- Alameda’s $WLD sell-off may drive further price declines below $1.50.

- Alameda’s diverse holdings show strategic risk management amid market volatility.

- $WLD’s RSI suggests potential rebound as it nears oversold territory.

Alameda Research, the trading arm of the collapsed FTX exchange, holds substantial cryptocurrency assets, including $BIT and Worldcoin (WLD), according to recent reports. Investors are particularly interested in understanding the extent of Alameda’s crypto portfolio, its risk management strategy, and the effect on specific cryptocurrencies like Worldcoin (WLD).

Alameda Research continues to manage its cryptocurrency assets and Spot On Chain reveals that Alameda still holds significant amounts of various cryptocurrencies, including $BIT and $WLD.

Specifically, Alameda currently holds roughly 98.86 million $BIT, valued at about $78.8 million, and 24.3 million $WLD, worth around $36.2 million. This diversification suggests a strategy to spread risk across different assets.

Since August 9, Alameda has deposited 698,312 $WLD (equivalent to $1.13 million) in four small batches to Binance at an average price of $1.622. This activity is likely part of a broader effort to repay creditors. Such large transactions could affect $WLD’s market dynamics.

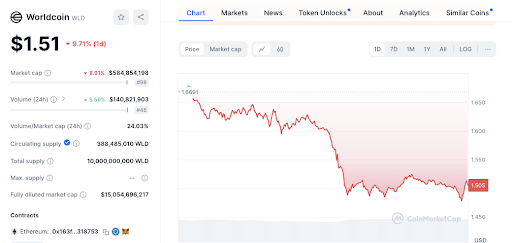

The price of $WLD has recently experienced a decline. Over the past 24 hours, it has fallen from around $1.70 to approximately $1.50. This downward trend reflects broader bearish sentiment in the market.

Key resistance levels include $1.70, where the price initially peaked, and $1.65, a minor rebound point. On the support side, $1.50 is currently a critical level. If the price falls below this mark, it may trigger further declines, potentially approaching $1.45 or $1.40.

Moreover, technical indicators provide additional insights. The 1-day RSI for $WLD stands at 39.93, nearing oversold territory. This suggests that $WLD might be undervalued and could potentially rebound. Additionally, the 1-day MACD, which is currently trading above the signal line, might signal a reversal in the ongoing downtrend.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.