- WLFI breaks key EMAs, signaling possible bullish reversal ahead.

- Volatility expands as price closes above upper Bollinger Band.

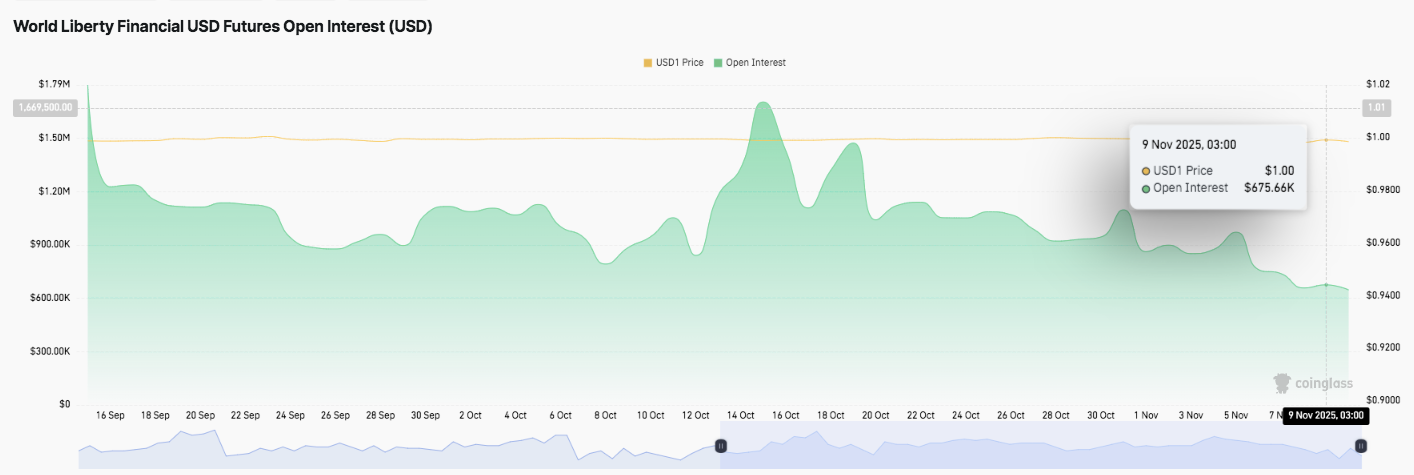

- Futures open interest drops, showing reduced leverage participation.

World Liberty Financial (WLFI/USD) has displayed renewed strength after weeks of muted trading, with recent technical shifts signaling a potential bullish reversal. The token’s four-hour chart shows price reclaiming crucial moving averages and breaking through key Fibonacci retracement zones, suggesting momentum could be shifting in favor of buyers. This development comes amid cooling open interest and steady stablecoin flows, hinting that traders are repositioning for the next move.

Price Action Signals Renewed Strength

WLFI recently advanced to $0.157, surpassing the 0.382 Fibonacci retracement level at $0.1396 and briefly touching the 0.5 retracement at $0.1557. This marked the first major breakout since mid-October and positioned the token above its 20, 50, and 100 exponential moving averages (EMAs). The alignment of these averages around $0.1297, $0.1271, and $0.1307 reflects growing technical convergence a sign of trend transition.

Immediate resistance lies near the 200 EMA at $0.1425 and the 0.618 Fibonacci level at $0.1719. If the rally holds, the next upside target sits at the 0.786 level around $0.1948. On the downside, strong support remains between $0.1396 and $0.1055, aligning with prior consolidation zones that attracted heavy accumulation.

Indicators Confirm Volatility Expansion

The breakout candle closed above the upper Bollinger Band, indicating a volatility expansion phase. Such behavior often precedes accelerated momentum if supported by strong volume. Moreover, the convergence of EMAs signals the early stages of a bullish crossover — a technical condition that historically precedes sustained upward trends.

Holding above the $0.155 area is essential to confirm this bullish scenario. A slip below $0.14 could weaken short-term structure, leading to a retest near $0.12, where previous demand zones have consistently stabilized price.

Related: Could World Liberty Financial’s WLFI Debit Card Revolutionize Crypto Spending?

Futures and Flows Reflect Market Adjustment

Beyond the spot market, open interest in WLFI futures has declined steadily from $1.67 million in September to around $675,000 by November 9. The trend underscores lower speculative activity and reduced leverage participation as traders await confirmation of direction.

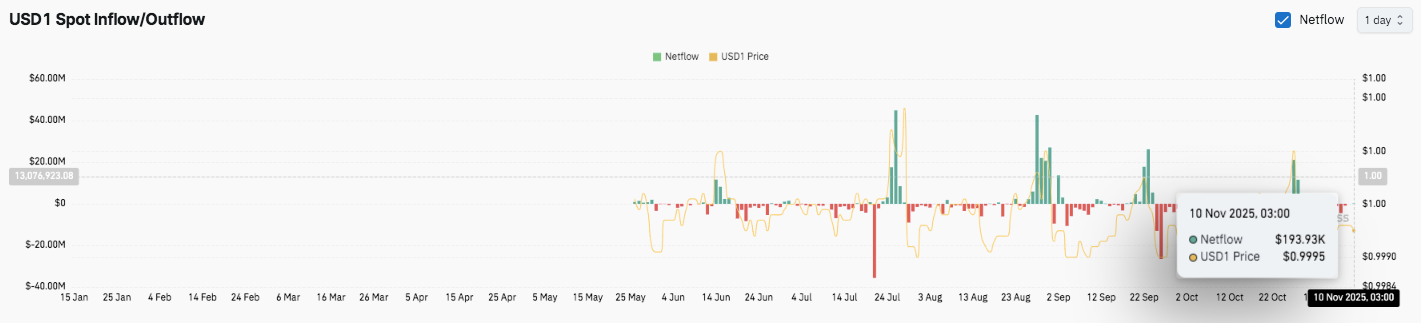

Meanwhile, USD1 stablecoin inflows and outflows show balanced capital rotation. Earlier inflow spikes exceeding $40 million between June and August have tapered to moderate levels. On November 10, net inflows stood at $193,930, with USD1 trading near $0.9995, suggesting stable liquidity conditions.

Technical Outlook for World Liberty Financial (WLFI/USD)

Key levels for World Liberty Financial remain clearly defined following its recent breakout attempt.

- Upside levels: Immediate resistance is seen at $0.1719 (0.618 Fibonacci), followed by $0.1948 (0.786 retracement) and $0.2000 as a psychological target. A confirmed breakout above $0.172 could extend gains toward the $0.195–$0.200 range if volume strengthens.

- Downside levels: Initial support sits near $0.155, aligning with the short-term EMA cluster, followed by $0.1396 (0.382 Fibonacci) and $0.1197 as secondary support. A breakdown below $0.14 could open the path toward $0.12 and $0.1055, where buyers previously defended.

- Resistance ceiling: The 200 EMA near $0.1425 remains a critical threshold to flip into support for sustained bullish momentum. Maintaining daily closes above this region will be essential for confirming trend continuation.

The broader structure suggests that WLFI is emerging from a multi-week consolidation, forming a potential ascending setup. The tightening EMAs hint at compression before a volatility expansion, similar to previous pre-breakout phases.

Will World Liberty Financial Sustain the Rally?

The next trend direction depends on whether bulls can defend $0.155 and reclaim the $0.17–$0.18 range. If upward momentum accelerates, WLFI could retest $0.195 and $0.20 in the near term. However, failing to hold $0.14 could push prices back into the accumulation zone around $0.12.

For now, WLFI remains in a pivotal zone, with both technical compression and fading futures interest suggesting a potential volatility build-up. Sustained inflows and renewed trading activity will determine whether this rally matures into a confirmed trend reversal or fades into another consolidation phase.

Related: World Liberty Financial to Tokenize Commodities, Launch Debit Card: Timeline Revealed

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.