- XRP price today holds $2.36, consolidating near $2.24 support as buyers defend the lower end of its multi-month triangle.

- The U.S. shutdown stalls SEC ETF reviews, extending delays and adding pressure to XRP price momentum.

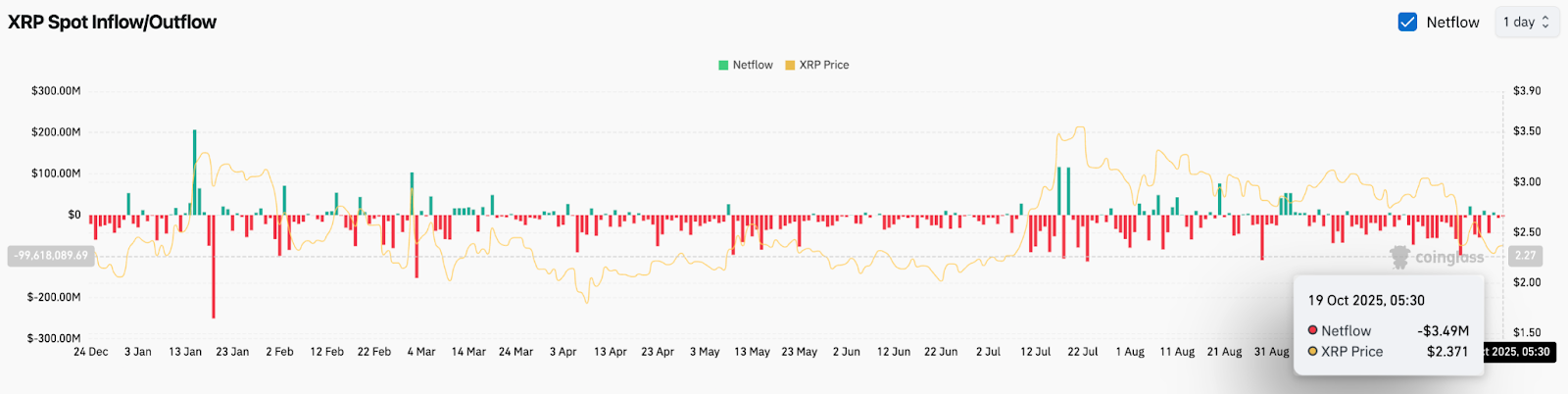

- On-chain flows remain weak, with only $3.49M in outflows, showing limited accumulation amid cautious sentiment.

XRP price today trades near $2.36, holding just above its key $2.24 support after a steep three-week decline of nearly 27%. The token continues to consolidate inside a broad symmetrical triangle, with traders monitoring whether the ongoing delay in the U.S. SEC’s ETF review could trigger a deeper correction before the next rebound attempt.

XRP Price Holds Structural Support But Momentum Weakens

XRP Price Dynamics (Source: TradingView)

The daily chart shows XRP trading at the lower end of its multi-month triangle structure, with immediate resistance levels at $2.59, $2.77, and $2.91 aligned with the 20-, 50-, and 100-day EMAs. The broader setup suggests that the bullish structure remains intact as long as price stays above the rising trendline support near $2.24.

Momentum indicators, however, reveal fading strength. The Supertrend remains bearish at $2.91, while RSI readings hover around the neutral zone after weeks of downside pressure. A decisive close below $2.24 could expose deeper liquidity near $2.00 and potentially trigger a retest of $1.85. For now, buyers are cautiously defending the support base, but trading activity has slowed sharply as ETF uncertainty dominates sentiment.

ETF Delay Adds Bearish Pressure

The biggest headwind for the XRP price this week is the stall in the SEC’s decision-making process caused by the partial U.S. government shutdown. Analysts warn that a prolonged halt in operations could push back key ETF review dates, delaying what many investors had hoped would be a landmark catalyst for institutional inflows.

Crypto market commentator BlissfulSoul highlighted that XRP could face a renewed sell-off if the ETF timeline is extended further, citing the lack of near-term catalysts and weakening momentum. The SEC’s processing of filings has been paused since early October, leaving the XRP ETF review among several pending approvals.

The U.S. Senate’s failure to advance a funding resolution last week confirmed that the shutdown will extend into another week, keeping regulatory activity on hold. Traders now see the earliest possible ETF progress coming only after the government resumes full operations, a delay that has already weighed on market sentiment across altcoins.

October 19b-4 Filings Not True Launch Deadlines

Legal experts have moved to calm speculation that the original October 19b-4 filings marked a launch deadline for the XRP ETF. Greg Xethalis, a fellow at Duke Law School, clarified that the filing represents only one procedural step and not an approval or activation trigger. Once the SEC reopens, the process will resume at the review stage rather than from scratch.

This clarification offers context for traders who misinterpreted the October filing as a guaranteed launch signal. While the pause delays potential institutional inflows, it does not derail the longer-term outlook for the ETF. Xethalis added that products such as CoinShares’ proposed XRP ETF—filed with BitGo as custodian and Valkyrie as seed investor—are expected to move forward swiftly once administrative normalcy returns.

On-Chain Flows Reflect Weak Demand

XRP Netflows (Source: Coinglass)

Exchange data from Coinglass shows a net outflow of $3.49 million on October 19, underscoring the lack of strong accumulation during the latest pullback. The absence of meaningful inflows indicates that traders remain cautious despite institutional filings.

Overall, XRP price action continues to lag behind broader market recovery trends, with spot flows staying mixed since mid-September. Sustained positive net inflows above $20 million would be needed to confirm renewed buying pressure, but for now, flow activity remains subdued.

Technical Outlook For XRP Price

- Upside levels: $2.59, $2.77, and $2.91 as near-term resistance.

- Downside levels: $2.24 as key support, followed by $2.00 and $1.85 if breakdown occurs.

- Trend structure: Symmetrical triangle tightening toward November apex.

Outlook: Will XRP Go Up?

The outlook for XRP price prediction hinges on whether ETF-related optimism can return before the next macro move. If the U.S. government reopens and the SEC resumes ETF reviews within weeks, momentum could shift back toward $2.77 and $2.91.

Until then, technicals point to continued consolidation or a potential retest of $2.24 if sellers stay active. Institutional interest remains the medium-term safety net, but the near-term bias stays cautious. Analysts suggest that only a breakout above $2.77 would confirm renewed bullish control, while any close below $2.24 would signal a short-term bearish continuation toward $2.00.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.