- XRP broke out to hit $1.2567, marking a 156.5% increase from earlier this month.

- Large wallets accumulated 453.3M XRP, while retail traders sold off 75.7M tokens.

- Market speculation links the surge to potential SEC leadership changes under Donald Trump.

Last week, XRP shocked the crypto market by breaking past the $1 mark for the first time in three years. On November 16, the token hit $1.2679, a remarkable 64% jump from the previous day’s low of $0.7726. Earlier in November, XRP traded at just $0.4930, marking an impressive 158% rise.

This unexpected rally caught many off guard, especially after years of underperformance, with XRP struggling to regain market momentum.

Ripple’s Regulatory Wins and Trump’s Pro-Crypto Presidency

Ripple CEO Brad Garlinghouse attributed XRP’s price rally to easing regulatory challenges across the cryptocurrency industry. This shift is closely tied to Donald Trump’s recent presidential election win.

Notably, with Trump set to take office in January 2025, significant changes in regulatory leadership, including the replacement of SEC Chairman Gary Gensler, could occur.

Although the Ripple vs. SEC case recently entered its appeal phase, investors are optimistic about a resolution, speculating that the appeal could be dismissed under the new administration. Adding fuel to the speculation, Gensler recently shared a reflective message, interpreted by some as signaling his intention to resign ahead of the new Trump entering office.

XRP’s Global Popularity Reaches New Heights

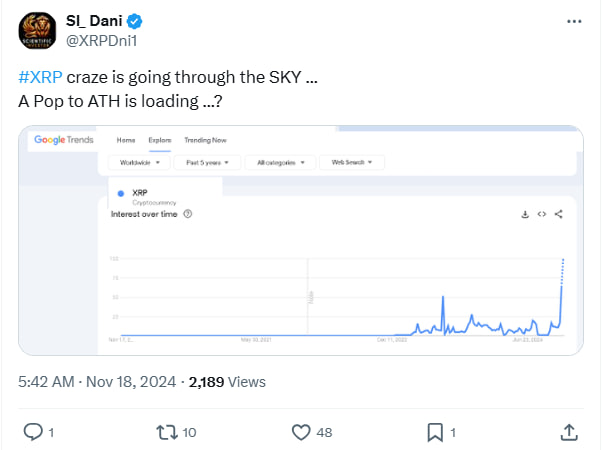

As XRP’s value skyrocketed, global interest in the token also soared. Data from Google Trends shows that search interest for XRP reached a peak score of 100 on November 16, up from 8 on November 8.

This spike in interest is particularly notable in regions like Australia, South Africa, Canada, and the U.S. The last comparable surge occurred in April 2021, when XRP hit $1.96.

Whale Activity Accelerates XRP’s Rally

On-chain analysis from Santiment highlights significant accumulation by large wallets holding between 1 million and 100 million XRP. Over the past week, these wallets have collectively added 453.3 million XRP to their holdings.

Conversely, smaller retail wallets, holding less than 1 million XRP, sold off 75.7 million tokens during the same period. This trend suggests whales are capitalizing on retail traders’ attempts to sell during minor price upticks.

Santiment noted that crypto assets often experience market cap growth when key stakeholders increase their holdings during periods of retail-driven uncertainty. This pattern is now a key factor behind XRP’s sustained momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.