- XRP stabilizes above key Fibonacci level, signaling potential base formation.

- Rising open interest shows traders’ renewed optimism despite market caution.

- Persistent exchange outflows suggest long-term accumulation among XRP holders.

XRP’s price has steadied after a steep correction earlier in October, showing signs of renewed balance in the market. The token currently trades near $2.45, hovering around the midpoint of the Fibonacci retracement drawn between $3.10 and $1.58. After several weeks of volatile swings, XRP is attempting to establish a base that could support a potential rebound if key levels hold.

Market Stabilization and Key Technical Levels

The market structure suggests XRP is stabilizing above the crucial 0.5 Fibonacci level at $2.34. This region has attracted consistent buying interest, preventing deeper declines.

The token’s candles are positioned close to the 20- and 50-EMAs between $2.41 and $2.43, indicating a neutral zone where both bulls and bears remain cautious. Sustained closes above the 50-EMA could tilt momentum in favor of buyers.

Immediate resistance stands at $2.52, which coincides with the 0.618 Fibonacci level. A breakout beyond this range may push XRP toward $2.64, where the 200-EMA presents a significant challenge.

Related: Ethereum Price Prediction: ETH Tests Recovery as Liquidity Clusters Build Above $4,200

Clearing this area would mark a potential shift toward bullish continuation. On the downside, $2.16 and $1.94 form the next layers of support, with $1.58 remaining the structural base for any broader rebound.

Open Interest and Market Participation

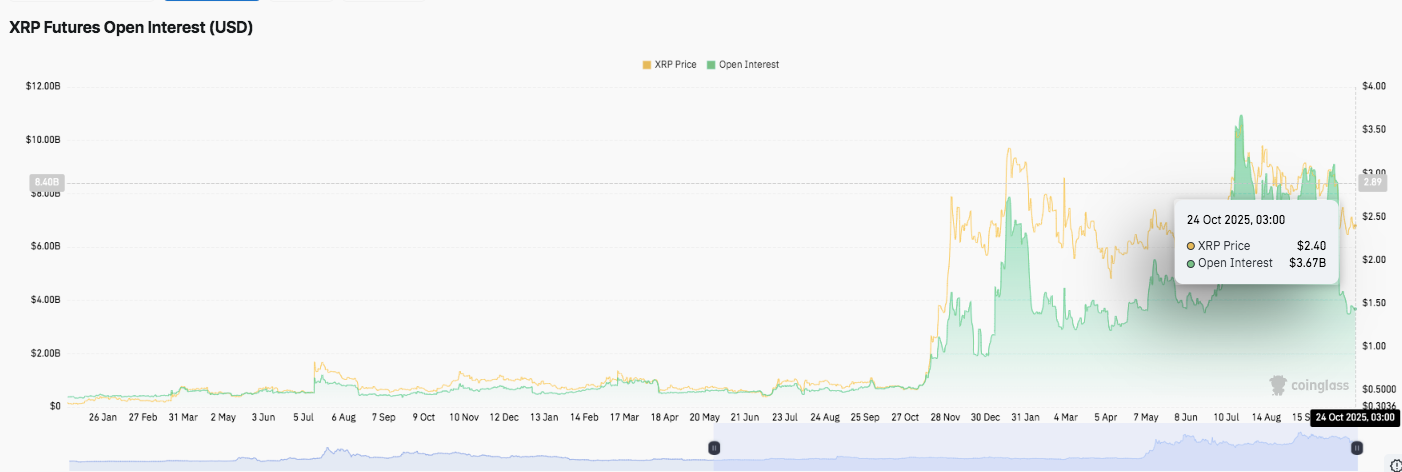

XRP futures open interest has shown notable expansion in 2025, rising from around $1 billion in mid-2024 to more than $3.6 billion by late October. This increase highlights growing speculative activity and leveraged positioning among traders.

The rise aligns with renewed optimism surrounding XRP’s medium-term recovery prospects. However, recent dips in open interest suggest some profit-taking as traders adjust exposure amid uncertainty.

Inflows, Outflows, and Market Sentiment

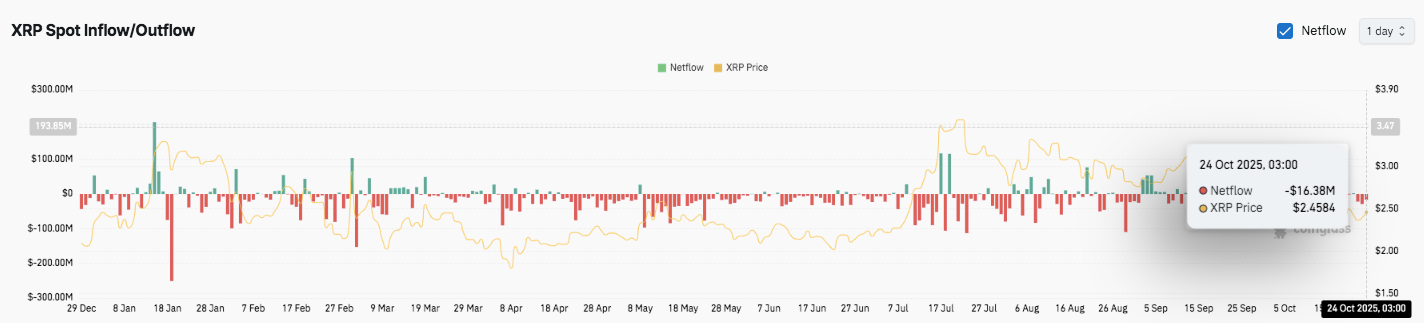

Despite strong speculative participation, XRP’s spot netflows have remained predominantly negative throughout the year. Exchange data shows consistent outflows, with investors withdrawing tokens to external wallets, possibly signaling long-term accumulation.

Related: Bitcoin Price Prediction: BTC Rebounds Ahead of Trump–Xi Meeting

As of October 24, XRP recorded a net outflow of $16.38 million while trading near $2.45. The persistent outflows imply cautious sentiment as holders opt to store assets off-exchange instead of engaging in short-term trades.

Technical Outlook for XRP Price

Key levels for XRP remain well-defined heading into late October. Upside hurdles sit at $2.52, $2.64, and $2.77, marking the Fibonacci 0.618–0.786 retracement zone. A breakout above this cluster could pave the way toward $3.10, the cycle high from earlier in 2025.

On the downside, $2.34 serves as the immediate support level and aligns with the 0.5 Fibonacci line. Below that, $2.16 (Fib 0.382) and $1.94 (Fib 0.236) provide secondary safety nets, while the $1.58 swing low forms the structural base for any broader recovery attempt.

The current setup shows XRP compressing between the 20- and 50-EMAs ($2.41–$2.43), suggesting neutral momentum before a decisive move. A sustained close above the 200-EMA at $2.64 would be a strong bullish signal, potentially confirming the formation of a higher low around $2.34.

Will XRP Rebound Toward $3?

XRP’s price action suggests it is at a pivotal point. If buyers successfully defend the $2.34 support and break through $2.52–$2.64, momentum could accelerate toward the $3.00–$3.10 zone. Open interest expansion and persistent exchange outflows reinforce the case for medium-term accumulation.

However, losing $2.34 may expose the market to further correction toward $2.16 or even $1.94. Hence, price stability near the mid-Fibonacci range remains essential to validate any bullish continuation. For now, XRP is consolidating in a tight band, and the next move will likely depend on volume expansion and trader conviction at these key inflection points.

Related: Shiba Inu Price Prediction: Holder Base Hit 1.54M But Key Support Faces Pressure

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.