- Ripple Prime, Palisade and a Nov 13 XRP ETF lane give XRP its own capital path outside Bitcoin.

- U.S. legal clarity and 2025 acquisitions turn XRPL into infrastructure, not a speculative side-trade.

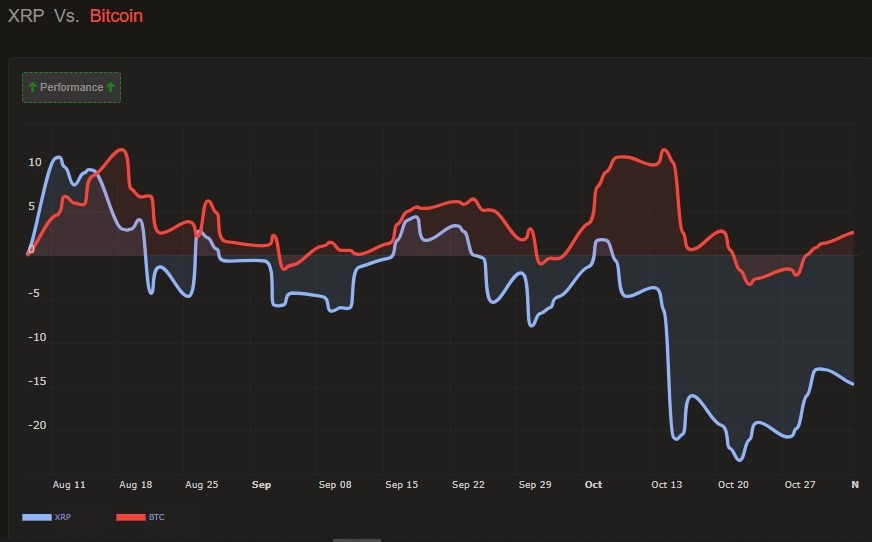

- Correlation with BTC is still high in 2025, but a second demand curve is now visible.

The XRP price story is shifting from speculation to infrastructure. At around $2.26 today, XRP still trades inside a market led by Bitcoin at about $104,000, yet new U.S.-based products now let institutions buy, settle, and custody XRP without touching BTC first.

This is the core argument X user @XrpArthur made this week, and it is the same path Ripple set out when it launched Ripple Prime for U.S. clients.

This stance mirrors remarks from Ripple CEO Brad Garlinghouse. Speaking at the Future Investment Initiative Panel in Riyadh, Garlinghouse said the next 16 years of crypto will be different. He cited emerging scaled use cases as the driver of a new divergence from pure speculation.

Related: Ripple Courts Real Money To XRP with Prime For Trading, Palisade For Storage

Institutional Rails Start Breaking BTC’s Grip

Macroaxis still shows XRP and Bitcoin trading with correlations near 0.8 to 0.85 in recent months. That will not vanish while Bitcoin keeps most of crypto’s liquidity and media attention.

Correlation Is Still High, But Now It’s Explained

What changes now is the mix inside XRP’s order book: live U.S. OTC through Prime, custody through Palisade, and ETF inflows sitting next to the usual speculative spot demand. When fundamentals take control of part of that flow, XRP can print breakouts even if Bitcoin is flat.

The Thesis: Institutional Utility vs. Speculative Value

According to Arthur, Bitcoin will remain a speculative store of value while XRP evolves to an infrastructure layer. Bitcoin has been perceived as the digital gold due to its market resilience since its inception.

However, Arthur noted that the Bitcoin network has fallen short of delivering scaled use cases through decentralized applications (DeFi) and programmable smart contracts. On the other hand, the XRPL has significantly benefited from Ripple Labs’ initiatives to enhance the mainstream adoption of XRP.

Related: Bitcoin Bull Run at a Major Crossroads As Whales Offload; What’s Next?

Year to date, Ripple has acquired GTreasury for $1 billion, Rail for $200 million, and Hidden Road for $1.25 billion. Through the acquisition of Hidden Road, Ripple Labs unveiled Ripple Prime, an institutional prime-brokerage that converges digital assets, derivatives, foreign exchange (FX), fixed income, and Over the Counter (OTC). Arthur noted:

“When institutions settle through Ripple Prime using XRP and RLUSD, they don’t care about Bitcoin. They care about efficiency, regulation, and liquidity. That’s a totally separate demand curve from crypto speculation”

Why Arthur Believes XRP Will Decouple From Bitcoin Price Action

Catalyst 1: The ‘Regulatory Overhang’ Is Gone

Since President Donald Trump was sworn in for his second term, Ripple Labs and XRP have gained significant regulatory clarity. At the top list, the United States Securities and Exchange Commission (SEC) worked together with Ripple to end the four-year lawsuit, which largely argued that XRP was a security.

The enactment of the GENIUS Act by President Trump earlier this year has helped Ripple USD (RLUSD) reach $1 billion in market cap. Meanwhile, the Clarity Act, which is expected to be passed and enacted in the near future, will further give XRP the needed legal clarity to enhance its institutional adoption.

Catalyst 2: A New, Independent Demand Curve from ETFs

The institutional adoption of XRP will be expedited by the spot ETF market. The listing of more than a dozen spot XRP ETFs in the United States will accelerate the independent capital inflow to XRP rather than the traditional rotation from Bitcoin.

“When fundamentals take control of price action, that’s when the real market begins.XRP’s path forward isn’t to follow Bitcoin, it’s to replace the rails Bitcoin never had,” Arthur concluded.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.