-based mid-cap altcoin gained as much as 18%, during the past 24 hours, to reach a range high of about 45 cents on Saturday, October 18, during the early European session.

Why is Ethena Price Up Over 10% Today Amid Crypto Selloff?

USDe Resilience Amid Crypto Crash

The ENA price rebound amid the notable crypto crash was heavily influenced by the stability of Ethena USDe (USDe). During last week’s historic crypto crash, which wiped out nearly $20 billion in 1 day, USDe experienced a temporary depeg.

However, the large-cap stablecoin, with a fully diluted valuation of about $12.2 billion, held its peg to the U.S. dollar during the recent crypto selloff.

Rising Demand for ENA Amid Negative Funding Rates

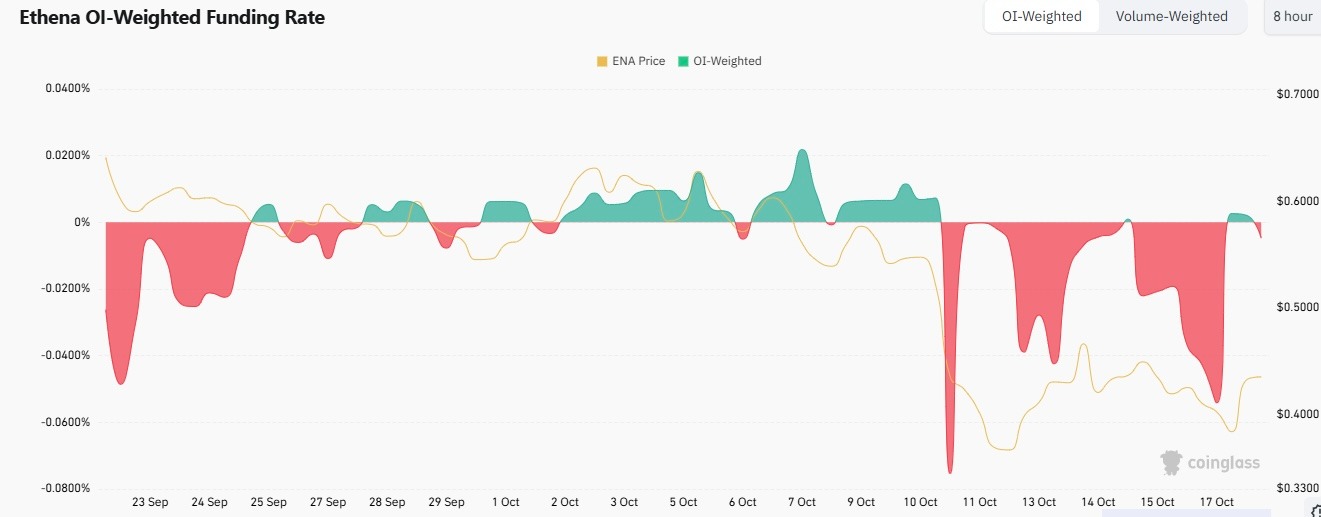

Today’s notable ENA price rebound was partially influenced by the token market dynamic. According to market data analysis from CoinGlass, ENA’s funding rate has recently turned negative. Historically, a negative funding rate is associated with bearish sentiment and vice versa.

However, on-chain data analysis shows a renewed demand for ENA. A multisig wallet, likely associated with Ethena CEO and Founder, accumulated ENA tokens valued at about $25 million during the last few days.

During the past few days, the ENA Futures Open Interest (OI) has gradually increased to about $618 million. The rising ENA’s OI and spot demand amid its negative funding rate have bolstered its bullish outlook.

Growing Adoption of Ethena Products

The Ethena ecosystem has grown to a robust Web3 community fueled by its regulatory compliance and rising organic adoption. According to market data from DeFiLlama, Ethena’s total value locked (TVL) has surged from $5.46 billion in July 2025 to hover about $12.4 billion at press time.

Related: Ethena Secures $20M From UAE’s M2 Holdings as Synthetic Dollar Protocol Expands Market Reach

Ethena Labs announced that its Stablecoin-as-a-Service stack was integrated with Conduit, a web3 protocol that powers 55% of chains on Ethereum with over $4B in TVL across over 60 mainnet deployments. Since Ethena Labs unveiled its Stablecoin-as-a-Service stack, it has integrated with MegaETH Labs, Sui Network, and Jupiter Exchange.

What’s Next for ENA Price?

After its rebound during the past 24 hours, ENA price may be poised to make further gains fueled by its strong fundamentals. According to crypto analyst Ali Martinez, the ENA price is well-positioned to rally towards $1.3 in the midterm, if a reversal pattern is confirmed.

Related: “Not a Depeg but a Tokenized Hedge Fund”: OKX CEO Defends Ethena After USDe Crash

In the long term, market analyst Crypto Patel noted that the ENA price is on track to hit $5 before the end of this bull run.

The crypto analyst noted that ENA’s macro bullish outlook will remain intact if it holds above the support range between 30 and 40 cents.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.