- Monthly rejection near $3 keeps XRP defensive as $1.90 close risks deeper downside.

- Cup-and-handle structure keeps long-term targets alive if XRP reclaims resistance.

- Cooling RSI and MACD, and fading open interest, point to a monthly reset phase.

XRP’s monthly chart has turned into a key battleground as traders debate whether the pullback signals deeper downside or a long setup. XRP traded near $1.97 as of press time, up 4.09% in 24 hours.

However, the token still showed a 7.65% weekly decline. That mixed performance has kept attention on the latest 1-month candle. Several analysts said the monthly structure now reflects heavy supply and cautious risk.

Monthly Candle Signals Pressure at Key Supply

Analyst crypto bullet described the latest monthly candle as ugly and distribution-heavy. The analyst pointed to strong selling pressure near the $2.70–$3.00 supply zone. That rejection shifted the market from momentum to defense. Price has also drifted toward the $1.90–$1.95 pivot, which now acts like a trigger level.

The analyst highlighted $1.60 as the next major support and flagged $1.30 as another reaction area. The $1.00 psychological level remains the deeper line if fear returns. Consequently, a monthly close below $1.90 could increase the odds of weakness.

Bulls now need a stronger monthly structure to shift sentiment. The analyst said buyers regain control above $2.20 first. The next confirmation zone sits near $2.50. Hence, XRP needs a clean strength above resistance to rebuild confidence.

Cup-and-Handle View Keeps Macro Targets Alive

XRP community member and crypto analyst Maxi offered a longer-term view that contrasts with the bearish monthly candle narrative. The analyst tracked an 8-year rounded bottom that resembles a cup formation and said XRP has spent about one year consolidating under the previous all-time high resistance. That range action can signal absorption instead of exhaustion.

Additionally, the handle zone can act as a launch pad if the market confirms support. Maxi’s targets are $7.0, $19.5, and $58.9. However, that path still depends on regaining and holding major resistance levels.

Indicators and Leverage Show a Cooling Phase

Momentum signals also support the idea of a reset. An RSI near 53 indicates the market has cooled after the earlier spike. Moreover, MACD shows momentum cooling down with the MACD line trading below the signal line and the rising red histograms.

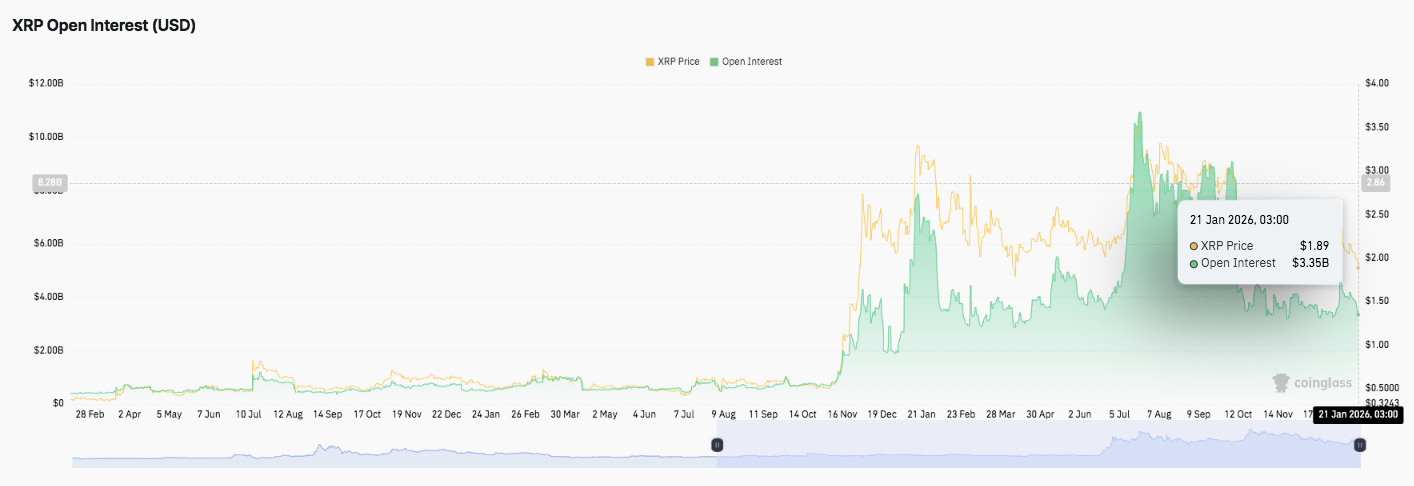

Leverage data has followed a similar boom-and-cooldown pattern. Open interest climbed hard in November, then spiked again into early January. It later faded as volatility increased.

Significantly, open interest was near $3.35 billion on Jan. 21, while XRP was at $1.89. That shift suggests traders reduced exposure rather than taking on new risk.

Related: XRP Price Prediction: Can Bulls Defend $1.85 Before $1.77?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.