- Ethereum surged above $2,000, reversing previous bearish sentiment.

- Large holders withdrew significant ETH from exchanges.

- Despite the bounce, the larger trend remains bearish with support testing below $2K.

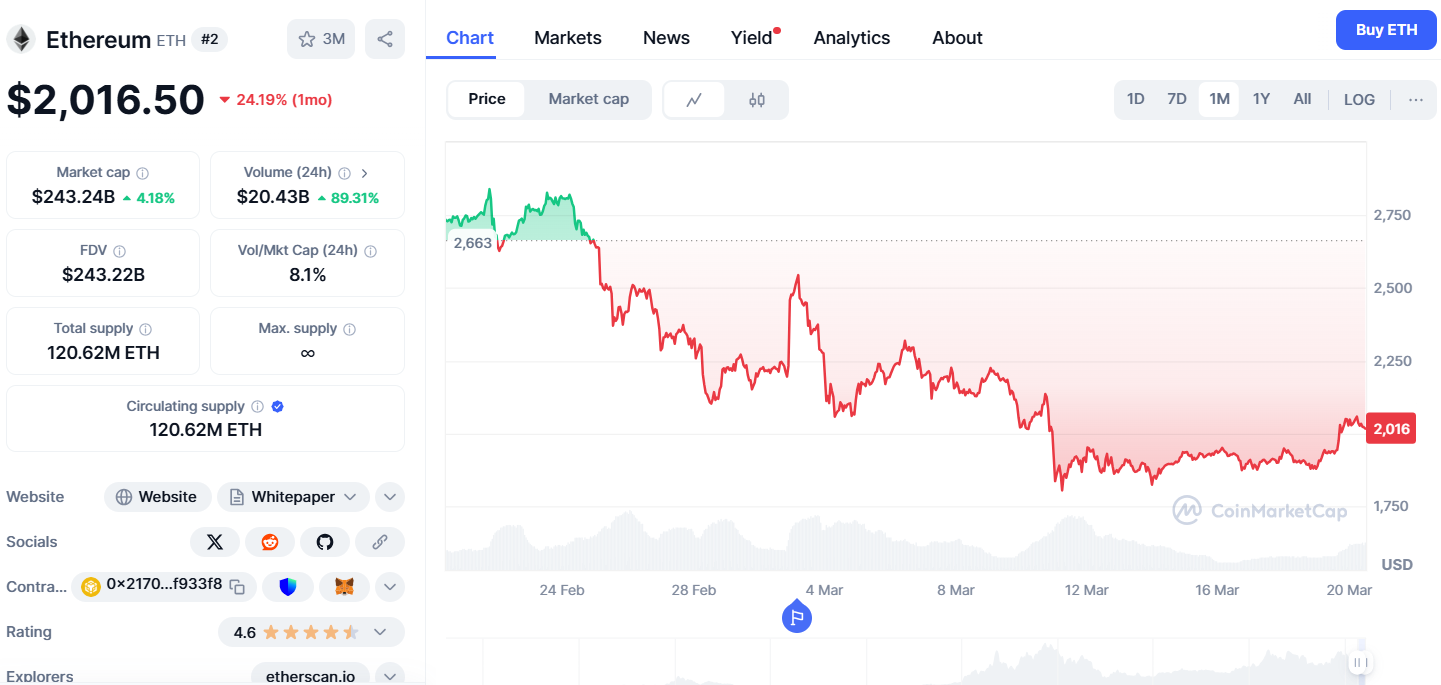

Just yesterday, the market seemed to have written off Ethereum, with even optimistic analysts losing hope. However, in a classic crypto turnaround, Ethereum surged back, reclaiming the $2,000 mark.

Now that the price is holding above this key level, the question investors are asking is: how high can Ethereum realistically go for March 21st.

Key Price Levels to Watch for Ethereum

Despite this recent bounce, the overall price structure for Ethereum still leans bearish. While the current recovery is underway, Ethereum is testing key support levels, and the broader trend still faces downward pressure.

Ethereum had earlier seen buying interest around the high $1,800s, just below $1,900. If the current upward momentum continues, resistance is likely to be encountered in the $2,100 to $2,200 range.

If Ethereum can decisively break through this resistance zone and establish it as new support, the market sentiment could shift to a more bullish outlook.

A break above $2,200 would naturally lead to $2,500 or even $2,800 in the next few days. However, if Ethereum fails to hold steady above current levels, the next support could fall around the $1.5K mark. Currently, Ethereum’s RSI is at 40.4, showing neutral conditions—neither overbought nor oversold.

Related: Which 6 Altcoins Have the Potential for Massive Gains? ETH, SOL, ALGO, DOGE, AVAX, TON

ETH Whale Activity

Three large investors, or “whales,” withdrew a significant amount of Ethereum – 14,217 ETH, worth approximately $28.95 million – from the Binance exchange right as the price of ETH climbed back above $2,000. Following these withdrawals, the same whales borrowed 12 million USDT (Tether, a stablecoin) on Aave, a decentralized lending platform.

They then deposited the USDT back onto exchanges like Binance and OKX. This move can be bullish because taking ETH off exchanges suggests the whales are holding it, which may reduce selling pressure and show confidence in future price growth.

According to IntoTheBlock, large holders have been more active since mid-March. Inflows from large holders jumped from 197,370 ETH on March 16 to 910,810 ETH by March 18. At the same time, outflows increased from 198,960 ETH to 438,360 ETH. This was the highest net ETH flow in the last three months.

This surge in whale activity also matched a rise in exchange outflows, with more ETH leaving exchanges than entering, showing rising demand along with the whale movements.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.