- Willy Woo says Bitcoin’s 12-year trend against gold has broken.

- He links the shift to rising awareness of quantum computing risks.

- Woo estimates 4 million lost BTC could return if cryptography fails.

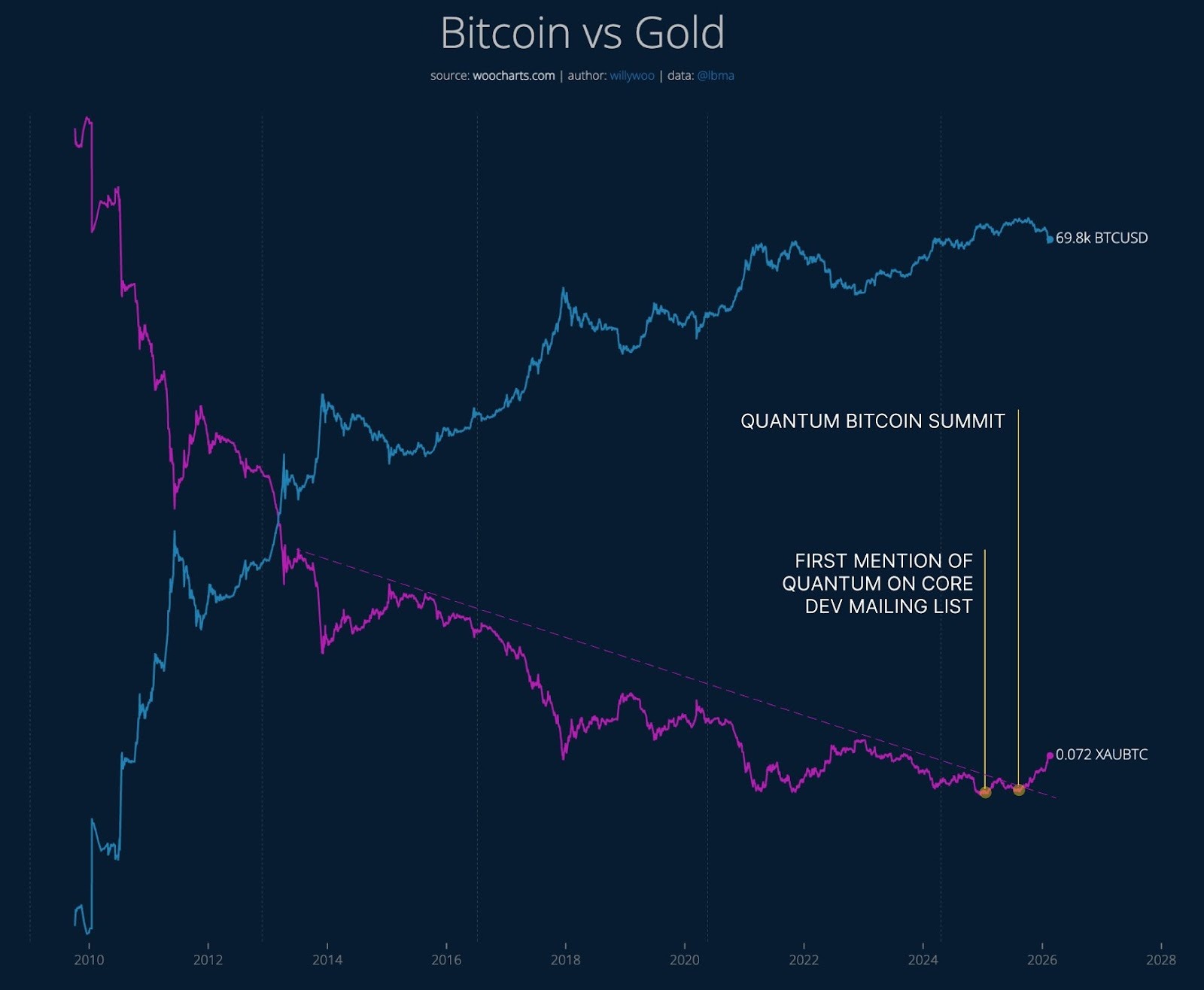

On-chain analyst Willy Woo says quantum computing risk is weighing on Bitcoin’s valuation relative to gold. He shared a chart showing a 12-year trend break between Bitcoin and gold prices. Woo argues markets are beginning to price in future cryptographic threats tied to “Q-Day.”

12-Year Bitcoin-Gold Trend Breaks

In the chart, Woo compares Bitcoin’s price in U.S. dollars with gold priced in Bitcoin. For more than a decade, Bitcoin steadily gained value against gold. That upward trajectory has now broken.

He wrote that Bitcoin “should be valued a lot higher relative to gold,” but said it is not. According to Woo, the shift began when quantum computing risks entered mainstream discussion among developers and investors.

The chart shows Bitcoin trading well below its all-time high in dollar terms, while its relative strength against gold has also weakened. Woo said this signals a structural change in how markets value the asset.

Quantum Risk and Lost Coins

Quantum computers could, in theory, break the cryptographic signatures that protect Bitcoin wallets. Developers have discussed possible upgrades to quantum-resistant signatures.

Woo said such upgrades would not address another concern: dormant or lost Bitcoin. Estimates suggest that about 4 million BTC tokens are permanently lost due to inaccessible private keys.

He said there is a 75% chance those coins would not be frozen through a protocol hard fork if quantum technology advanced enough to unlock them. If accessed, those coins could return to circulation and increase supply.

Woo compared that figure with recent institutional demand. Since 2020, public companies and U.S.-listed Bitcoin exchange-traded funds have accumulated about 2.8 million Bitcoin combined.

He said 4 million coins would equal roughly eight years of similar accumulation. He argued the market is starting to price in this potential supply risk ahead of time.

Q-Day Timeline and Market Impact

Woo defined “Q-Day” as the point when quantum computers can crack a Bitcoin public key within 24 hours. He estimated that the event may be five to 15 years away.

Until the threat is resolved, Woo said Bitcoin’s U.S. dollar price will reflect the uncertainty. He added that the next decade is critical, as investors often turn to hard assets such as gold during late-stage debt cycles. In his view, gold has benefited from that shift while Bitcoin faces additional technological risk.

Mixed Reactions From Market Participants

Other industry figures disputed Woo’s assessment. Samson Mow said quantum computing is a “non-event” and argued that markets do not price in distant risks in advance.

Other commentators said the timing, probability, and scale of quantum breakthroughs remain uncertain. Some noted that Bitcoin developers could implement quantum-resistant upgrades before any large-scale threat materializes.

Critics also pointed to alternative explanations for Bitcoin’s recent performance, including concentrated ownership and selling by large holders.

The debate reflects broader questions about how markets assess long-term technological risks. While no practical quantum attack on Bitcoin exists today, discussion of potential vulnerabilities continues to shape investor sentiment.

Related: Bitcoin Price Prediction: Can BTC Defend $68k After CPI Drop And Coinbase Data?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.