- XRP price today trades near $2.44, holding the $2.30 trendline support zone.

- ETF speculation emerges after reports of 13 XRP filings with the SEC.

- Resistance sits at $2.58–$2.69, while a break could target $2.95–$3.10.

XRP price today trades near $2.44, holding firm after defending trendline support around $2.30. Despite weeks of pressure, renewed excitement over multiple pending XRP ETF filings with the U.S. Securities and Exchange Commission (SEC) has revived interest in the asset’s near-term outlook.

XRP Price Finds Support Amid Heavy Selling

The 4-hour chart shows XRP maintaining its broader uptrend structure despite recent volatility. The token remains above the key ascending trendline that has guided price since June, while facing overhead resistance between $2.58 and $2.69, where the 20- and 50-day EMAs cluster.

Repeated defenses of the $2.30–$2.35 zone confirm strong buying activity around the trendline base. The Parabolic SAR dots have started to flatten near $2.60, signaling a possible reversal attempt. For bulls, a clean break above $2.70 could trigger an upside extension toward $2.95–$3.10, while a failure to hold $2.30 could expose the $2.10 floor.

Related: Chainlink Price Prediction: LINK Eyes Recovery as Bulls Defend Key Support

Momentum indicators are showing early signs of recovery. RSI readings have edged back above 45, and MACD signals are flattening after weeks of bearish divergence. This setup suggests XRP may be entering a compression phase before a directional breakout.

ETF Filings Spark Institutional Speculation

Market sentiment shifted sharply after a chart shared by analyst @amonbuy highlighted 13 XRP ETF filings with the SEC, including applications from Bitwise, 21Shares, WisdomTree, Grayscale, Franklin Templeton, and CoinShares. Most filings are for spot XRP ETFs, with final review deadlines ranging between October 18 and November 14, 2025.

While the authenticity of these filings has not yet been confirmed through the SEC’s official database, the wave of discussion has reignited institutional speculation around XRP’s regulatory clarity. Traders note that approval of even one spot product could dramatically increase liquidity and accessibility, similar to the inflows observed during Bitcoin’s ETF debut.

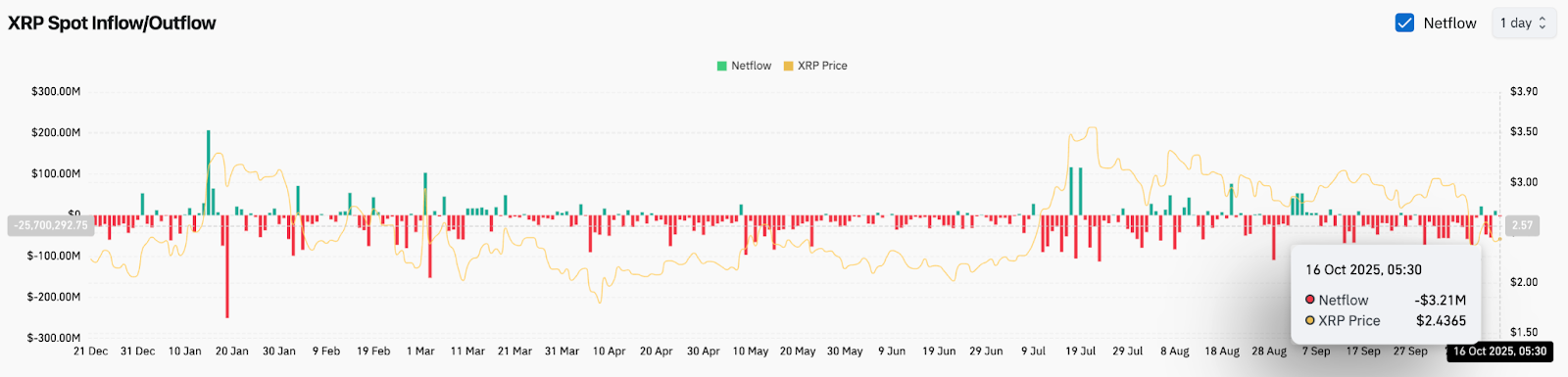

On-Chain Data Shows Mixed Flows

Exchange flow data from Coinglass indicates a $3.21 million net outflow on October 16, reflecting mild accumulation at current levels. Broader flow trends, however, remain inconsistent, with alternating red and green bars signaling a market still searching for direction.

Related: Tron Price Prediction: TRX Attempts Recovery as Traders Eye Key Resistance

Throughout the first half of October, persistent outflows followed XRP’s sharp rejection near $3.10. The stabilization of net flows this week may suggest early re-entry from long-term holders positioning for potential ETF-related developments. Analysts emphasize that stronger inflows, particularly those exceeding $25 million per day, would be needed to validate renewed bullish conviction.

Technical Levels Traders Are Watching

Immediate resistance is set at $2.58, where short-term EMAs converge. A sustained close above this mark could invite momentum buying toward $2.69 and the next ceiling near $2.95. Breaking that range would signal a bullish breakout from the descending channel visible on mid-term charts.

Support remains at $2.30, with deeper demand expected at $2.10 and $1.95 if selling pressure resumes. The Bollinger Bands have tightened considerably, suggesting a strong directional move could emerge once volatility expands.

Overall structure favors a rebound scenario as long as XRP maintains its ascending base and holds above the $2.30 threshold.

Outlook: Will XRP Go Up?

XRP’s next move depends heavily on confirmation of the rumored ETF filings and broader market sentiment. The asset continues to trade within a compressed range, with technical indicators hinting at the possibility of an upward breakout if bulls reclaim the $2.70 zone.

Related: Cardano Price Prediction: ISO 20022 Hype Sparks Attention

Analysts remain cautiously optimistic. As long as XRP stays above $2.30, the bias tilts toward recovery, targeting $2.95–$3.10 in the short term. A decisive breakdown below $2.30, however, would invalidate the bullish structure and expose $2.10.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.