XRP has shown resilience over the past day, holding steady above key support as traders weigh bearish pressure against growing optimism fueled by ETF speculation. Trading at $2.81 as of press time, XRP has stabilized after testing the $2.77 support zone and is under pressure inside a descending triangle.

However, market observers predict that a potential price change is on the horizon with talks of XRP ETF filing. Traders are now weighing technical headwinds against renewed institutional interest.

XRP Price Holds Crucial $2.77 Support

The daily chart indicates that XRP is consolidating slightly above its $2.77 floor, a level it has consistently defended since August. Below this, the 200-day EMA at $2.52 acts as the last major support before deeper downside.

Overhead, the immediate resistance sits near $2.90–$2.92, aligned with the 20-day EMA. A breakout above this could open the door toward $3.10 and $3.40. However, the descending trendline from July continues to cap rallies, keeping bears in short-term control.

Meanwhile, momentum indicators remain cautious as the RSI hovers around 43, signaling weak momentum while the MACD has flattened, reflecting indecision, while narrowing Bollinger Bands suggest a potential volatility expansion ahead.

ETF Filing Sparks Market Optimism

An XRP ETF was filed under the ETF Opportunities Trust by Commonwealth Fund Services and according to analysts, if the filing is approved, it could mirror the liquidity impact seen in Bitcoin and Ethereum ETFs.

Meanwhile, analyst JackTheRippler shared the filing document, noting that such institutional products could transform XRP’s investor base. Traders argue that ETF approval may provide the long-awaited trigger to break out of the consolidation range and retest the $3.40–$3.60 supply zone.

Related: XRP ETF Odds Drop to 62% on SEC News, But Bloomberg Analyst Holds at 95%

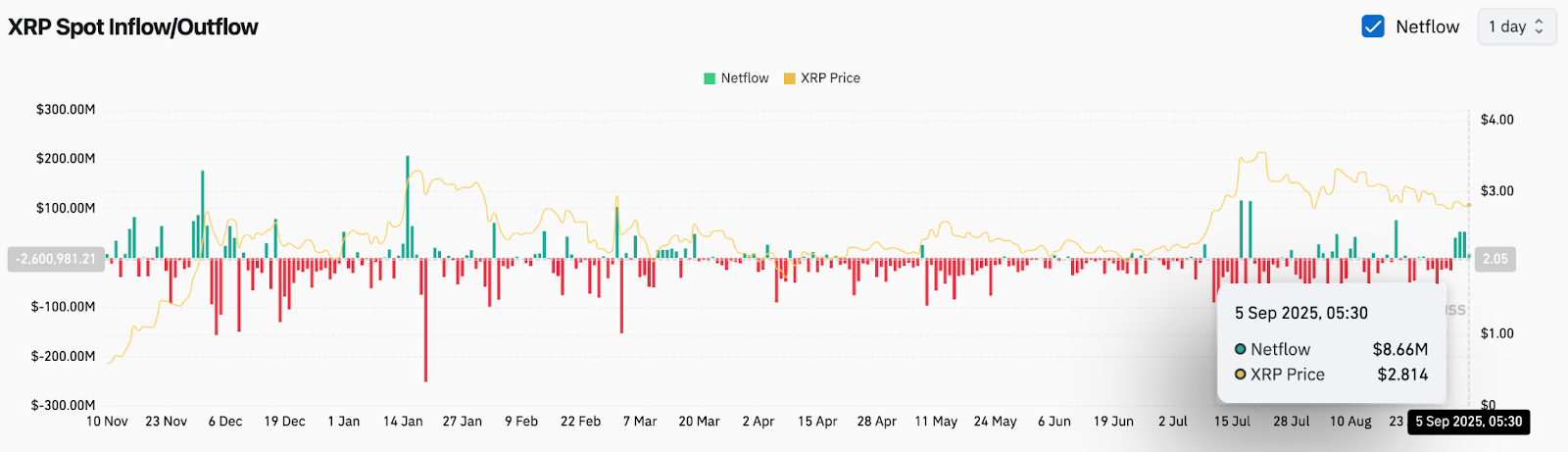

Net Inflows Signal Renewed Accumulation

On-chain data supports the improving sentiment. Exchange netflow data on September 5 showed an $8.66 million inflow, the strongest in weeks, which is in contrast with the extended outflow trend seen through July and August, signaling that accumulation is reappearing at current levels.

If sustained, these inflows could provide the liquidity base for a rebound, especially as speculative interest grows around the ETF narrative. However, analysts caution that inflows remain modest compared to peaks seen earlier this year, and stronger participation would be needed to fuel a decisive breakout.

Technical Outlook For XRP Price

XRP’s immediate roadmap hinges on the $2.77 support and the $2.90 resistance. Holding above $2.77 maintains the bullish bias, while a breakdown risks exposing $2.60 and then $2.52.

On the upside, reclaiming $2.92 would invite momentum buyers, targeting $3.10. A breakout above the descending trendline at $3.20 would strengthen the case for a rally toward $3.40–$3.60, the next supply zone.

Outlook: Will XRP Go Up?

XRP sits at a pivotal juncture, with ETF headlines providing the strongest bullish catalyst in months. As long as price holds above $2.77, the structure favors cautious accumulation, with $3.10–$3.40 the next key test levels.

Related: XRP to $26.97 by 2030: Too Ambitious or Perfectly Plausible?

Failure to defend $2.77, however, would tilt the setup bearish, leaving XRP vulnerable to a retest of $2.52. For now, traders are watching whether institutional optimism around the ETF filing can overpower technical compression and trigger a breakout.

Forecast Table: XRP Key Levels

| Indicator | Level | Bias |

| Support 1 | $2.77 | Must-hold zone |

| Support 2 | $2.52 | 200-day EMA |

| Resistance 1 | $2.92 | EMA cluster |

| Resistance 2 | $3.40 | Breakout target |

| RSI | 43 | Weak momentum |

| Netflow | +$8.66M | Positive inflow |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.