- Buyers continue to defend the $2.10–$2.20 zone, preventing a deeper breakdown after the rebound.

- Spot outflows and falling open interest suggest the move was driven by short covering, not fresh demand.

- XRP must reclaim $2.35 and the EMA cluster to confirm a real trend shift beyond a corrective bounce.

XRP price today trades near $2.25 after a sharp rebound from December lows stalled below declining resistance. Buyers have stepped in aggressively near the $2.10 to $2.20 zone, but broader structure remains fragile as spot outflows persist and derivatives positioning resets.

Spot Outflows Undercut The Recovery

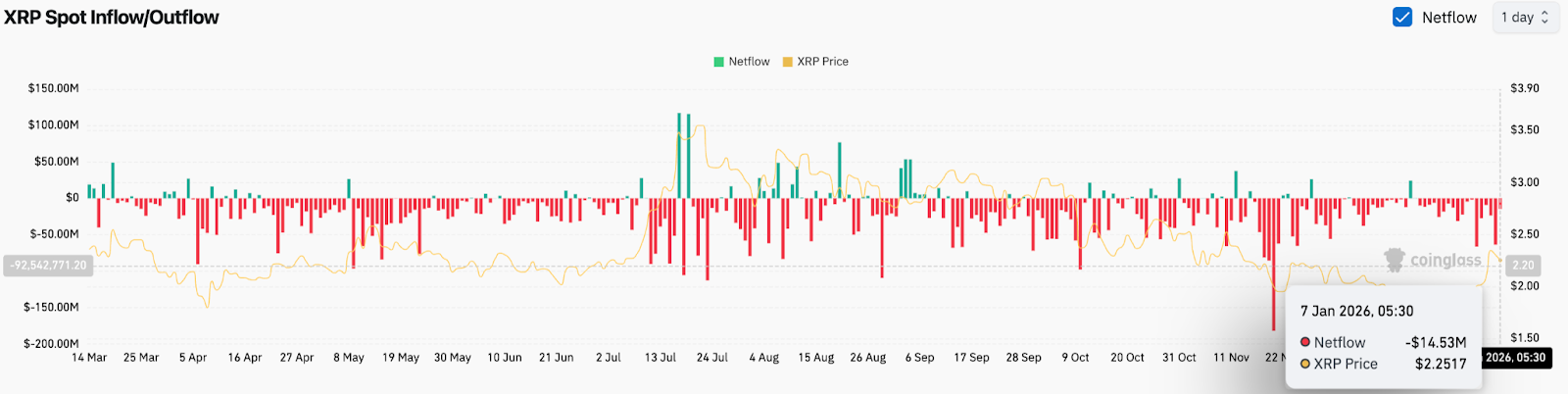

Spot flow data continues to lean defensive. XRP recorded a $14.5 million net outflow on January 7, extending a pattern of capital leaving exchanges during rallies rather than accumulating during dips.

This behavior matters because the bounce has not been accompanied by strong inflows. Price lifted, but participation did not expand. That divergence often signals short covering or tactical buying rather than fresh directional conviction.

As long as spot flows remain negative, upside attempts risk fading into resistance.

Descending Trendline Still Defines Structure

On the daily chart, XRP remains capped beneath a descending trendline that has guided price lower since the early October peak. The recent bounce stalled near the $2.28 to $2.30 region, aligning with the underside of that trendline and the 0.382 Fibonacci level near $2.29.

Related: Ethereum Price Prediction: ETH Maintains Uptrend as Derivatives Activity Stabilizes

The EMA structure reinforces the ceiling. XRP trades below the 50-day EMA near $2.07, the 100-day EMA around $2.23, and the 200-day EMA near $2.35. That stack forms layered resistance rather than a launchpad.

Until price reclaims this zone decisively, rallies remain corrective inside a broader downtrend.

Derivatives Data Shows Leverage Cooling

Derivatives metrics suggest positioning is resetting rather than building aggressively. Open interest has fallen 6.36 percent to roughly $4.43 billion, indicating leveraged exposure is being reduced after the rebound.

Liquidation data supports that view. Over the past 24 hours, nearly $25 million in positions were flushed, with longs accounting for the majority. That unwind removed excess leverage that had built during the late December slide.

Related: Solana Price Prediction: SOL Price Action Signals Strength Despite Cooling Momentum

Long short ratios remain skewed toward longs on major exchanges, but the reduction in open interest suggests traders are waiting for confirmation before reloading risk.

Intraday Price Action Shows Hesitation

Lower timeframes show XRP struggling to build momentum above $2.30. On the 30-minute chart, price failed to hold above the Parabolic SAR resistance near $2.29, forcing consolidation back toward the $2.22 to $2.25 range.

RSI on intraday charts remains below 50, reflecting hesitation rather than continuation. Buyers are active, but they are not chasing price higher.

This behavior fits a market transitioning from sell pressure to balance, not yet to trend.

Outlook. Will XRP Go Up?

XRP is stabilizing, but the burden of proof remains on buyers.

- Bullish case: A daily close above $2.35, followed by acceptance above $2.60, would confirm a trend shift and open room for a broader recovery.

- Bearish case: Failure to hold $2.20 would signal that the rebound has exhausted, exposing the $2.05 and sub-$2.00 zones.

Until XRP reclaims its EMA cluster and breaks the descending trendline, the move higher remains a corrective bounce. Buyers are present, but control has not yet changed hands.

Related: Bitcoin Price Prediction: Buyers Test $93k as Spot Outflows Keep Pressure On

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.