- Analyst Zach Rector says SOL and XRP are next for spot ETFs, having met the CME futures requirement

- He predicts they will follow the BTC/ETH pattern: a post-launch dip, then a rally to new all-time highs

- He forecasts $10-20B in XRP ETF inflows and a “base case” price target of $20-$30 for XRP in 2026

Analyst Zach Rector has revealed that the next big catalysts for the crypto market could be exchange-traded funds (ETFs) for Solana (SOL) and XRP.

In an interview with Paul Barron, he said that these assets are set to replicate the same sequence as Bitcoin and Ethereum ETFs; a “sell the news” dip followed by a massive, institutionally-driven rally to new all-time highs.

Related: BTC, XRP, SUI, TON, KAS, FTM Price Analysis: Has the Bottom Been Found?

The Historical Pattern: A Dip, Then a New All-Time High

Rector’s thesis is based on the precedent set by the Bitcoin and Ethereum ETF launches and the fact that SOL and XRP now meet the key requirements to be next in line.

Why are Solana and XRP next in line for an ETF?

Both Solana and XRP have had futures contracts trading on the CME Group exchange for over six months. This is a critical prerequisite for the SEC, as it establishes a regulated market for the underlying asset.

Rector said that despite this, Solana communities have shown little excitement about their pending ETFs, possibly because retail traders are more focused on meme coins and smaller projects.

What happened when the Bitcoin and Ethereum ETFs launched?

Rector points out that both launches followed a “sell the news” pattern. Bitcoin dipped roughly 30% and Ethereum fell 40% immediately after their ETFs went live. However, this dip was followed by fresh institutional capital infusion that pushed both assets to new all-time highs. This is the historical sequence that many traders are now watching for both ADA and XRP.

XRP’s Rapid Growth and Institutional Demand

Why is XRP unique among these assets?

XRP, in particular, has shown strong institutional interest. At the CME, XRP became the fastest contract ever to surpass $1 billion in open interest, beating Solana, Ethereum, and Bitcoin.

Beyond ETFs, XRP is benefiting from tangible adoption of real-world assets on its ledger. Recent reports show a 13.3% quarter-over-quarter growth in real-world asset activity on the XRP ledger.

Is the current consolidation a concern?

Rector says the current consolidation in these assets may be a temporary suppression, building anticipation for a massive rotation once the ETFs are approved.

There is also an ongoing rotation from Bitcoin to altcoins. Since early July, Ethereum ETFs have started seeing more inflows than Bitcoin ETFs. Historically, this rotation occurs just before altcoin season.

XRP Price Targets?

The analyst said, “I think we could see 10 to 20 billion dollars flow into XRP ETFs in the first year. That’s why I’m holding firm to my double-digit price targets for XRP in 2026. I think that 20 to 30 bucks is kind of like my base case for XRP in 2026.”

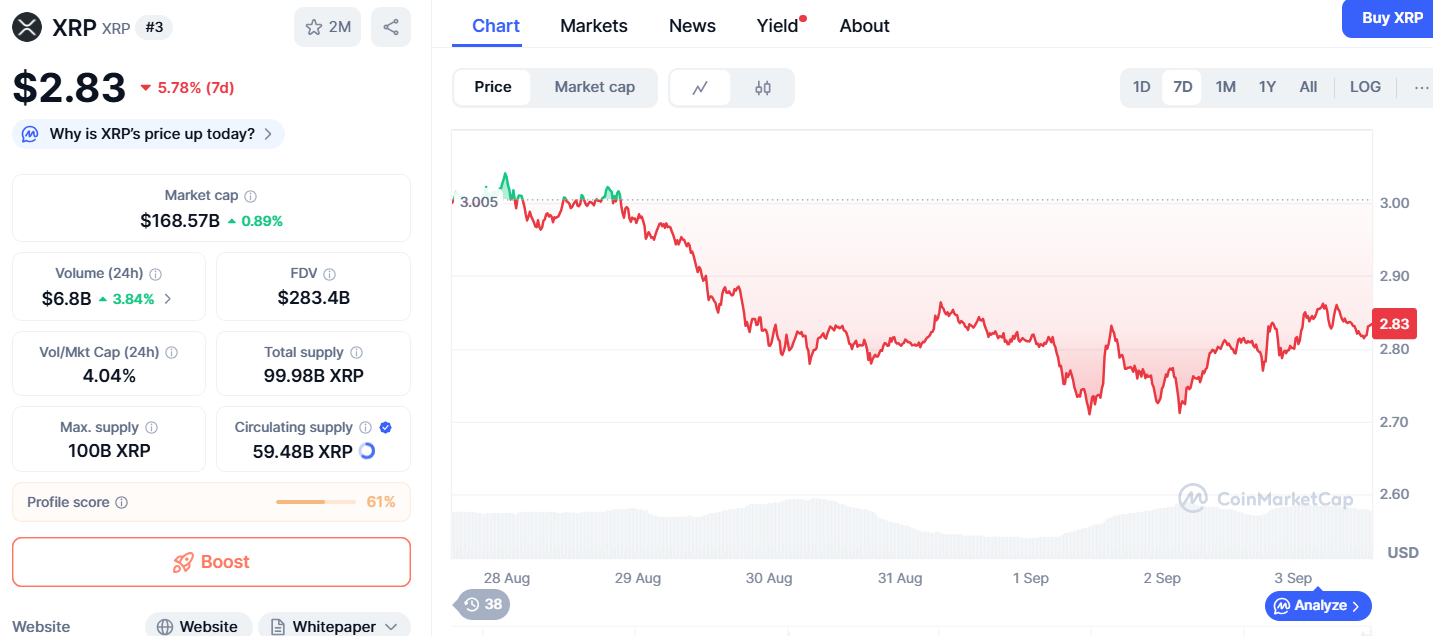

At the time of writing, XRP is trading at $2.83 and is eyeing to break above the important $3 resistance level.

Related: XRP Price September: Prediction Markets Bet on a Modest Rebound, Not a Breakout

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.