- XRP price today holds $2.84 after rejection near $2.90, with $2.83 acting as critical short-term support.

- Futures open interest slipped 2.08% to $7.40B as options activity fell, signaling weaker derivatives demand.

- Exchange net outflows of $17.8M show mild accumulation, but whale activity remains subdued.

XRP price today is trading at $2.84, slipping after rejection near $2.90 while defending short-term support above $2.83. The market’s focus is whether XRP can reclaim the $2.92–$3.00 resistance cluster or if fading derivatives interest will keep momentum capped.

XRP Price Holds Fib Support

XRP has remained compressed within a descending structure since July, with the daily chart showing repeated rejections near the $3.09–$3.19 Fibonacci zone. Current support lies at $2.83, which aligns with the 50-day EMA and the lower boundary of the pattern.

The 20-day EMA at $2.90 is acting as immediate resistance, while the Parabolic SAR has shifted closer to price, adding pressure on buyers. A clean breakout above $2.92 would strengthen the setup for a retest of the $3.10–$3.30 range. On the downside, losing $2.83 risks opening the door toward $2.70 and deeper liquidity around $2.61.

Related: Bitcoin Price Prediction: Analysts Track $120K Resistance As Whale Outflows Persist

Momentum remains neutral, with RSI mid-range and Bollinger Bands narrowing, pointing to an upcoming volatility expansion.

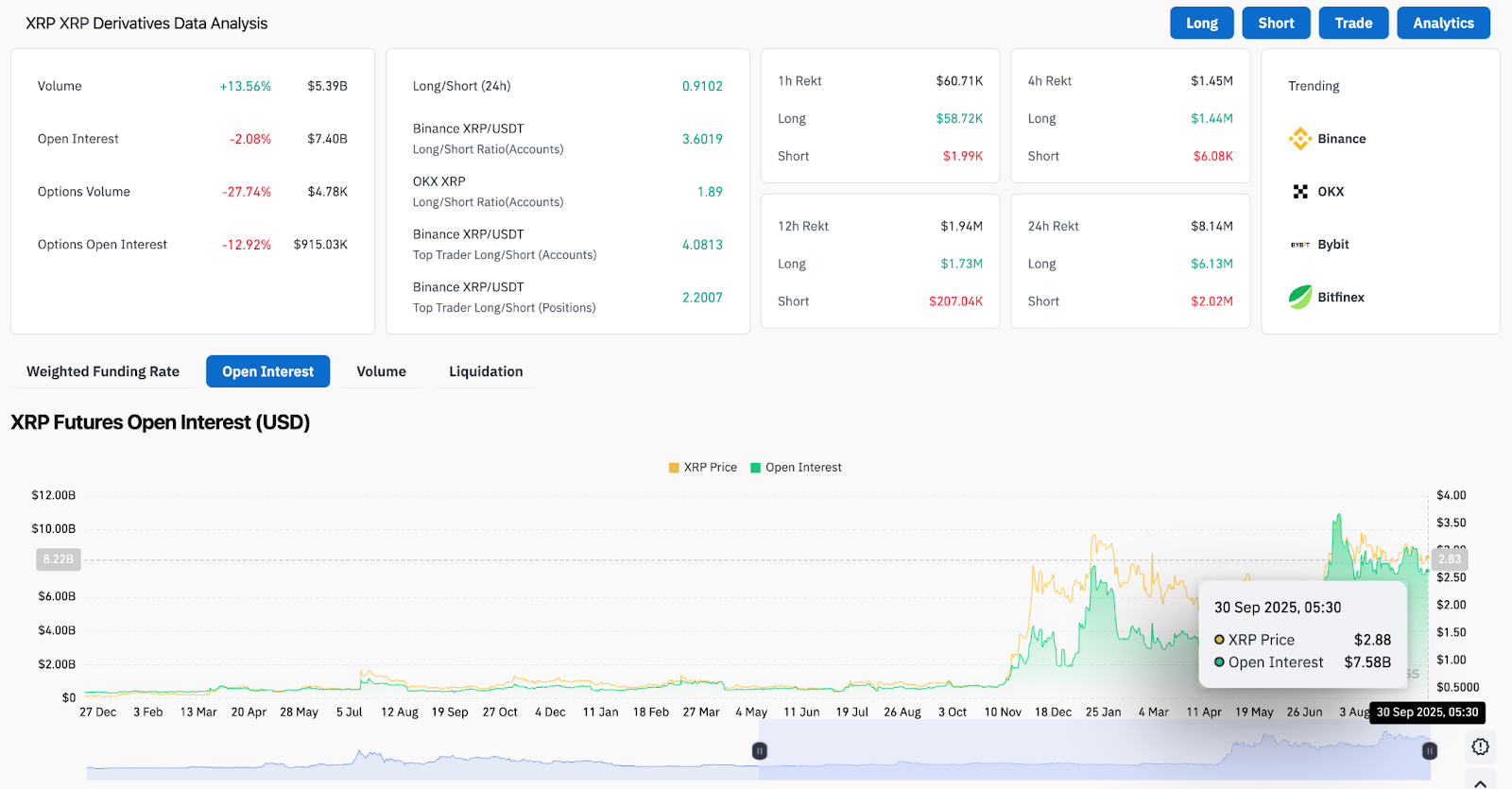

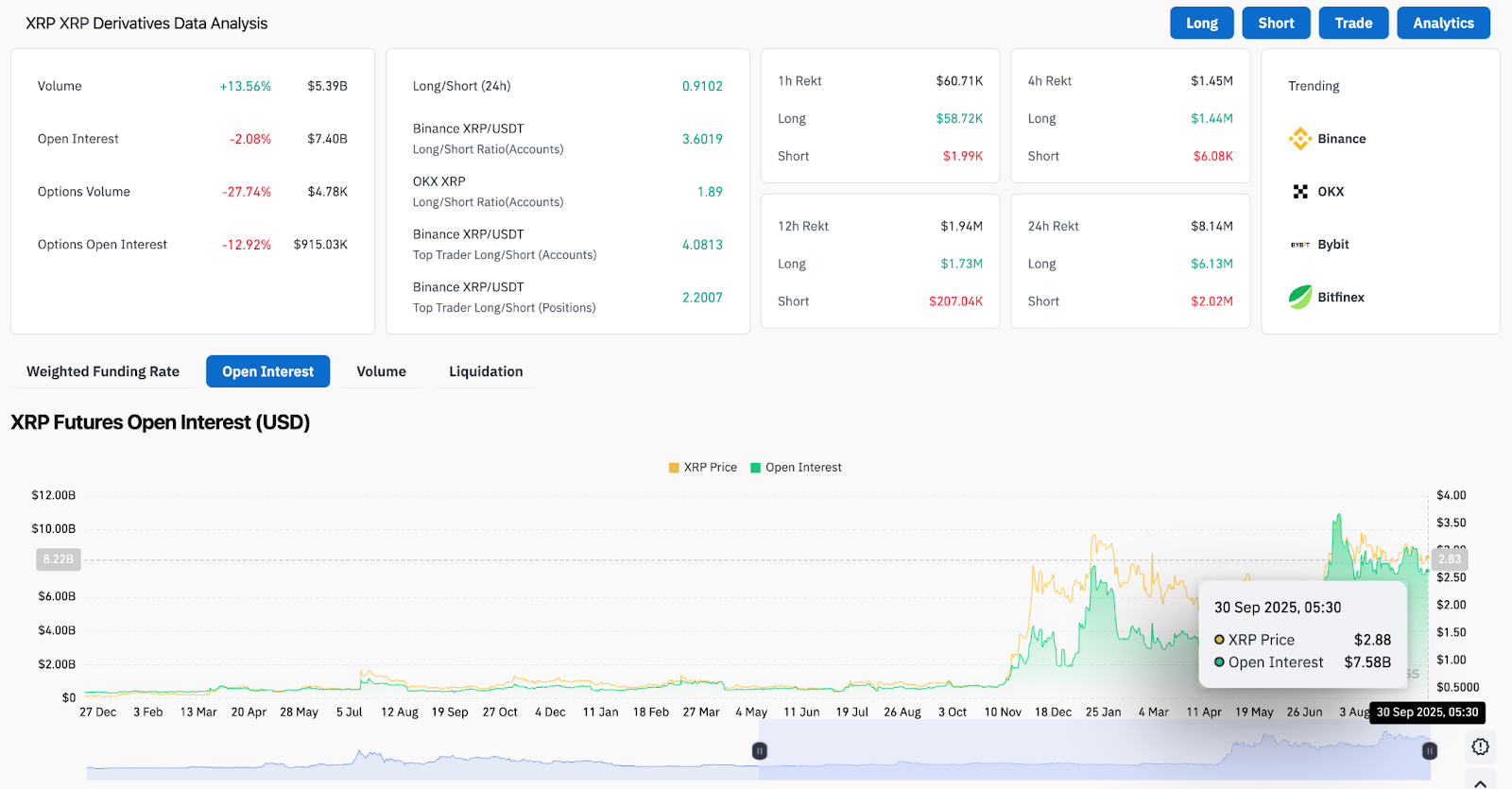

Derivatives Data Shows Mixed Positioning

Derivatives markets reflect cautious sentiment. XRP futures open interest has slipped to $7.40 billion, down 2.08% in the past 24 hours, while options open interest fell by nearly 13%. At the same time, daily trading volume rose 13.5% to $5.39 billion, highlighting short-term activity despite weaker positioning.

Long/short ratios remain tilted bullish on Binance, with top traders holding more than 3.6 longs per short on accounts and over 4 on position data. This imbalance suggests leveraged traders are still leaning toward an upside attempt, but overall reduced open interest underscores hesitation.

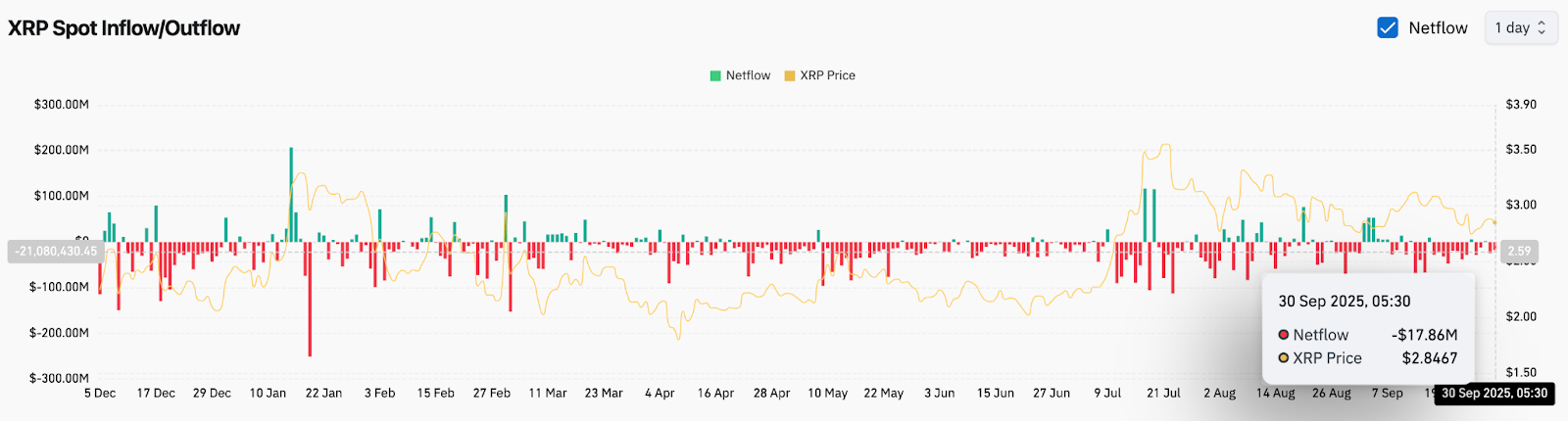

On-Chain Flows Highlight Outflows

Exchange data shows $17.8 million in net outflows on September 30, signaling mild accumulation after earlier volatility. While consistent outflows are often viewed as supportive, the relatively small scale compared with July inflows points to a lack of aggressive demand.

Related: Pi Price Prediction: Pi Faces Pressure As Governance Allegations Weigh On Sentiment

Active address activity has cooled since midsummer, and whale wallets have yet to return in force. Without stronger accumulation trends, XRP price action may struggle to sustain rallies beyond the $3 threshold.

Technical Outlook For XRP Price

Upside targets include $2.92, $3.10, and $3.30, with a breakout above $3.30 exposing the $3.46 and $3.66 Fibonacci zones. Downside risks rest at $2.83, $2.70, and deeper at $2.61 if sellers gain momentum.

Trendline support from June still holds above $2.73, keeping the long-term bullish structure intact despite near-term compression. Losing this zone would shift focus back to $2.50, where the 200-day EMA sits as the last line of defense.

Outlook: Will XRP Go Up?

XRP price today holds a fragile balance at $2.84, with bulls defending the $2.83 floor while futures data shows waning conviction. On-chain flows indicate mild accumulation, but the absence of stronger whale participation limits upside momentum.

Related: Shiba Inu Price Prediction: Analysts Track Resistance Flip Ahead Of October Volatility

Analysts remain cautiously optimistic as long as XRP defends $2.83. A breakout above $2.92 would open the door for a push toward $3.10–$3.30, with a larger extension possible if inflows return. Failure to hold $2.83, however, risks sending price back toward $2.70 and stalling the bullish outlook.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.