World Liberty Financial (WLFI) price is below the $0.1867 resistance level that has capped upside attempts throughout the week. Sellers continue to defend the downtrend structure, while buyers are trying to build support around the $0.1800 area, keeping the token in a tight consolidation phase.

WLFI Price Struggles To Break Resistance

The 30-minute chart highlights a descending triangle formation, with price repeatedly failing to sustain momentum above $0.1867. The 20-EMA and VWAP lines are clustering around the same zone, reinforcing this resistance. On the downside, short-term support sits near $0.1810, where buyers have been defending intraday dips.

Momentum remains balanced but fragile. RSI hovers around 50, suggesting neutral sentiment, while Bollinger Bands show compression, pointing toward a potential volatility breakout. For bulls, a decisive move above $0.1900 would be required to flip near-term momentum positive.

Justin Sun’s Token Freeze Dispute Adds Pressure

Market sentiment turned volatile after Justin Sun, an early investor in World Liberty Financial, said his WLFI tokens were “unreasonably frozen.” In his X post, Sun urged the team to unlock his holdings, arguing that early investors deserve equal treatment and that freezing tokens violates fundamental blockchain principles.

Related: Justin Sun Presses World Liberty Financial to Release Frozen WLFI Tokens

Sun’s intervention has amplified uncertainty around governance and investor confidence and his comments stressed that unilateral restrictions risk undermining the credibility of the WLFI ecosystem, raising concerns about fairness and transparency within the project.

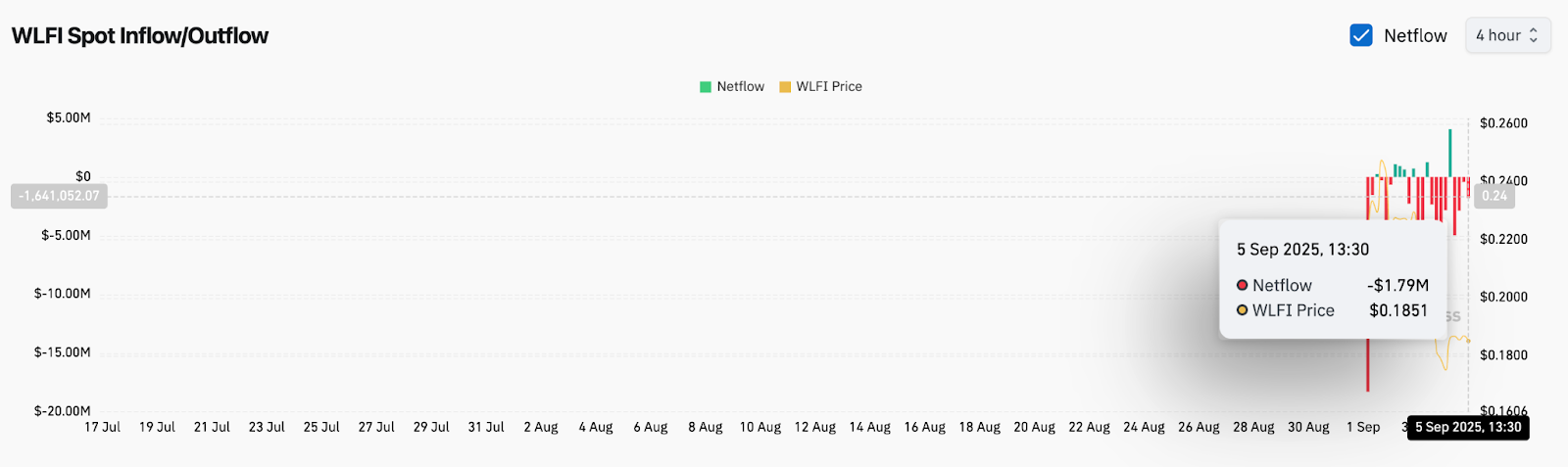

On-Chain Flows Reflect Investor Caution

On-chain data shows continued net outflows, with a $1.79 million exit recorded on September 5 as WLFI traded at $0.1851. This marks the latest in a string of negative flows that began in late August, reflecting investor hesitation amid governance concerns.

While occasional inflow spikes have appeared, the overall pattern leans bearish. Persistent outflows suggest that traders are reducing exposure until clarity emerges around token policies and early investor rights. For now, liquidity remains fragile, limiting the potential for sustained rallies.

Related: Here’s How the Trump-Linked WLFI is Trying to Stop its Post-Launch Price Crash

Broader Narrative Weighs On Confidence

World Liberty Financial was initially positioned as a next-generation financial ecosystem, with strong backing from early investors like Sun. However, disputes around token access and transparency have shifted the narrative toward governance risks. Until trust is rebuilt, WLFI may struggle to attract new capital despite its underlying roadmap.

Broader crypto sentiment has provided some cushion, with Bitcoin holding near $108,000 and Ethereum stabilizing around $4,300. Yet without stronger inflows into WLFI, relative underperformance may continue.

Technical Outlook For WLFI Price

Key levels are tightly defined. On the upside, breaking above $0.1867 could open a path to $0.1950 and potentially $0.2100 if momentum strengthens. A flip above these thresholds would also break the descending triangle pattern, offering buyers renewed control.

On the downside, losing $0.1810 could expose WLFI to the $0.1700–$0.1720 zone. A deeper breakdown risks revisiting the August lows near $0.1600, which acted as the last major defense level on the chart.

Outlook: Will WLFI Go Up?

WLFI’s short-term direction hinges on whether governance concerns can be eased and outflows reversed. Technically, price remains stuck between $0.1810 support and $0.1867 resistance, with compression signaling a breakout in the coming sessions.

Analysts see a cautious bias. If WLFI can break $0.1900 with strong inflows, upside targets toward $0.2100 may open. However, continued net outflows and unresolved disputes around token freezes could keep the token under pressure, risking another slide toward $0.1700. For now, traders are watching closely for clarity before committing to fresh positions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.