- WLFI climbed 51% from $0.17 but sellers pushed it back toward $0.20 support.

- Analysts say a close above $0.24 could confirm bullish strength and trend reversal.

- Trading debut saw $3.1B volume, but Justin Sun controversy raised concerns about token risks.

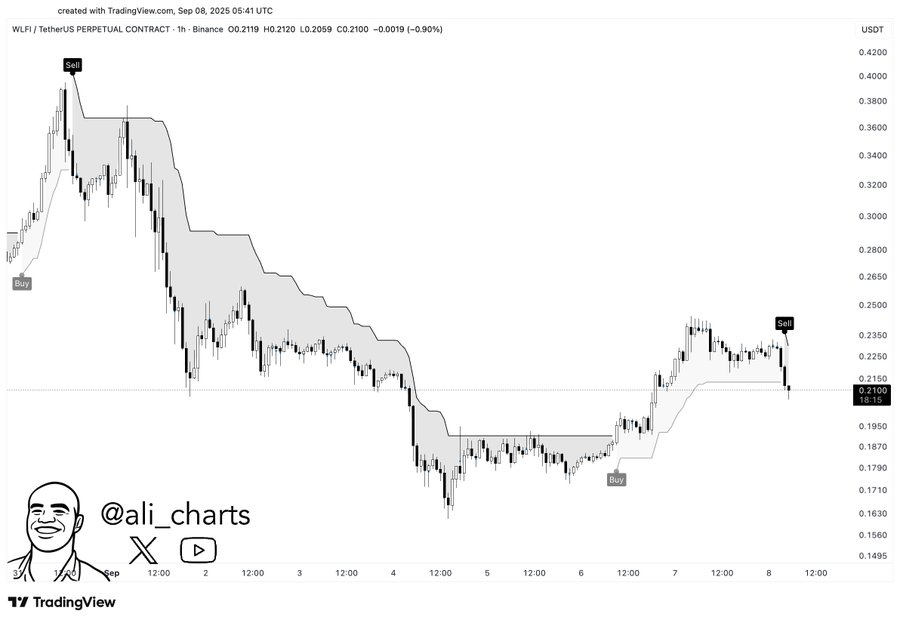

After a brutal post-launch sell-off, the Trump-linked World Liberty Financial (WLFI) token showed early signs of recovery, soaring more than 51% from its recent lows. However, the rally was short-lived, with sellers stepping in to push the price back down 13% to the critical $0.20 support zone, at the time of writing.

How Has WLFI Performed Recently?

According to analyst Ali Martinez, WLFI price climbed more than 51% from the bottom near $0.17, breaking through its consolidation phase. However, after reaching the $0.25 region, sellers re-entered, triggering a fresh pullback toward $0.20.

The chart pattern showed that this recovery hints at a possible trend reversal, but the current correction needs to stabilize above $0.20 for bullish momentum to continue. A close above $0.24 would confirm strength, while failure to hold support risks another leg down.

Related: Which Altcoins Should You Be Watching? Analysts are Focused on ETH and ADA

What’s Driving WLFI’s Momentum?

Much of the current momentum is being fueled by futures markets. Perpetual futures trading volume crossed $2 billion in the past 24 hours, far outpacing spot trading. With open interest rising, leveraged bets are putting upward pressure on WLFI’s price.

How Does the Fibonacci Level Influence WLFI’s Price?

The token was previously trading at $0.24, which corresponds to the 0.382 Fibonacci retracement of the early September downward move. This level has acted as temporary support in the past

What Are Important Short-Term Levels?

In the short term, if WLFI breaks above $0.22 quickly, it could push toward $0.245 and potentially higher. If it fails to reclaim $0.22, sideways consolidation is likely, possibly leading to a retest of strong support around $0.20.

Overall, the $0.20 to $0.22 range remains a critical zone, providing technical support, but confirmation above $0.22 is needed before any upward move can be expected.

How Has Trading Volume Impacted WLFI?

Eric Trump pointed out that WLFI saw around 3.1 billion in trading volume on its first day, making it the 10 most traded crypto and the 27 by market capitalization. He added that this is just the beginning, citing the company’s strong fundamentals and predicting unlimited potential for WLFI.

However, the story has not been without controversy. Tron founder Justin Sun, an early WLFI investor, saw his tokens frozen after he sold part of his holdings. Sun publicly asked the team to unlock his assets, raising concerns about whether other users could face similar risks.

Related: Over $45M in Insider Token Unlocks Set to Hit Market Sept. 8–14

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.