- XRP open interest climbs as traders rotate risk; Bitcoin and Solana futures cool.

- XRP holds $3 support while $3.06 caps upside; a break sets the next short-term leg.

- Bitcoin stalls near $116,000; Solana tests $232 support as flows shift toward XRP.

XRP pulled ahead this week as traders built new leveraged bets while Bitcoin and Solana futures lost steam. Glassnode data showed XRP perpetual open interest rising even as positions in BTC and SOL contracts fell, a sign that traders rotated exposure into assets still showing momentum.

The divergence clearly shows that Bitcoin held firm near its ceiling, Solana slipped under pressure, but XRP drew inflows into futures books. For desks, that marks a rotation of speculative flow back into Ripple’s token while peers pause.

Related: Analyst Predicts 750% XRP Breakout to $27 as Solana Eyes $1,100 Milestone

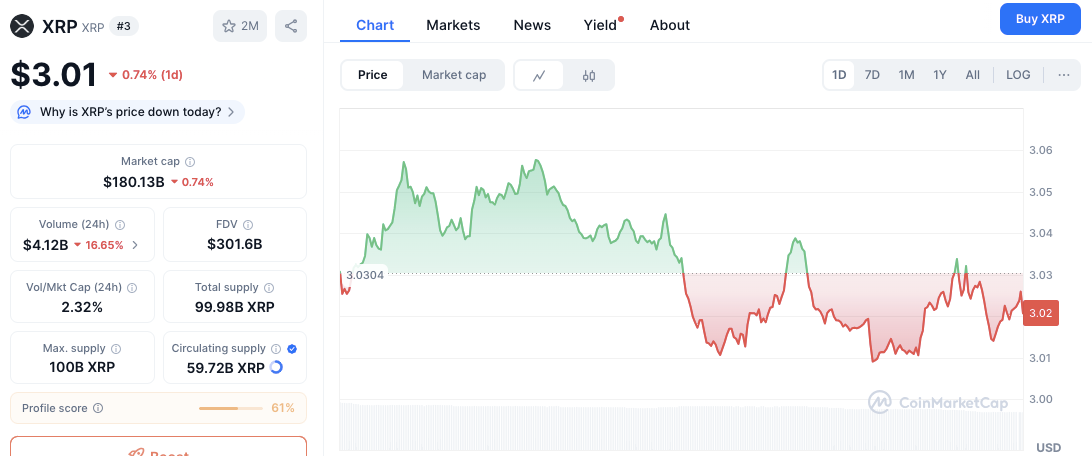

XRP Holding $3 With $3.06 Capping Upside

As of press time, XRP trades at $3.02, reflecting a modest decline of 0.36%. The token now sits in a narrow range between $3.00 support and $3.06 resistance. Traders repeatedly tested both ends of this channel, leaving price action stuck in consolidation. A decisive break could set the next short-term direction.

The $3.06 ceiling continues to cap bullish momentum, and repeated rejections show strong near-term resistance. On the downside, the $3.00 level remains psychological support, with further risks toward $2.97 if it fails.

Besides, daily volume fell by more than 16%, raising questions about buyer strength. If momentum returns above $3.06, targets extend toward $3.12–$3.15. Conversely, a loss of $3.00 may trigger selling pressure toward $2.95.

Related: Analyst Singles Out XRP to Rival Bitcoin. Not in Price Though

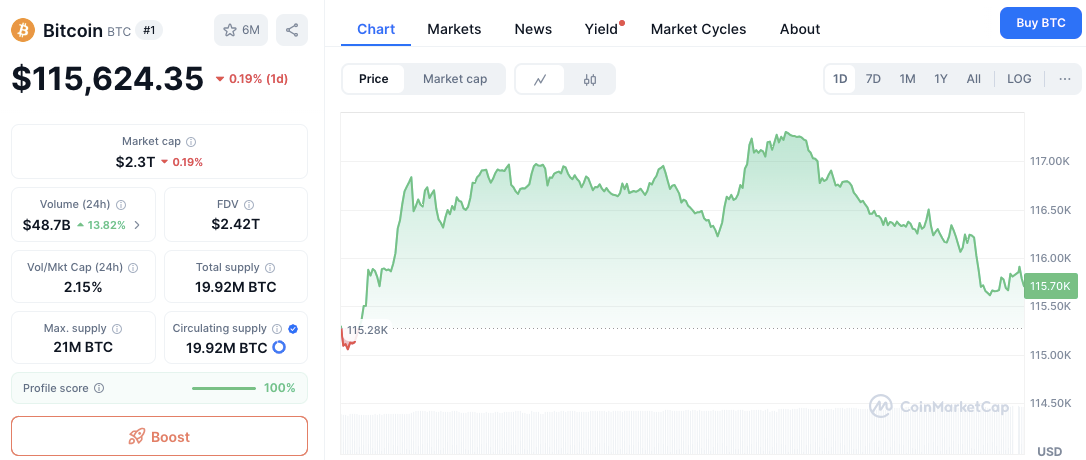

Bitcoin at $116K Ceiling

Bitcoin shows resilience, holding steady around $115,912 after a sharp run toward $117,000. Resistance at $117K stalled the rally, while $115,500 served as a key short-term floor. The asset now trades in a consolidation zone between these levels, reflecting reduced speculative interest.

Volume data provided an interesting contrast. Activity climbed by more than 21%, yet profit-taking capped momentum near resistance.

Hence, traders remain cautious, awaiting a confirmed breakout before adding exposure. A push above $117K could open a path toward $118,500–$119,000. However, slipping below $115,500 might expose $115,000 and $114,800.

Solana Under $232 Pressure

Solana declined 1.43% to $234 in the past 24 hours, trading in a tight band with $232 as immediate support and $238–240 acting as resistance. The structure shows lower highs, suggesting sellers continue to dominate the short-term. Moreover, despite a modest increase in trading volume, bearish pressure limited upside attempts.

If $232 breaks, traders may eye $228–225 as the next support cluster. On the other hand, regaining $240 could spark recovery toward $245–250. Consequently, Solana appears locked in a battle between strong holders and short-term profit takers.

Market Read for Traders

The rotation is obvious; traders are cutting back on Bitcoin and Solana leverage but adding to XRP.

With open interest climbing and price boxed between $3.00 and $3.06, XRP has become the high-conviction short-term trade among the majors.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.