XRP is attempting to stabilize after a volatile start to September, with the XRP price today trading near $2.80. Buyers stepped in to defend the $2.75–$2.80 range after repeated pullbacks through late August, keeping the broader uptrend intact despite heavy resistance overhead.

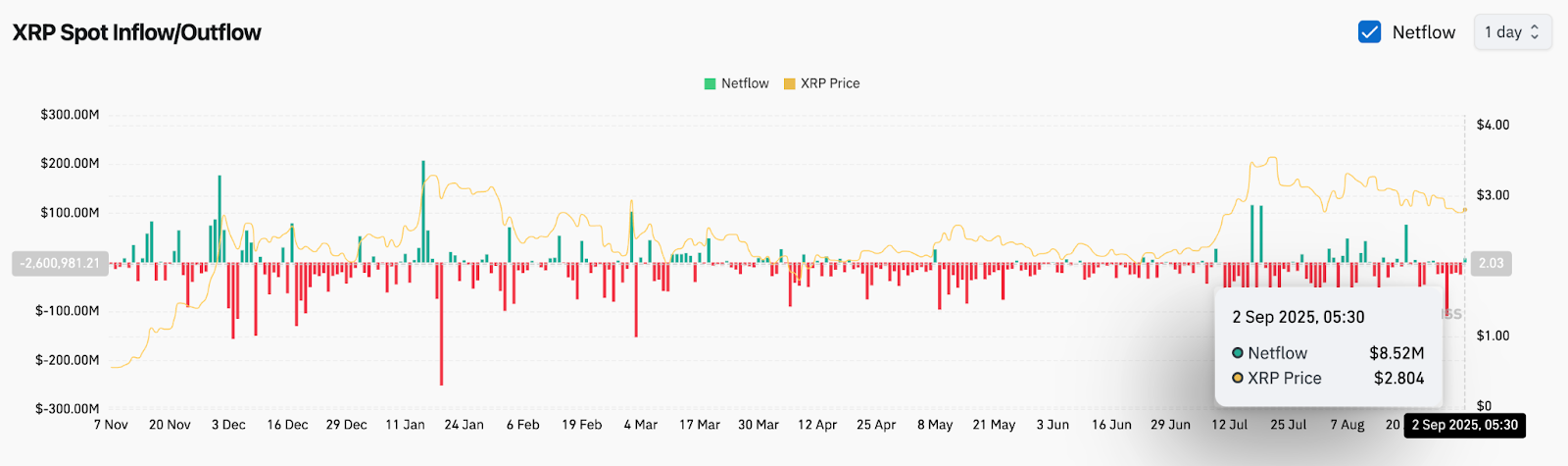

The latest rebound comes as on-chain data shows positive net inflows into spot markets, suggesting whales are accumulating at current levels. At the same time, descending resistance continues to cap upside momentum, leaving traders split on whether XRP is preparing for another breakout or at risk of deeper retracement.

With critical support layered between $2.60 and $2.65 and immediate resistance at $2.93, the next few sessions could define short-term direction.

XRP Price Holds Structure Near Key Support

On the daily chart, XRP price action is compressing beneath a descending trendline that has limited upside since the early August peak above $3.60. Price has consistently tested the $2.80 support area, which overlaps with the 0.5 Fibonacci retracement at $2.50 and provides a structural base for buyers.

If bulls reclaim $2.93, attention shifts toward the $3.35–$3.38 zone, where prior supply capped rallies in July. A clean break above this zone could extend the advance toward the $3.77 Fibonacci projection.

Moving averages on the 4-hour chart underline the struggle. The EMA cluster (20 at $2.81, 50 at $2.87, 100 at $2.93, and 200 at $2.96) has acted as a ceiling, keeping momentum subdued. Until price can close decisively above $2.93, bearish pressure lingers.

Related: Pi Coin (PI) Price Prediction for September 2025

Whale Inflows and Analyst Optimism Boost Sentiment

Fundamental flows are leaning constructive. Coinglass data shows XRP recorded $8.52 million in net inflows on September 2, marking one of the strongest accumulation days of the past month. Persistent positive flows hint at renewed whale participation despite wider market caution.

At the same time, prominent analyst Steph Crypto highlighted XRP’s breakout structure on X, describing 2025 as “the hardest bull market ever” while projecting long-term upside into double digits. His chart framed XRP’s repeated breakout cycles since 2022 as a precursor to a new leg higher.

Together, the on-chain signals and external analyst commentary provide a counterweight to the technical headwinds, encouraging traders to frame the current consolidation as accumulation rather than distribution.

Contrasting Views: Bulls eye $3.35, Bears Warn of $2.60 Retest

Bulls argue that the defense of the $2.75–$2.80 region reflects resilience, especially as RSI on the 30-minute chart has rebounded to 66, indicating recovering momentum without reaching overbought extremes. If XRP can reclaim the EMA cluster and close above $2.93, momentum could quickly extend toward $3.35 and $3.77, aligning with Fibonacci projections.

Bears counter that the descending trendline and repeated rejections near $3.00 show underlying weakness. Failure to defend the $2.80 shelf risks a breakdown toward $2.60, a critical support that aligns with both horizontal structure and Fibonacci retracement. A decisive breach of $2.60 could accelerate losses toward $2.41 or even $2.08, where deeper demand sits.

This divergence leaves the market finely balanced between breakout optimism and the risk of renewed selling pressure.

Related: Official Trump (TRUMP) Price Prediction for September 2025

XRP Short-Term Outlook: Breakout or Breakdown Ahead?

Heading into September 3, the short-term XRP price prediction hinges on whether buyers can reclaim the $2.93 pivot. Sustained closes above this level would signal bullish control, opening the path to $3.35–$3.38 and potentially $3.77.

Conversely, failure to overcome resistance could keep XRP pinned in a tightening range, with $2.80 and $2.60 acting as decisive support. Given rising inflows and improving intraday momentum, traders are cautiously leaning toward a constructive bias, though volatility remains elevated.

XRP Price Forecast Table

| Indicator | Signal | Levels/Notes |

| Price Today | $2.80 | Holding key support cluster |

| Support | $2.80 / $2.60 | Defended zone, Fibonacci base |

| Resistance | $2.93 / $3.35 | EMA cluster and breakout trigger |

| RSI | 66 (30-min) | Neutral-bullish, momentum recovering |

| MACD | Bearish-neutral | EMAs still capping upside |

| Pattern | Descending triangle | Compression before breakout |

| Flows | +$8.52M inflow | Whale accumulation evident |

| Supertrend | Bearish below $2.93 | Needs breakout confirmation |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.