- WLFI breaks consolidation as higher lows and renewed momentum strengthen trend outlook.

- Rising futures interest and improving spot flows signal a shift toward active buying.

- Strategic reserve wallet’s automated buys add steady demand during trend expansion.

World Liberty Financial is attracting renewed attention as its token begins to recover from weeks of slow trading. The asset now moves into a developing uptrend after breaking a long consolidation band.

The move comes as broader market activity picks up and WLFI records stronger participation across spot and futures markets. Additionally, the project’s strategic reserve wallet has begun an aggressive automated accumulation program, adding fresh demand during a critical period for price stabilization.

WLFI Price Moves Out of Consolidation

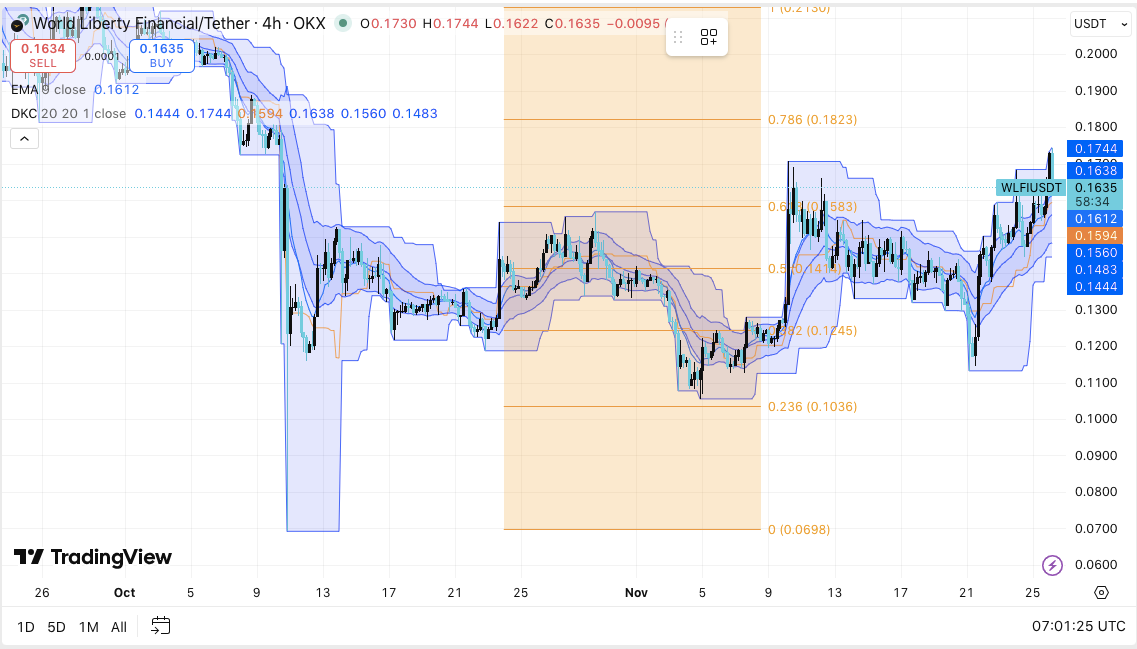

WLFI recently shifted out of a narrow multi-week range and formed a consistent pattern of higher lows. The move gained strength after the token pushed above the mid-range barrier near $0.158.

Buyers held the breakout and kept price action above the EMA line, showing early trend expansion. Moreover, the DKC channel tightened before turning upward, signaling improving momentum.

Support remains firm at $0.148 and $0.156. Each level held repeated tests during November as sellers lost pressure. Price now trades above $0.161 and approaches the breakout point at $0.1635. A close above that barrier opens a path toward $0.1744. Hence, traders are closely watching trend continuation signals.

Futures Interest and Spot Flows Recover

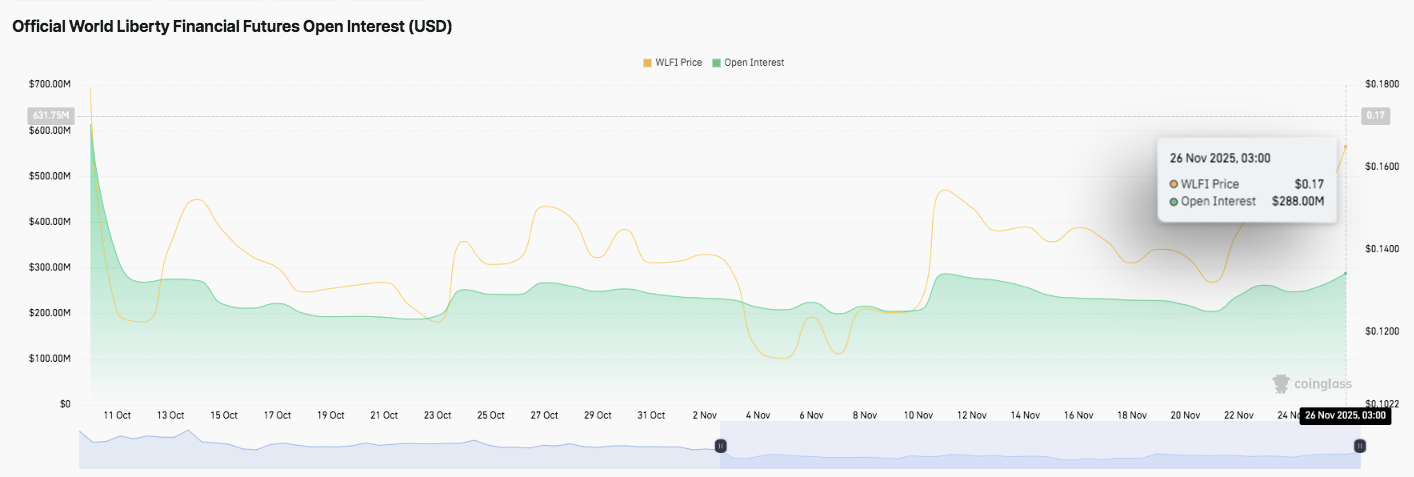

WLFI futures open interest shows a long cycle of unwinding from early October’s peak. Activity dropped sharply after volatility increased, and traders avoided large positions.

However, interest began climbing again in late November. Open interest approached $288 million on November 26, showing a return of confidence. This slow recovery marks a shift from defensive positioning to more active risk-taking.

Spot flows also changed tempo. The market recorded persistent outflows through September and October as selling dominated. November brought steady improvement. WLFI posted a $1.51 million inflow on November 26 as price hovered near $0.163. Consequently, the shift suggests easing pressure and stronger appetite for accumulation.

Strategic Wallet Accelerates Buying Program

Market attention increased after World Liberty’s strategic reserve wallet launched an $11 million automated buy program on CowSwap. The wallet has already purchased roughly $1.2 million worth of WLFI.

The system executes about $131,000 every five minutes. The remaining allocation continues to add new demand as price attempts to build higher structure. Moreover, the program signals internal confidence and introduces a steady stream of liquidity during a key trend transition.

Technical Outlook for World Liberty Financial (WLFI)

Key levels remain well-defined as WLFI builds a developing uptrend into December.

Upside levels: $0.1635, $0.1744, and $0.1823 stand as immediate resistance zones. A breakout above $0.1635 could open the path toward the local swing zone at $0.1744 and later the 0.786 Fibonacci marker at $0.1823.

Downside levels: $0.1612 EMA support, followed by $0.1560 high-volume support, and $0.1483 as the key demand floor. Losing $0.1560 would weaken short-term momentum and expose the lower accumulation band.

Trend structure: WLFI is emerging from a prolonged consolidation and now shows higher lows across multiple timeframes. The structure suggests early trend expansion as candles hold above the EMA baseline and the DKC mid-line. Volatility bands are tightening, indicating compression before the next directional move.

Will WLFI Continue Higher?

WLFI’s December trajectory depends on whether buyers can maintain strength above $0.1612 and secure a sustained breakout above $0.1635. Technical compression, improving spot flows, and rising open interest all point toward building momentum. If inflows remain firm and price holds its EMA support, WLFI could attempt a move toward $0.1744 and possibly $0.1823.

Failure to defend $0.1560, however, risks breaking the recent higher-low structure and returning price to the $0.1483 accumulation zone.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.