- XRP price today trades near $2.41, slipping below key EMAs as bears test the $2.35–$2.30 support zone.

- Evernorth launches a $1B Nasdaq-listed XRP treasury, sparking both long-term optimism and short-term uncertainty.

- Technical outlook sees $2.20 as the critical downside level, while bulls eye $2.75–$3.00 on recovery.

XRP price today trades near $2.41 after sliding more than 3% in the past 24 hours. The token has broken below its ascending triangle structure, forcing traders to focus on the $2.35–$2.30 support range as selling momentum intensifies. The launch of a new $1 billion XRP treasury fund has injected both optimism and confusion, with Ripple executives clarifying their roles.

Price Action Pressures Mount As Breakdown Extends

The latest move leaves XRP price action under strain. On the daily chart, the token rejected resistance near $2.76, aligned with the 50-day EMA, before retreating sharply. Price now trades below all major short-term EMAs, with the 20-day ($2.56) and 50-day ($2.73) flipped into overhead resistance.

Related: Ethereum Price Prediction: ETH Price Consolidates Below $4K as Developer Rift Surfaces

Momentum indicators confirm weakness. The RSI sits at 36, just above oversold conditions, highlighting fragile sentiment. Unless XRP reclaims the $2.62–$2.76 zone quickly, bears may attempt to drag price back toward the broader ascending trendline around $2.20.

Netflows Highlight Weak Investor Commitment

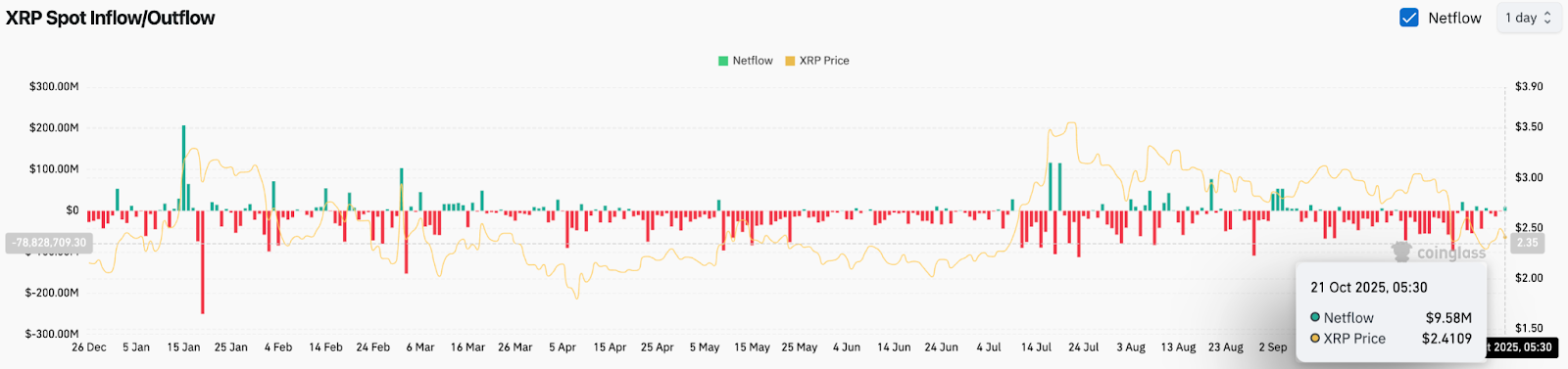

On-chain flows reflect subdued confidence. According to Coinglass data, XRP spot netflows showed a modest $9.58 million inflow on October 21, yet this comes after weeks of consistent outflows.

Earlier in July, exchange outflows coincided with a sharp rally toward $3.80, but recent months have seen persistent inflows that historically signal potential selling pressure.

Evernorth Treasury Announcement Divides Market

The key catalyst is the launch of Evernorth, a newly merged entity modeled after corporate Bitcoin treasuries. The firm plans to raise over $1 billion via a Nasdaq listing and act as an institutional buyer of XRP. Ripple CTO David Schwartz clarified he is only advising the project, not taking on a full-time role, easing speculation about his departure.

Related: Bitcoin Price Prediction: BlackRock Selling Challenges Bullish Sentiment

At the same time, Ripple board member Asheesh Birla confirmed he will serve as Evernorth’s CEO, emphasizing its mission to build a war chest for acquisitions.

Technical Outlook Signals $2.20–$2.75 Range

From a technical lens, the immediate resistance stands at $2.56, then $2.76, where the 50-day EMA converges with descending trendline resistance. A daily close above this band could spark a recovery toward $3.00.

On the downside, failure to hold $2.35 exposes XRP to a retest of $2.20. A deeper breakdown would put $2.00 back in play, marking the base of the broader ascending channel that has guided price since early 2025. For traders, this narrow risk-reward band makes $2.35–$2.75 the decisive zone for the next breakout.

Outlook: Will XRP Go Up?

The XRP price prediction remains balanced. Bulls must defend $2.35 and reclaim $2.62–$2.76 to reestablish momentum, with upside potential toward $3.00 if Evernorth inflows materialize. Bears, on the other hand, are watching for a clean break below $2.20 that could unravel the broader uptrend.

For now, XRP price today reflects hesitation. The launch of a $1 billion treasury has created long-term optimism, but without stronger inflows and a clear technical recovery, short-term volatility is likely to persist.

Related: Cardano Price Prediction: ADA Faces Range-Bound Pressure as Momentum Cools

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.