- XRP’s price breaks out, forming a bullish pattern, sparking optimism.

- Technical indicators show mixed signals, with neutral RSI and potential bearish MACD.

- Crypto Barbie predicts a massive 30,000% XRP price surge, though this is a very optimistic forecast.

Ripple’s XRP has shown signs of a bullish breakout, with the price currently at $0.6075. This positive momentum has been highlighted by Crypto Yapper, who points to a bullish formation in the cryptocurrency’s chart.

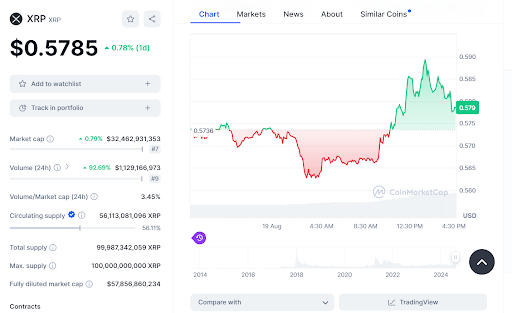

XRP’s 24-hour trading volume is approximately $1.65 billion, and the price has risen by 7.1% in the last day. The cryptocurrency’s market cap currently stands at $34 billion.

While positive sentiment surrounds XRP, technical indicators show a mixed picture. The daily chart shows an RSI of 52.71, indicating neutral momentum. The MACD line is below the signal line, hinting at potential bearish sentiment. This suggests XRP might experience either downward pressure or consolidation in the short term.

Key support levels analysis shows that the immediate support is around $0.5736, a recent low where the price has bounced back. Should XRP drop further, this level could offer short-term support.

Additionally, $0.5700 serves as a psychological support level, potentially attracting buyers if the price declines further. A break below this level could lead to $0.5650, another support zone where previous stabilization occurred.

In a contrasting view, Crypto Barbie, a crypto enthusiast, asserts that XRP is on the verge of its most significant breakout in history. She suggests that if XRP performs similarly to its 2018 rally, it could see a 30,000% increase. This would push XRP’s market cap to $9.66 trillion, an ambitious forecast.

The symmetrical bullish triangle pattern observed since 2018 could be crucial to this potential breakout. After a massive 60,000% rally in 2018, XRP’s price started a declining trend but formed a bullish pattern over the past six years.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.