- XRP price today trades near $2.65 as buyers defend the $2.60 support zone.

- Evernorth confirms $1B XRP treasury purchase, boosting institutional sentiment.

- $60M in outflows and rising derivatives activity point to a $2.94 breakout test.

XRP price today trades near $2.65, gaining modestly after recent volatility as traders react to renewed institutional inflows and macro liquidity expectations. The token’s rebound follows confirmation that Evernorth, backed by Ripple, purchased over $1 billion worth of XRP to seed its new treasury platform.

Buyers Reclaim Mid-Fib Zone As Structure Turns Neutral

The daily chart shows XRP price action attempting to reclaim the 0.5 Fibonacci retracement level at $2.72, a key midpoint from the summer rally to the $3.66 peak. The token has recovered sharply from its October low near $2.20, with the 20-day EMA at $2.68 providing a pivot for buyers to hold.

Immediate resistance sits between $2.73 and $2.94 — aligning with the 50% and 61.8% retracement zones and the descending trendline that caps the current structure. A decisive break above this pocket could open a path toward $3.26, the 0.786 retracement mark and the upper boundary of the wedge.

Related: Chainlink Price Prediction: Whales Accumulate as LINK Eyes a Bullish Reversal

Support remains firm around $2.56–$2.60, where both the 100-day EMA and ascending trendline converge. Losing this area could invite a deeper retest of $2.45, though broader sentiment appears to be stabilizing after heavy liquidation earlier this month.

Evernorth’s $1B Purchase Boosts Institutional Confidence

The Evernorth acquisition, confirmed by Coin Bureau, marks one of the largest single corporate accumulations of XRP in 2025. The firm now holds 388.7 million tokens, reinforcing Ripple’s expanding footprint in institutional payments and digital asset treasury solutions.

This announcement has significantly improved near-term sentiment, with traders interpreting it as validation of the XRP price prediction narrative that institutions continue to see value in XRP’s liquidity framework. The move also underscores Ripple’s ongoing strategy of expanding corporate adoption beyond remittances, aligning with its RLUSD stablecoin initiatives and partnerships across fintech and healthcare sectors.

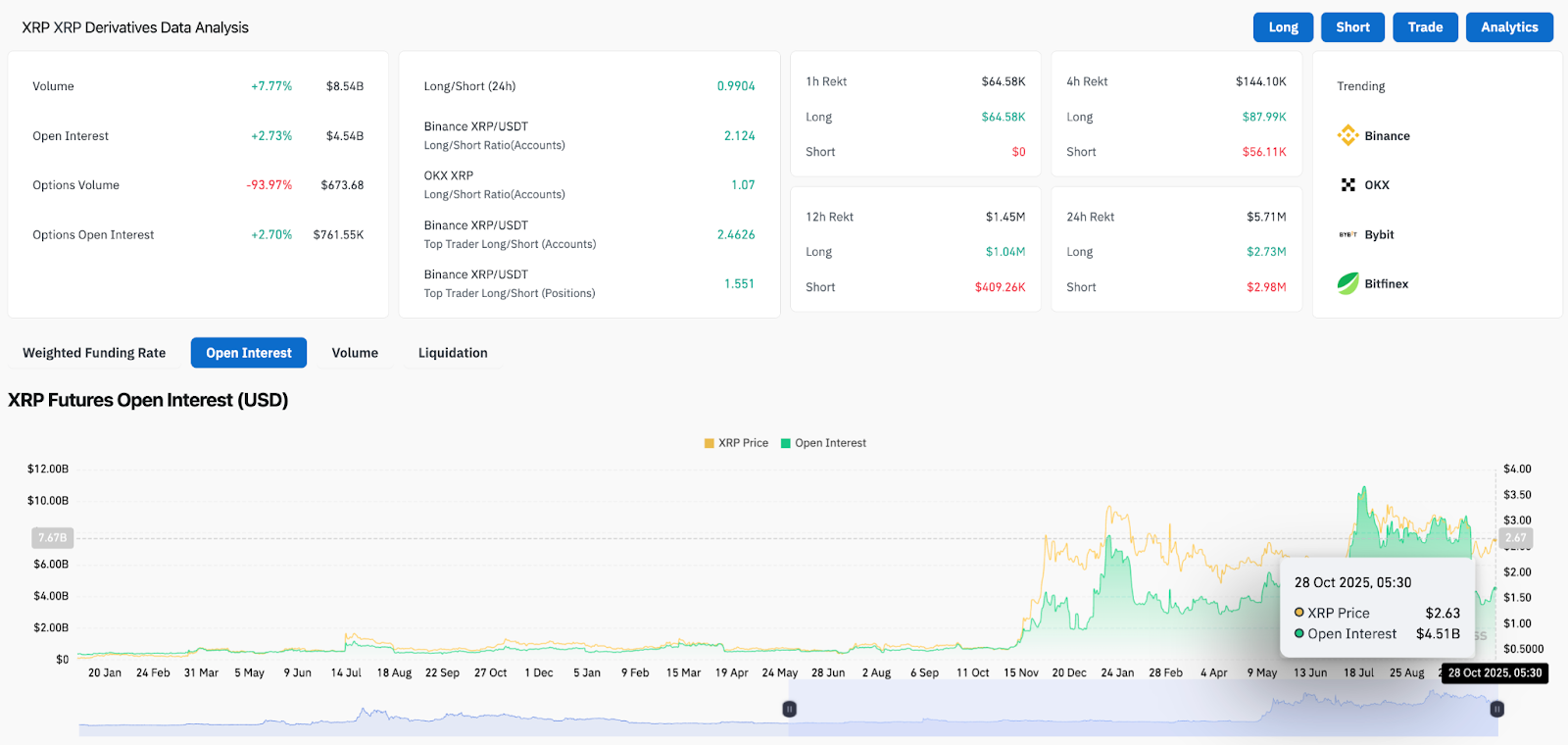

Derivatives Data Points To Strengthening Long Interest

According to Coinglass derivatives data, open interest rose 2.7% to $4.54 billion, while futures volume climbed 7.8% to $8.54 billion. The long/short ratio remains balanced at 0.99, though Binance traders lean heavily long at 2.12, suggesting renewed speculative confidence.

Related: Hedera Price Prediction: HBAR Gains Investor Momentum as ETF Launch Nears

Funding rates have normalized after last week’s deleveraging, and options open interest also increased 2.7% to $761 million, indicating that volatility traders are re-engaging. These metrics suggest that positioning is shifting from defensive to neutral-bullish, particularly if XRP can confirm a break above the $2.72 pivot.

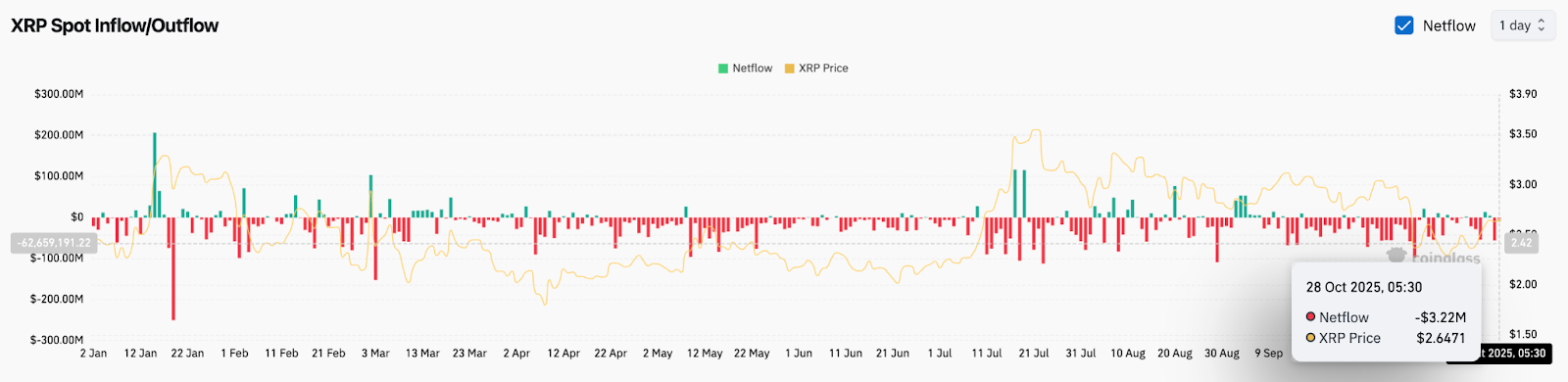

Exchange Flows Show Modest Outflows

Spot exchange netflows show a –$3.22 million outflow on October 28, extending a broader pattern of coins moving off exchanges this quarter. Historically, such mild outflows coincide with accumulation phases, as investors shift holdings to custody rather than liquidation.

Over the past month, cumulative outflows exceed $60 million, while price resilience near $2.60 implies that sellers are losing control.

Outlook: Will XRP Go Up?

For now, the XRP price prediction remains cautiously bullish above $2.60. A close above $2.73 would confirm short-term breakout potential toward $2.94, followed by $3.26 if momentum accelerates.

Failure to hold the $2.56 support zone would weaken the setup and likely bring XRP back toward $2.40–$2.45, where deeper liquidity sits.

Given improving derivatives positioning, steady exchange outflows, and renewed institutional demand, the near-term bias tilts upward. The key test lies in whether buyers can push through the $2.72–$2.94 resistance band and sustain volume as macro liquidity improves post-Fed.

Related: Bitcoin Price Prediction: Fed QT Pause And Trump–Xi Summit Put $118K In Play

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.