- XRP price today holds $2.41 after bouncing from $2.09, but resistance at $2.56 caps momentum.

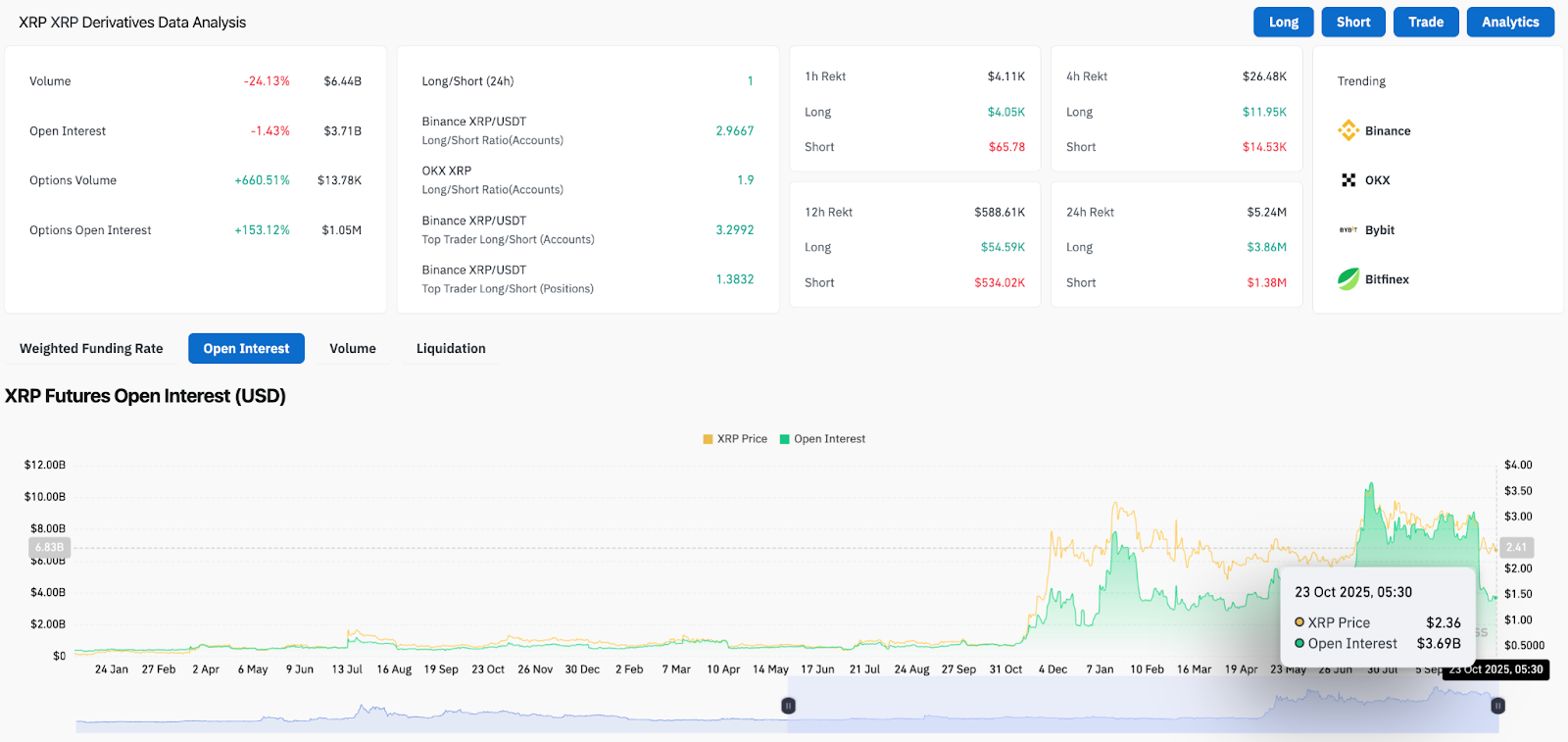

- Derivatives data shows open interest slipping 1.4% and volumes down 24%, signaling reduced speculation.

- A breakout above $2.56 could target $3.04, while failure to hold $2.09 risks $1.80.

XRP price today trades near $2.41, recovering modestly after dipping to $2.09 earlier in the week. The token remains capped under a descending triangle resistance, with volatility tightening as derivatives data shows fading speculative appetite.

Price Action Holds Ascending Support

The daily chart highlights a narrowing structure with XRP price consolidating between $2.09 support and $2.56 resistance. The long-term ascending trendline continues to act as a base, while repeated rejections from the descending triangle ceiling keep upside momentum contained.

Bollinger Bands show compression after October’s sharp breakdown, suggesting a breakout is approaching. A decisive move above $2.56 could open room toward $3.04, while failure to hold $2.09 risks revisiting $1.80.

Related: Ethereum Price Prediction: ETH Consolidates as Market Awaits Directional Breakout

On-balance volume has stagnated near 7.5 billion, reflecting the absence of strong accumulation despite the recent bounce. This leaves XRP price action vulnerable to sharper swings if liquidity tilts toward sellers.

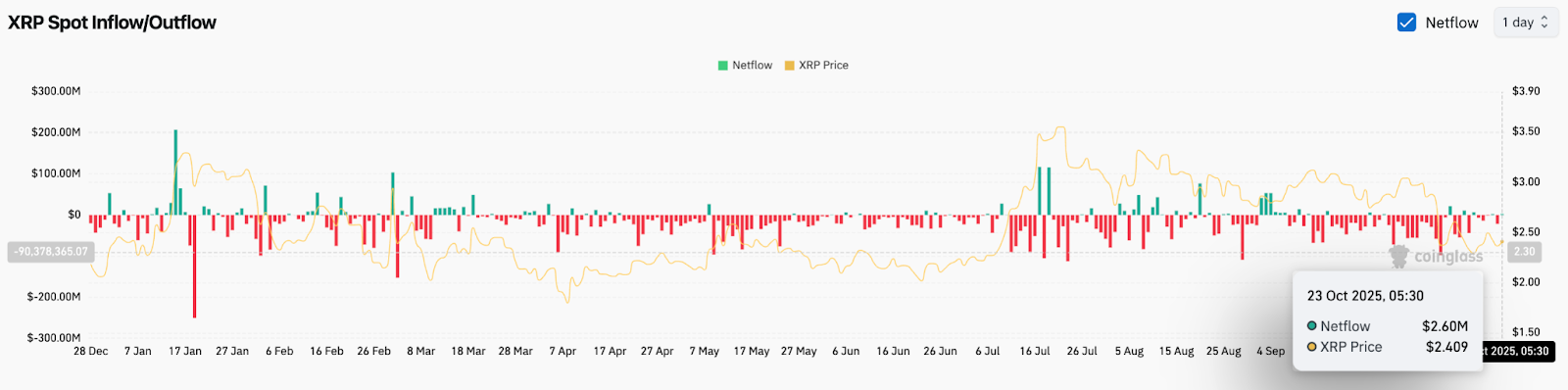

Exchange Flows Remain Modest

Spot flows reinforce the cautionary picture. XRP exchanges registered just $2.6 million in net inflows on October 23, a muted figure compared with the heavier outflows seen earlier this month.

Cumulative data shows persistent inflows since September, which often precede selling pressure. While the scale remains manageable, it adds weight to the bearish risks if support levels falter.

For investors tracking volatility, the balance between inflows and the narrowing triangle makes the $2.09–$2.56 band crucial for the next directional shift.

Derivatives Data Signals Reduced Speculation

Futures positioning confirms the slowdown in speculative activity. Open interest has slipped 1.4% to $3.71 billion, while trading volume dropped over 24% in the last session. By contrast, options activity spiked sharply, with volume up 660% and open interest surging 153%, signaling traders are hedging or betting on near-term volatility rather than extending leveraged positions.

Related: Dogecoin Price Prediction: Traders Eye Breakout as Momentum Builds

The long/short ratios across major exchanges still lean bullish, with Binance showing nearly 3 longs per short, but the broader decline in participation underscores weakening conviction. The liquidation data highlights this shift, with short liquidations outweighing longs but on relatively low notional value.

Outlook: Will XRP Go Up?

For October 24, the XRP price outlook is balanced but fragile. A reclaim of $2.56 would be the first bullish confirmation, setting the stage for a test of $3.04 and potentially $3.40 if momentum improves.

Failure to defend $2.09, however, could trigger a deeper sell-off toward $1.80, especially if exchange inflows accelerate and derivatives open interest continues to fade.

Until XRP price breaks decisively from the triangle, traders face a compressed range where the next directional move could be sharp and decisive. For now, buyers must hold $2.40 and push above $2.56 to reestablish confidence in the upside.

Technical Forecast Table

| Level | Support/Resistance | Signal |

| $3.40 | Resistance | Upper triangle ceiling |

| $3.04 | Resistance | Bollinger upper band |

| $2.56 | Resistance | Key midrange barrier |

| $2.41 | Current Price | Neutral |

| $2.09 | Support | Triangle base / lower band |

| $1.80 | Support | Major downside target |

Related: Bitcoin Price Prediction: BlackRock Adds $73M To Holdings

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.