- XRP’s price has dropped in tandem with Bitcoin, hitting a 14-month low today.

- CoinGlass data shows XRP open interest fell from over $9B to about $2.5B.

- XRP entered a bear phase after its monthly RSI fell below the 50 level.

The ongoing crypto capitulation has pushed the XRP price to a 14-month low of about $1.42. After losing its crucial support level around $1.61 last week, XRP has extended its losses over the past few days.

This large-cap altcoin, with a fully diluted valuation of about $142 billion, has dropped over 23% in the past seven days. As such, the XRP price has lost its 2025 support range between $1.61 and $1.85, amid heightened selling pressure.

Why Is XRP Price Dropping?

Liquidity Crunch

The main reason the XRP price has been in a free fall over the past few weeks is the broader liquidity crunch in the crypto market. According to CoinGlass market data, XRP Open Interest has dropped from over $9 billion in October 2025 to about $2.5 billion at press time.

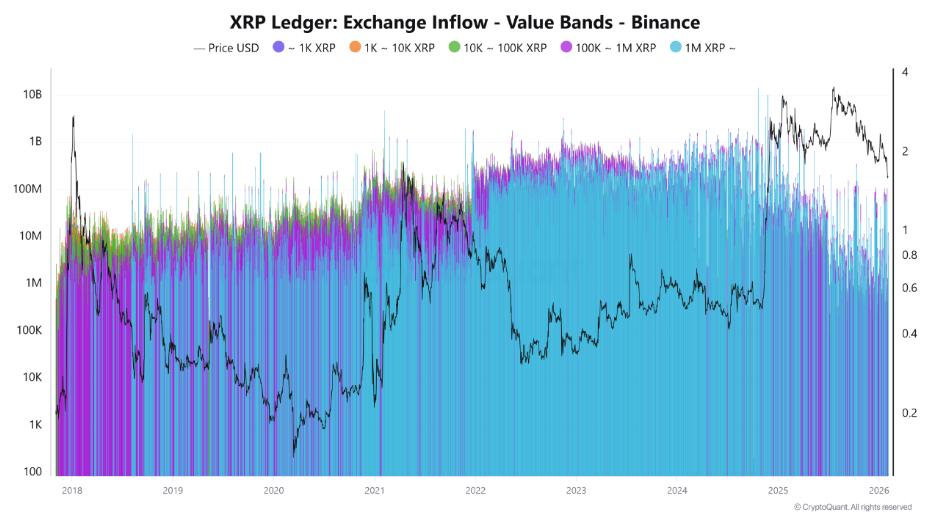

The XRP liquidity crunch has been exacerbated by low whale activity in recent months. According to onchain data from CryptoQuant, XRP’s inflows to Binance have dropped in tandem with its price in recent months.

Is the Bottom In?

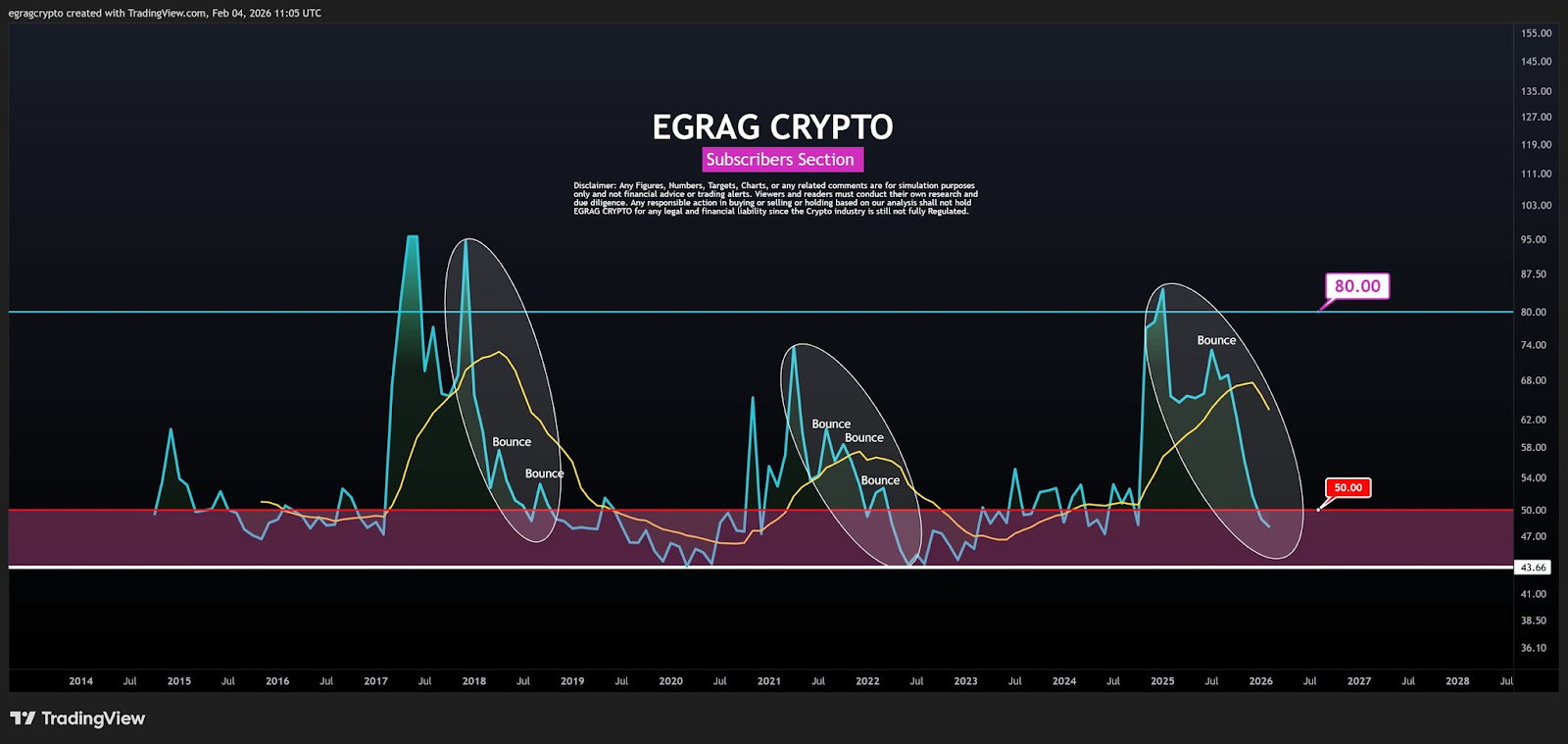

From a technical analysis standpoint, XRP price entered the bear market after its monthly Relative Strength Index slipped below 50. According to Egrag Crypto, XRP’s RSI peaked in 2025 at around 85 and has been declining ever since.

However, the analyst noted that XRP’s monthly RSI has historically found a bottom in the range between 43 and 50. As such, the analyst cautioned XRP traders about further capitulation if the monthly RSI drops below 43, as the macro bullish structure would be broken.

Nonetheless, Egrag Crypto expects the XRP price to find a bottom in the near future as its momentum shifts to prepare for a fresh expansion.

Bigger Market Picture

Although XRP price has been trapped in a falling trend, its cumulative fundamentals support the macro bull market. For instance, XRP gained legal clarity in the U.S. after both the SEC and Ripple filed motions last year to bring their long-running legal battle to a close.

As such, institutional investors have shown interest in XRP, as observed with several spot XRP ETFs and treasury companies. With the Congress expected to pass the CLARITY Act in the near future, XRP is well-positioned to rebound after forming a reversal pattern.

Related: XRP Price Outlook 2026: What 1,000 XRP Could Be Worth Based on Market Forecasts

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.