- XRP surpasses ETH in trading revenue on Coinbase, marking a historic shift in market dynamics

- SEC acknowledges XRP ETF filings, triggering a 240-day countdown for final approval or denial.

- South Korea plans to lift the ban on institutional crypto trading, opening new liquidity channels for XRP

In a major shift, XRP achieved a milestone as it overtook Ethereum (ETH) in trading revenue on Coinbase.

The surge is mainly due to increased trading, growing institutional interest, and excitement about a potential XRP spot ETF.

XRP’s Rise to 14% of Coinbase Revenue

Kaiko’s latest analysis showed that XRP’s contribution to Coinbase’s trading revenue has greatly increased, reaching a 14% share in Q4.

Specifically, the post-U.S. election rally brought back interest in altcoins, with XRP becoming a top gainer. Interestingly, this trend comes after its re-listing on major U.S. exchanges following Ripple Labs’ partial legal win against the SEC.

Related: Ripple ($XRP) vs SEC: Price Predictions and Market Trends Explained

The growing institutional interest in XRP is clear from asset managers getting ready for spot XRP ETFs. Last week, the SEC acknowledged multiple XRP ETF filings, starting a 240-day period for approval or rejection. This clear timeline has sparked more speculation and a surge in trading.

Bullish Signs for XRP Echo Ethereum’s ETF Rally

A similar scenario played out in Ethereum’s May 2024 rally, where its volumes skyrocketed following the SEC’s unexpected approval of spot ETH ETFs.

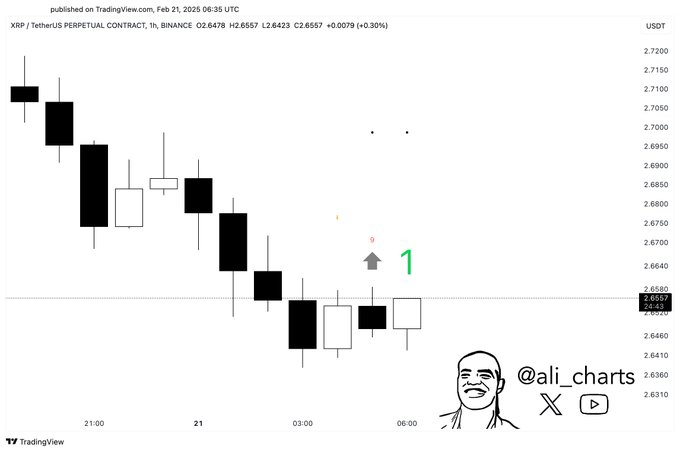

If history repeats itself, traders can anticipate another large rally. Adding to the bullish outlook, the TD Sequential indicator has given a buy signal for XRP on the hourly chart.

This points to a possible short-term rebound, which could further boost investor excitement. With market depth returning to pre-FTX levels and good liquidity rankings, the token looks set to continue its upward movement.

Macro Trends Support Crypto Market Growth

Separately, macro trends support broader crypto market growth. South Korea is planning to lift its institutional ban on crypto trading in 2025. Currently, only retail traders with verified identities can use digital assets, limiting institutional liquidity.

Once lifted, hedge funds, corporations, and universities could add new liquidity to the market, further increasing XRP’s trading volume.

Related: Whale Activity, Buy Signals, and Liquidation Risks: A Closer Look at $XRP, $DOGE, and More

With its growing lead in trading revenue, positive regulatory news, and rising institutional adoption, the next few months could show whether XRP keeps this lead or faces new competition.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.