- XRP saw >$300M net outflows Apr 1-13, signaling persistent selling pressure

- Weekend price bounce failed to reverse trend; outflows dominate inflows

- Analysts clash: Egrag sees potential $1.40 dip first; Steph eyes 486% rally

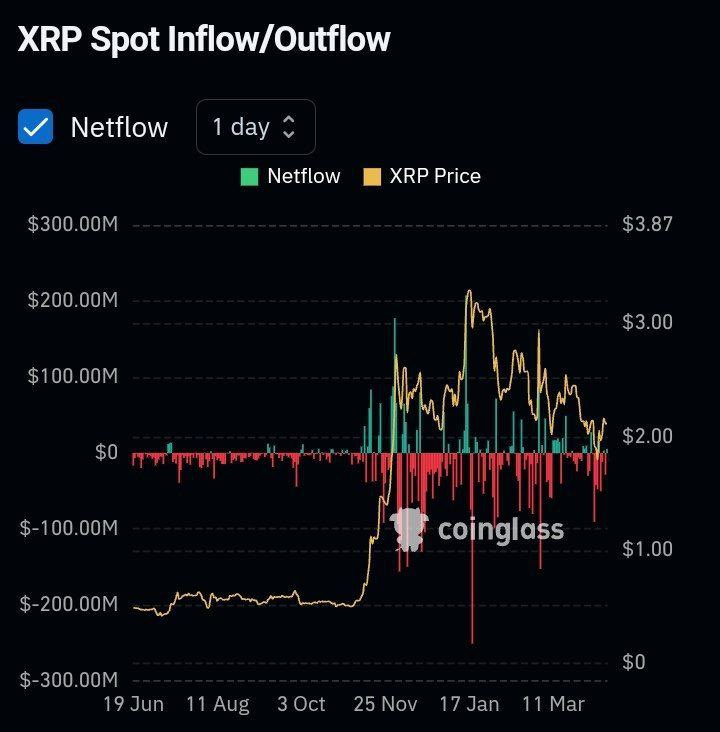

XRP recorded over $300 million in net outflows in the first 13 days of April, according to Coinglass data. A short-lived price rise over the weekend failed to reverse broader selling trends. This bearish flow data creates a stark contrast with bullish signals identified by some technical analysts.

Why Do XRP Outflows Signal Caution Despite Price Bounce?

XRP has continued to face pressure this month. The net flows chart shows more red days than green days in April. Even the green days were mild and failed to match the volume seen during outflows.

Only four of the 13 days ended with positive net flows, bringing in a total of $56.08 million in inflows. In contrast, outflows reached $311 million by Sunday, April 13. The highest single-day outflow came on April 6, totaling $90 million.

Related: Whales Accumulate XRP: Are They Betting on This Bullish Chart Signal?

While this is lower than the $150 million outflow days seen in January and March, it still reflects caution in the market. The pace of outflows has slowed slightly, but negative sentiment continues to dominate.

Weekend Bounce Brings Temporary Optimism

XRP saw a slight rise in price over the weekend. This sparked brief optimism among bulls. However, many investors used the price bump as a chance to exit at better prices.

The renewed selling added more red to an already downbeat month. With consistent outflows, XRP’s price remains under pressure. With money steadily leaving XRP markets, the asset’s price remains pressured.

Analysts Divided: XRP Dip Coming or Major Rally Ahead?

This cautious picture drawn from fund flows clashes with analyses zeroing in on specific chart patterns. Analyst Egrag warns of a possible short-term dip as he expects XRP to fall as low as $1.40 before any major rebound. XRP is trading at $2.14, a 1.4% dip in the past day, cutting its weekly gain to 26.6%.

Despite this, the analyst holds his position. He sees potential for long-term growth and outlines three major price targets: $7.50, $13, and $27. He bases this outlook on chart patterns and long-term trends.

Egrag also emphasized the role of market narratives. He said tracking news and sentiment, alongside technical analysis, is key to understanding price movements.

Related: XRP Price Prediction April 11: Surge Tests $2.38 After Tariff Pause News

In sharp contrast, analyst Steph identified a bullish MACD crossover on XRP’s chart, calling it a “Golden MACD Cross” and suggesting a major rally may be underway.

The last time this signal appeared, in late October 2024, XRP surged by over 486% within weeks, rising from below $0.50 to more than $2.40. Steph believes the current crossover mirrors that historical setup, predicting a similar price jump of around 486% in the next four to five weeks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.