XRP (CRYPTO: XRP) price today is trading near $3.01, up 1.5% over the last 24 hours, as the token continues to move within a tightening symmetrical triangle pattern. The broader setup reflects a key standoff between ETF-driven optimism and recent on-chain outflows that have capped near-term upside momentum.

XRP Price Holds Pattern Support

The daily chart shows XRP price pressing against converging trendlines that form a symmetrical triangle, with support anchored near $2.94 and resistance around $3.10. The 20-day EMA has aligned at $2.94 while the 50-day EMA at $2.93 provides additional structural backing.

The 100-day and 200-day EMAs, positioned at $2.85 and $2.63 respectively, indicate a strong underlying uptrend. A decisive breakout above $3.10 could expose $3.30 and $3.55, while a failure to hold $2.94 may pull XRP toward $2.85 or even $2.63.

Momentum remains balanced, with the RSI at 54.9, suggesting modest bullish pressure. The current compression implies that volatility could expand sharply once the pattern resolves, likely coinciding with upcoming ETF news.

ETF Countdown Fuels Anticipation

Market focus is turning toward a series of XRP spot ETF decision dates scheduled between October 18 and October 25, with issuers such as Grayscale, 21Shares, and Franklin Templeton awaiting regulatory responses. The announcements could mark the next major catalyst for XRP, mirroring earlier reactions seen in Bitcoin and Ethereum ETF approvals.

Analysts note that the staggered decision timeline could sustain market interest throughout the month. A positive outcome may attract new institutional capital, particularly if funds are permitted to begin trading immediately following approval. Traders are closely watching this window as a defining moment for XRP’s fourth-quarter performance.

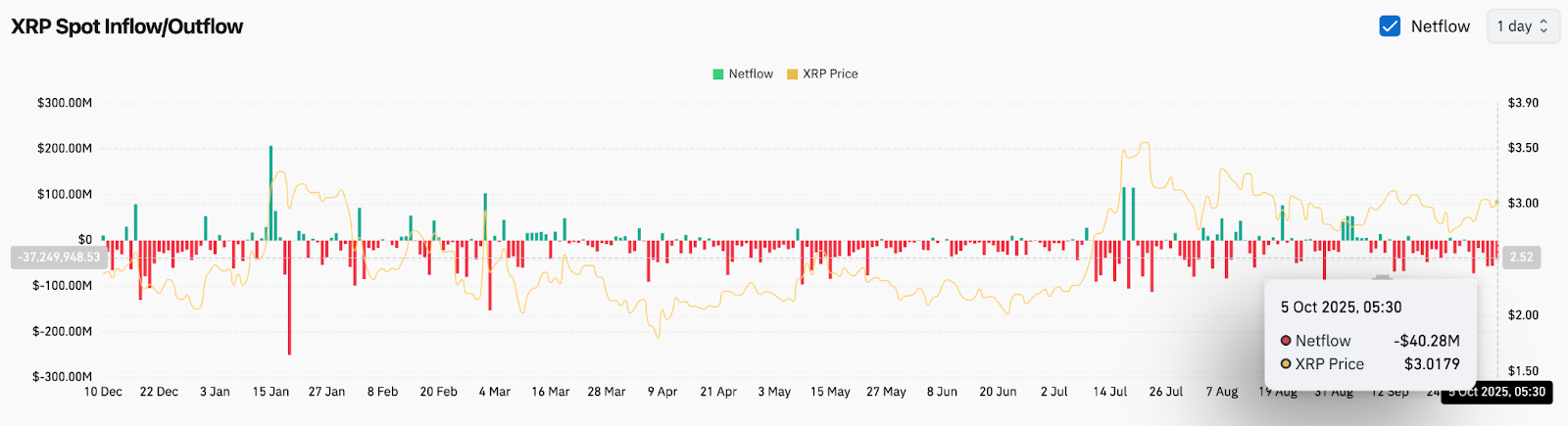

Outflows Raise Near-Term Concerns

On-chain data paints a more cautious picture. Coinglass data recorded $40.2 million in net outflows on October 5, extending the six-day total to approximately $300 million in cumulative withdrawals. Persistent outflows often indicate profit-taking or capital rotation toward other large-cap assets such as Ethereum or Solana.

Despite these pressures, XRP price action has remained resilient near the $3 mark, supported by its long-term ascending trendline. Analysts suggest that continued ETF anticipation and stable exchange liquidity may help absorb selling pressure if buyers reemerge near support.

Technical Outlook For XRP Price

Key technical levels define the immediate path for XRP price prediction:

- Upside targets: $3.10, $3.30, and $3.55 if bullish continuation develops.

- Downside supports: $2.94, $2.85, and $2.63 as critical defensive zones.

- EMA structure: Positive alignment of 20/50/100-day averages supports the medium-term bullish bias.

As long as XRP sustains above $2.94, the bias remains constructive, with traders positioning for a potential breakout aligned with ETF headlines.

Outlook: Will XRP Go Up?

The outlook for XRP heading into October 6 remains finely balanced. On one hand, ETF speculation and technical compression favor a possible breakout; on the other, persistent outflows suggest a cautious market tone.

If ETF approvals begin as expected from mid-October, analysts believe a move toward $3.30–$3.55 becomes likely. However, failure to maintain inflows or a rejection at $3.10 could delay momentum and push XRP back toward the $2.85 support zone.

For now, XRP price today reflects consolidation ahead of major catalysts, with traders watching whether the next two weeks confirm institutional participation or prolong the waiting phase.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.