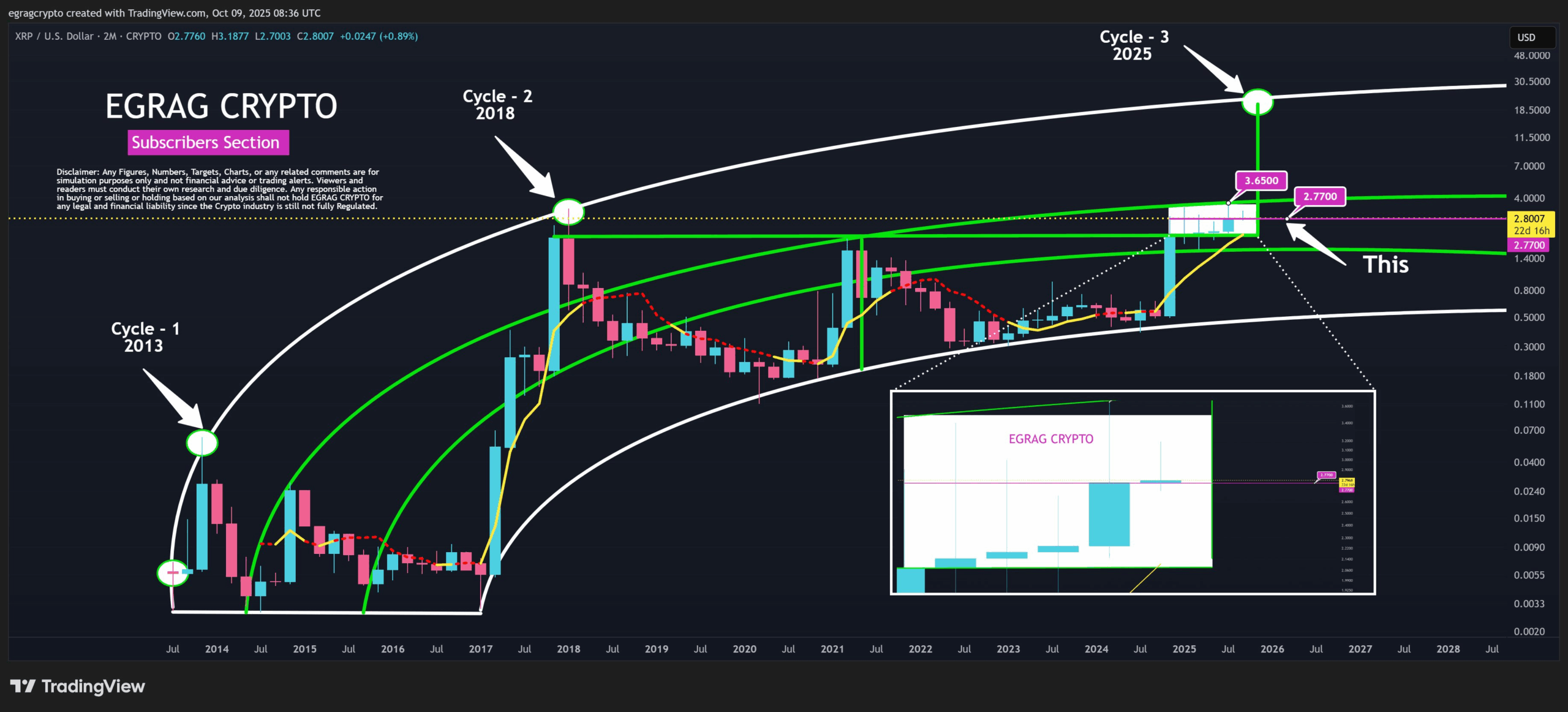

- The analyst stated that as long as XRP remains above $2.77 on the two-month timeframe, it’s just “noise”

- Egrag is utilizing a two-month chart to identify a key support line, believing that price movements above this threshold are insignificant fluctuations that don’t compromise the primary bullish trend

- Recent sentiment analysis of retail trader discussions indicates a shift toward a bearish outlook for XRP, with negative commentary now outweighing positive remarks

Egrag Crypto, a well-known chart analyst in the XRP community, addressed the market fear following a recent dip in XRP’s price. They stated that as long as XRP remains above $2.77 on the two-month timeframe, it’s just “noise”.

Egrag is utilizing a two-month chart to identify a key support line, believing that price movements above this threshold are insignificant fluctuations that don’t compromise the primary bullish trend. However, if the price closes below this line, even partially, the analyst would see it as a strong warning that the trend has seriously reversed.

The post is also rhetorical, directed at critics (“weak hands crying about this dip”), emphasizing that this kind of strategy requires strong conviction, math, logic, and stamina, not reactive fear.

Related: “Weak ETF Demand? I’m Still Panic Buying XRP,” Says Bill Morgan

Technical Anchor and Market Mood

Additionally, Egrag states that if the two-month candle closes below the mentioned threshold and the line turns red, they’re prepared to publicly jump ship with 80% of profits saved.

Even with the recent drops, the analyst maintains the bull run scenario and expects new all-time highs ahead.

Similar views as before

Egrag has been vocal historically about large multi-figure XRP targets. For instance, in August 2025, they pushed back against claims that XRP would top out at $4, instead projecting long-term targets like $27 and above, using Fibonacci extensions and advanced chart overlay analysis.

In recent days, Egrag also pointed out that XRP is nearing the final stages of a technical pattern identified as an ascending triangle. With the formation reportedly 70% complete, this stage often precedes a period of heightened volatility and a potential price breakout.

Interestingly, the XRP community identified a substantial transaction involving $600 million worth of XRP yesterday. Although it turned out to be an internal transfer between Ripple wallets rather than a market sale, the event still generated notable speculation among traders regarding potential institutional repositioning or exchange-related activity.

Still, recent sentiment analysis of retail trader discussions indicates a shift toward a bearish outlook for XRP, with negative commentary now outweighing positive remarks.

As for the cryptocurrency itself, XRP is now trading at approximately $2.81, which is roughly a 1.75% drop in the last 24 hours.

Related: XRP Price Prediction: ETF Decisions Could Define the Next Trend

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.