At press time, XRP price is trading around $2.81, consolidating after several rebounds off the $2.75–$2.80 support zone. The token faces strong resistance overhead, but renewed political narratives and steady derivatives activity are keeping traders engaged.

XRP Price Holds Support But Faces Trendline Pressure

The 4-hour chart shows that XRP is stuck in a descending triangle pattern. The price has been stuck below the long-term downtrend line since July, as the 100 and 200 EMAs converge near the $2.89–$2.93 region.

Support remains strong around $2.75 to $2.80, having successfully withstood selling pressure over the past two weeks. There isn’t much upside conviction until the price goes back up to $2.93, but sellers seem to be losing control as downside breaks haven’t continued.

Trump’s Comments Fuel Bullish Sentiment

Crypto traders turned their attention to President Trump after he declared, “The financial system is broken, crypto will fix it.” The statement quickly spread across trading desks, with many highlighting XRP’s positioning as a bridge currency for global settlement.

The remarks added speculative fuel to ongoing debates about U.S. regulatory clarity and institutional adoption. Traders view his endorsements not only as psychological drivers for sentiment but also as signals of a regulatory environment increasingly favorable to digital assets.

Derivatives Data Points To Steady Participation

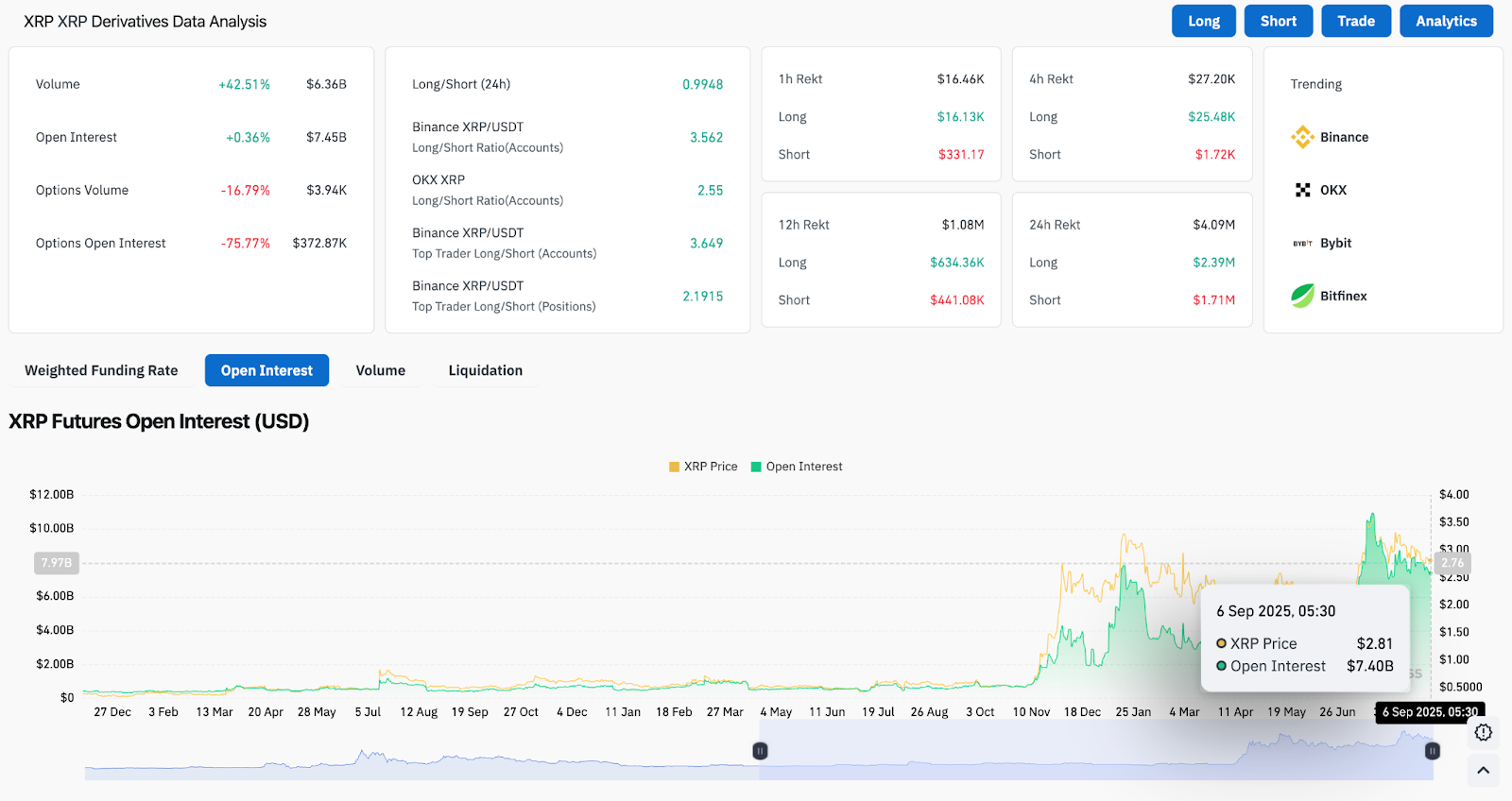

Futures data shows open interest stable at $7.45 billion, with a modest +0.36% uptick over the last 24 hours. Volume surged 42% to $6.36 billion, suggesting active repositioning among traders.

Notably, Binance long-to-short ratios continue to favor longs at 3.56, indicating a strong belief in potential upside moves. Options data, however, showed a sharp -16.7% drop in volume and -75% in open interest, reflecting declining hedging appetite as traders wait for a breakout confirmation. This balance between strong futures positioning and weaker options activity underscores a cautious but constructive market stance.

Related: XRP Futures Hit $1B Milestone as Analysts Eye $3.66 Breakout

Supertrend And DMI Highlight Neutral Bias

On the daily chart, the Supertrend indicator remains bearish at $3.18, keeping overhead pressure intact. A close above this threshold would flip signals bullish for the first time since mid-August.

Directional Movement Index (DMI) readings show ADX at 19.80, reflecting a weak trend environment. However, since the negative directional index (−DI) at 21.9 is above the positive directional index (+DI) at 14.5, the market currently shows a mild bearish bias.

Technical Outlook For XRP Price

XRP’s immediate roadmap hinges on reclaiming the $2.89–$2.93 resistance cluster. A breakout here would open the path toward $3.20 and $3.35, with the broader $3.60 supply zone as the bullish extension target. On the downside, a loss of $2.75 would risk exposing $2.60. Deeper failure could drag price toward the $2.40 zone, unwinding gains from July’s rally.

Outlook: Will XRP Go Up?

XRP remains in a compression phase where catalysts and sentiment are equally important as technicals. Trump’s comments have sparked new hope, but momentum is likely to remain limited in the absence of stronger inflows and a clear break above $2.93.

Analysts suggest cautious optimism. As long as XRP defends $2.75, the bias leans toward eventual upside, with $3.20 as the first key hurdle. However, sustained accumulation and a reversal in options activity will be needed for a broader move toward $3.60.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.