- XRP jumped 25% after a sharp dip, leading the broader crypto rebound.

- Whale accumulation surged, with over 1,300 large transactions recorded during the drop.

- Analysts now watch the $1.50–$1.60 resistance zone for continued bullish momentum.

The broader crypto market is showing signs of recovery, and XRP has emerged as one of the strongest performers, recording an impressive 25% rally after a recent sharp decline. The token rebounded quickly from lows below $1.15 and climbed back above the $1.50 level within hours.

Why The Surge?

Market analysts said that XRP experienced a significant liquidity sweep, briefly pushing prices lower before strong buying demand drove a rapid rebound. They described the move as a classic V-shaped recovery, where heavy selling is quickly followed by aggressive accumulation.

They now identify the $1.50–$1.60 range as an important resistance zone. A sustained move above this level could open the door for further upside if market momentum continues.

Whale Activity Signals Possible Trend Reversal

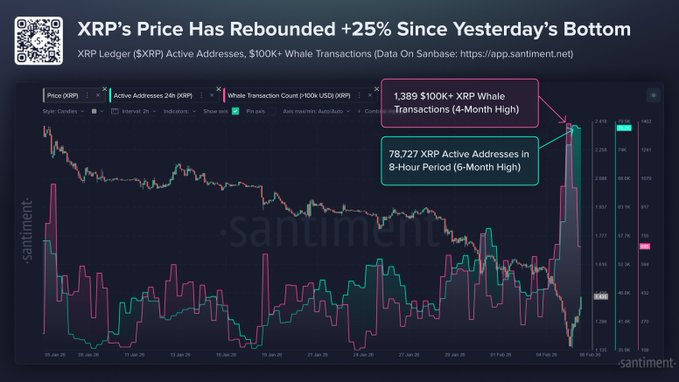

On-chain data from analytics platform Santiment shows that large investors played a key role during the dip. The network recorded 1,389 whale transactions worth over $100,000 each, the highest level in four months, indicating significant accumulation by large holders during the market downturn.

Source: X

At the same time, network activity on the XRP Ledger surged sharply. The number of unique active addresses jumped to 78,727 within an eight-hour period, marking the highest activity level in roughly six months. Santiment says spikes in both whale transactions and network participation often occur near market turning points, signaling growing investor interest.

Related: Is Trump Selling Bitcoin? WLFI Repays Aave Loans To Avoid Liquidation

White House Stablecoin Discussions Continue

Meanwhile, policy developments in the United States are also attracting market attention. A new round of discussions between banks, crypto industry groups, and policymakers is scheduled for February 10, where participants are expected to continue talks on stablecoin-related frameworks and yield-related issues.

For the first time, representatives from major banks are expected to participate directly in the staff-level discussions, signaling growing cooperation between traditional finance and the crypto sector.

Is the Rally Temporary or the Start of a Trend?

Despite the strong price recovery, some analysts warn that the move could represent a short-term rebound following the recent market decline rather than the start of a sustained uptrend. Quick price recoveries after large drops sometimes fade if broader market conditions remain uncertain.

For now, support is being monitored around $1.28, while potential resistance levels are seen near $1.85 and $2.50.

Related: Ripple CEO Hints at Buying Opportunity Amid Crashing Crypto Prices

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.