- XRP enters December with continued declines, while history shows mixed performance for the month.

- New XRP spot ETFs and shrinking exchange supply could trigger a potential supply squeeze.

- Analysts’ projections range from $4 to $10 on stronger demand.

XRP begins December with price declines after closing November on a bearish note. The token currently trades at $2.04, following a 7% dip over the past day and extending its monthly loss to 18%.

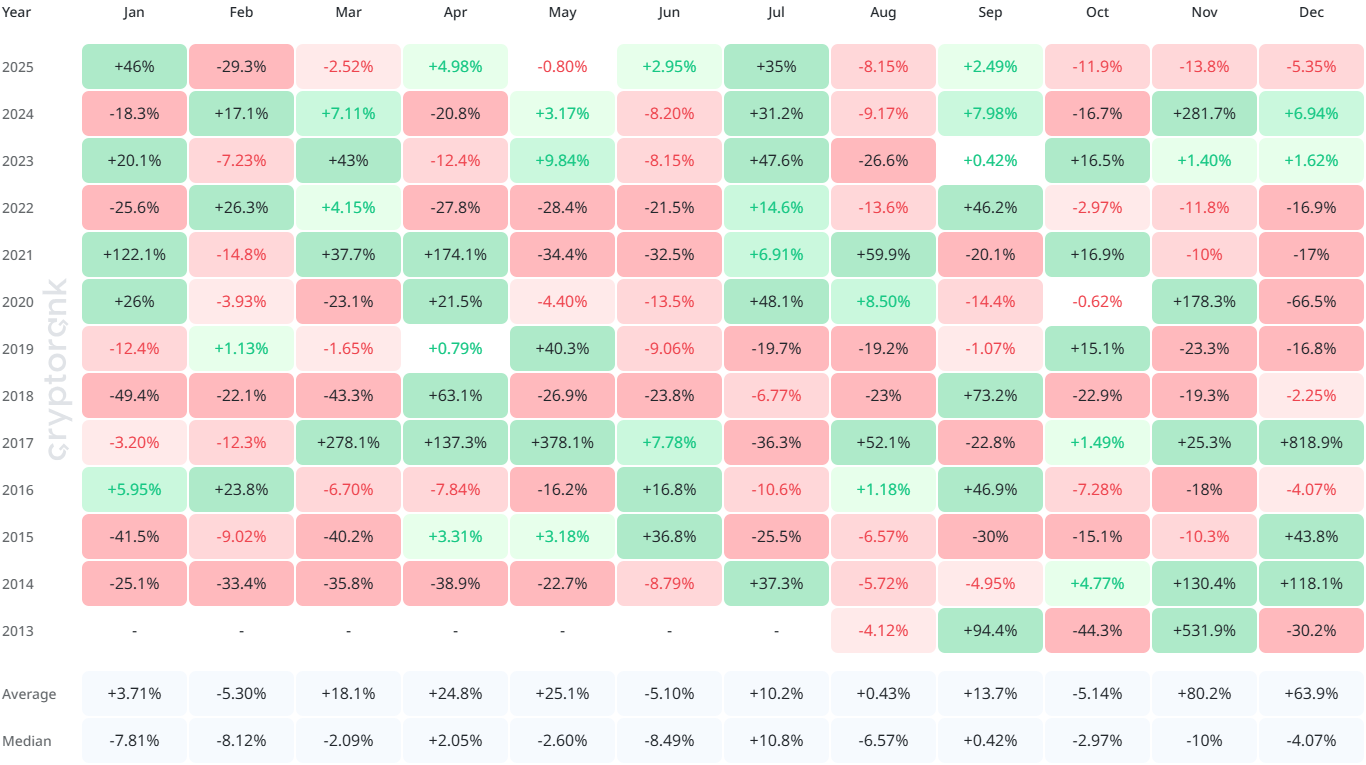

For two straight months, XRP has recorded persistent declines. For context, XRP fell 12% in October, followed by a 13.8% drop in November. Now, the asset has already registered a 5.35% decline in the first few days of the new month.

With this backdrop, many traders are turning to historical trends to understand how XRP typically performs in December.

XRP’s Price Performance in December

Historically, XRP has averaged a 63% gain in December. However, it’s important to note that in the past 13 years, XRP has only ended December in the green five times. The other eight years closed with significant red.

The reason December shows such a strong average performance is due to distinctive, massive spikes, such as 818% in 2017 and 118% and 43.8% in 2014 and 2015, respectively. These outliers heavily skew the long-term average. This suggests the likelihood of a bearish December is higher than many assume.

Furthermore, November historically has an average gain of 80%, yet XRP still ended last month with a 13.8% loss.

However, the opposite argument also exists. XRP has posted losses every month since August—except September, which only delivered a modest 2.49% gain. With several months of sustained downside, there is a possibility XRP may see relief this month.

Related: XRP Price Prediction: Trendline Rejection Deepens As Sellers Hold The EMA Wall

ETF Influence: A Key Catalyst

One of the biggest factors influencing a positive outlook for XRP is the emergence of spot ETFs. Five XRP ETFs are now live from 21Shares, Canary Capital, Bitwise, Grayscale, and Franklin Templeton.

Collectively, these ETFs have already purchased over 300 million XRP as of last week, with total assets surging to $687 million.

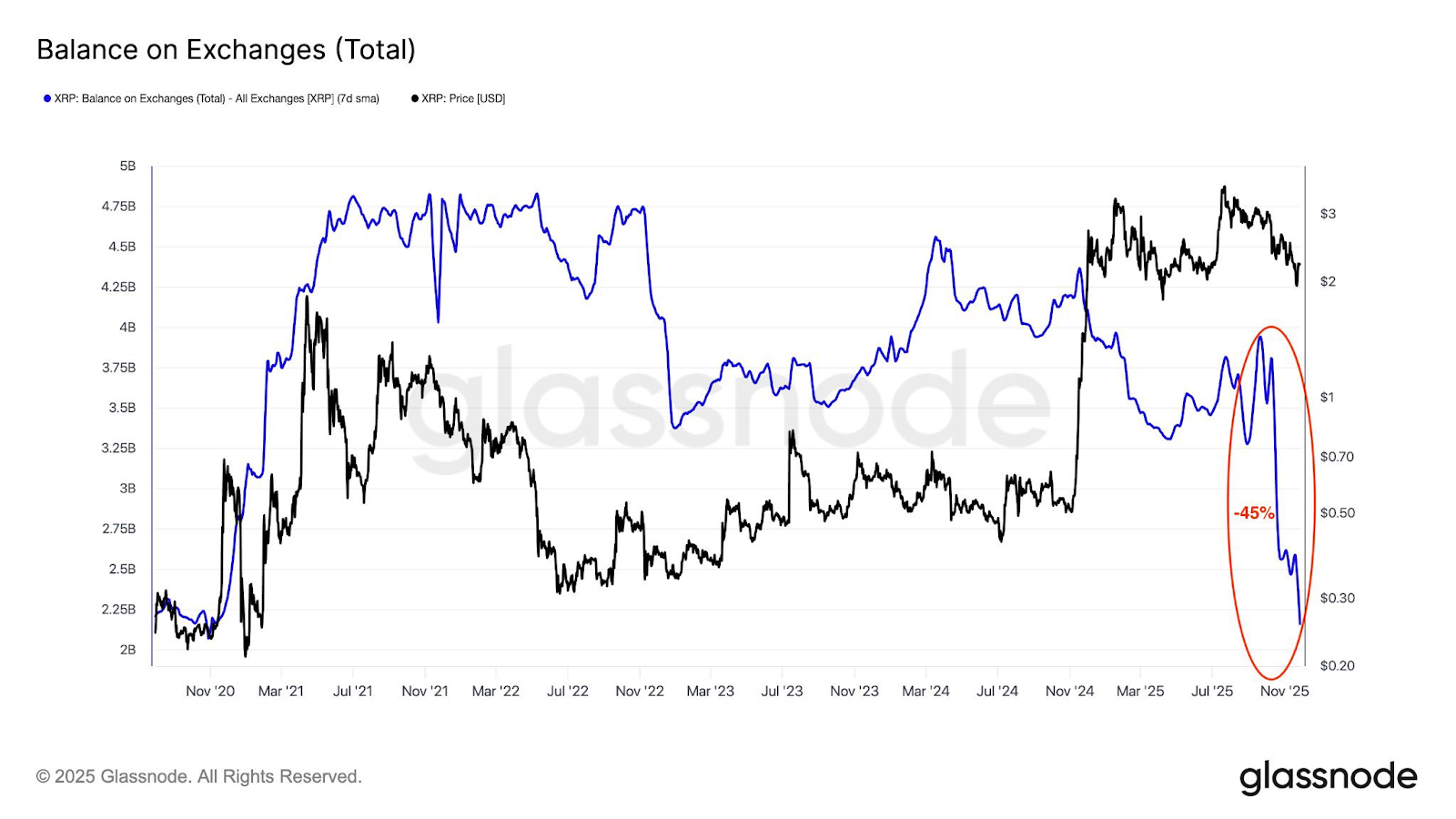

Meanwhile, XRP available on exchanges continues to decline sharply, suggesting reduced selling pressure. As highlighted by analyst Diana on X, total XRP held across all exchanges dropped from 3.95 billion on September 21 to just 2.6 billion by November 27—a 45% reduction in publicly available liquidity.

With supply tightening, even normal buying pressure can have a sharper impact on price. This liquidity squeeze aligns with rising ETF demand, creating conditions for a potential supply shock.

Related: Wall Street’s New Favorite Crypto? XRP ETFs See Record $622M in Cumulative Inflows

XRP Price in the Next Four Months: Dr. Whale’s Outlook

Meanwhile, analyst Dr. Whale has released updated short-term projections for major altcoins, including XRP. He believes XRP could reach $4 within the next four months, representing a near 2x increase from current levels.

While moderate, Dr. Whale’s estimate suggests a stabilizing market in which upward pressure can build without necessitating a full breakout.

Analysts argue that increased ETF inflows and Ripple’s enterprise adoption support stronger price surge to $10 and beyond.

Long-Term Potential With RLUSD Launch in Japan

According to 24/7 Wall St, Japan remains one of Ripple’s most strategically important markets due to its clear crypto regulations and well-defined stablecoin rules. Ripple, in partnership with SBI Holdings, aims to launch RLUSD by Q1 2026. This will integrate it into Japan’s remittance networks and enable USD-based settlements.

Analysts at 24/7 Wall St outline three potential 2026 scenarios for XRP:

- Bullish case: $3.50–$4.50

- Base case: $2.30–$3.30

- Bearish case: $1.80–$2.10, if regulatory delays or Bitcoin dominance suppress altcoin liquidity

Bitcoin Dominance and Altcoin Dynamics

Ultimately, Bitcoin’s dominance remains a constraint on altcoins, including XRP. Historically, XRP tends to rally only when Bitcoin dominance falls, enabling funds to rotate into secondary assets. At press time, Bitcoin is at $85,300, down 6.8% over the past day with a dominance of 59%, which reflects only a 1.08% change over the past month.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.