XRP price today is trading near $2.83, consolidating after defending its $2.77–$2.80 support floor. Price action remains trapped inside a descending triangle, with resistance clustered around $2.95–$3.00. Traders are debating whether on-chain inflows and political liquidity narratives can provide enough fuel for a breakout.

XRP Price Struggles But Defends Key Support

The 4-hour chart shows XRP pinned between lower supports and heavy trendline resistance. The downtrend from July continues to cap upside attempts, with the 20-EMA at $2.85 and the 50-EMA near $2.91 reinforcing the ceiling. The 200-EMA sits higher at $2.95, aligning with the upper boundary of the pattern.

Related: World Liberty Financial (WLFI) Price Prediction 2025–2030

Momentum remains muted. The Relative Strength Index (RSI) hovers around 49, signaling neutral sentiment after weeks of failed rallies. A clean move above $2.95 would be required to confirm strength, while losing $2.77 could trigger a retest of $2.65.

Analysts Point To Recurring Cycle Patterns

Market analysts are highlighting similarities between the current setup and XRP’s 2021 breakout. Crypto strategist Steph is Crypto noted on X that “history is repeating,” comparing XRP’s current wedge structure to the one that preceded a sharp rally in early 2021. His chart suggests that a decisive break above $3 could reopen a pathway toward $4–$5 over the coming months.

Cycle-based traders argue that XRP often compresses for extended periods before sudden expansions. This narrative is fueling optimism that the ongoing consolidation may be setting up for another leg higher if market liquidity improves.

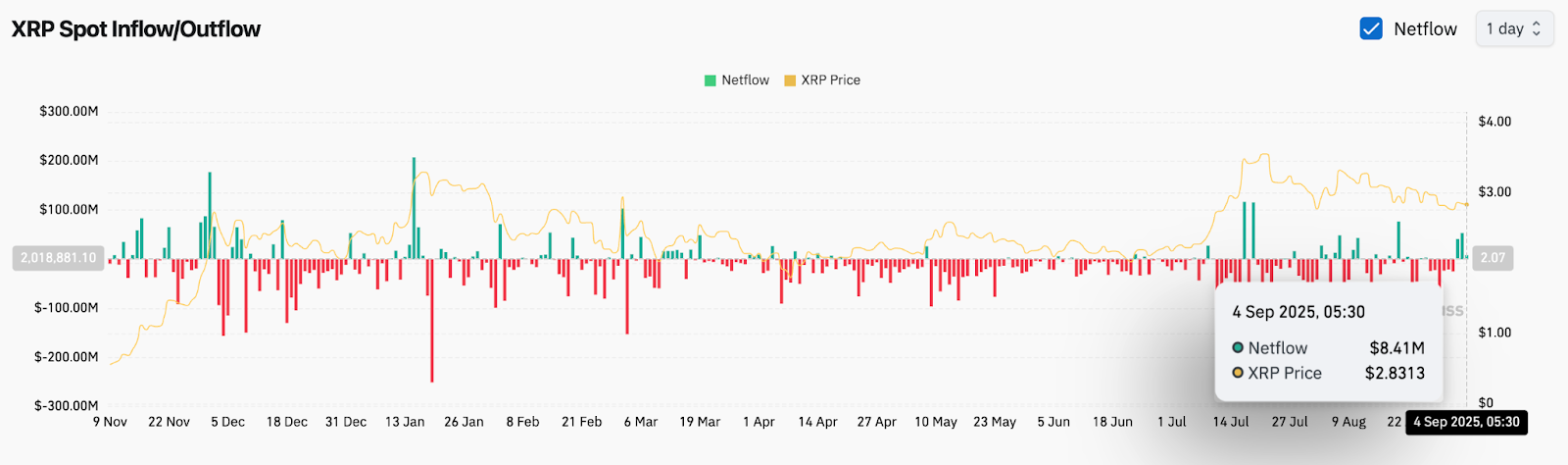

On-Chain Data Shows Return Of Inflows

Fresh on-chain data supports cautious accumulation. Coinglass reports a net inflow of $8.41 million into XRP spot exchanges on September 4, reversing the steady outflows seen through August. This uptick reflects renewed positioning by traders, potentially anticipating a catalyst-driven move.

Related: Shiba Inu Price Prediction: for September 3, 2025

Still, participation remains limited compared to the heavy inflows seen in July, when XRP traded above $3.20. Analysts stress that sustained inflows above $50 million would be needed to validate a strong accumulation phase.

Political Narratives Add To Market Buzz

A surprising macro catalyst emerged after President Trump suggested that tariffs could replace federal income tax. Market commentators argue that such a policy, if enacted, would inject massive liquidity into the system. Crypto strategist John Squire highlighted the potential impact on XRP, calling it “rocket fuel” for the token’s adoption.

While the policy debate remains speculative, the comments added momentum to bullish narratives. Traders are increasingly sensitive to political developments that could alter capital flows into digital assets, particularly tokens like XRP that are closely tied to the payments narrative.

Technical Outlook For XRP Price

Key levels are clearly defined heading into September 5. On the upside, a push above $2.95 could trigger a breakout, opening the door to $3.20 and $3.35. A further extension may target $3.60, especially if cycle repetition patterns hold and inflows strengthen.

On the downside, the $2.77–$2.80 support remains crucial. A breakdown here would expose $2.65, followed by $2.50 where the 200-day EMA sits as a final line of defense. Failure to hold this region could drag XRP back toward the $2.30–$2.40 zone, unwinding gains from midsummer.

Related: Ethereum (ETH) Price Prediction: Foundation Sale Sparks Market Debate

Outlook: Will XRP Go Up?

The immediate outlook for XRP hinges on whether bullish catalysts materialize before technical compression forces another rejection. With net inflows reappearing and analysts pointing to repeating cycle structures, the bias is cautiously tilted toward upside attempts.

As long as XRP holds above $2.77, the probability of a breakout toward $3.20–$3.35 remains intact. Without stronger inflows or a policy-driven liquidity spark, however, consolidation may persist. Traders now watch the $2.95 level as the decisive trigger for September’s next move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.