- XRP price holds above $2.98 support with $3.18 Fibonacci barrier capping upside momentum.

- Garlinghouse sparks ETF speculation, hinting at potential U.S. launch before year-end.

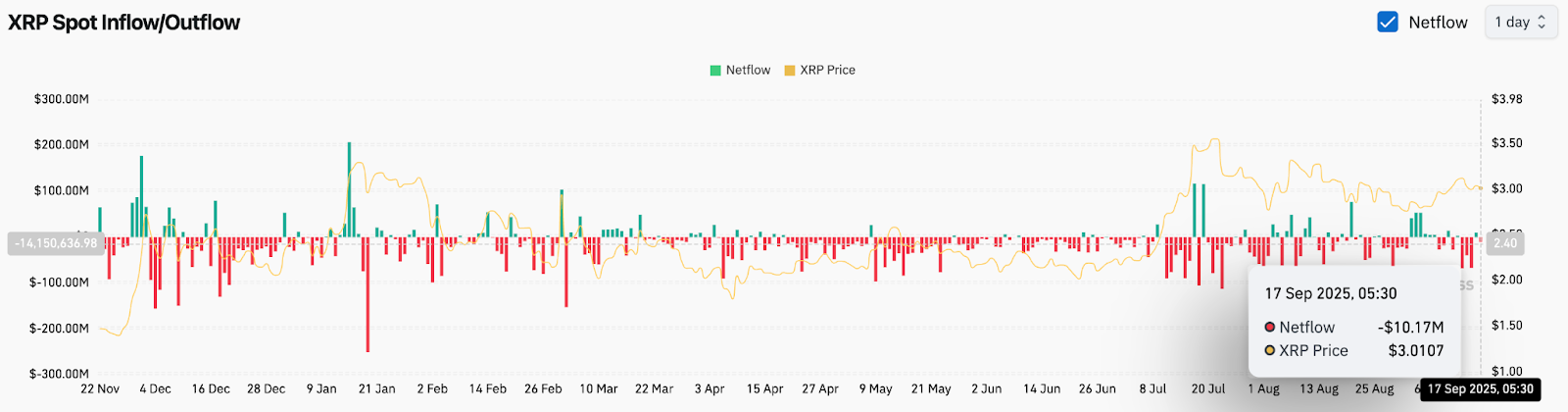

- On-chain data shows $10.1M outflows as whales accumulate, but short-term resistance remains at $3.11–$3.18.

As bulls and bears struggle for control, the XRP price is currently trading near $3.01, holding just above the $2.98 support. The key tension lies at the $3.18 Fibonacci barrier, where technical rejection has repeatedly capped upside momentum. Traders are now watching whether ETF speculation and institutional flows can shift the balance.

XRP Price Holds Fib Support But Faces Key Ceiling

The daily chart shows XRP stabilizing above the 20- and 50-day EMAs, clustered between $2.94 and $2.97. These levels form immediate support, keeping price action afloat after last week’s rebound. The 0.382 Fibonacci retracement at $3.06 and the 0.5 level at $3.18 remain decisive hurdles.

Related: Ethereum (ETH) Price Prediction For September 18

Momentum is neutral, with RSI at 52 reflecting indecision after cooling from overbought territory earlier in the cycle. A strong daily close above $3.18 would open the path toward $3.29 and $3.45, while a break below $2.94 risks revisiting $2.82 and $2.57 where the 100- and 200-day EMAs sit.

Garlinghouse Sparks ETF Speculation

A fresh narrative emerged after Ripple CEO Brad Garlinghouse said XRP is poised to become part of the U.S. government’s digital asset stockpile, adding that an ETF launch could arrive before year-end. His comments revived speculation that regulators may finally clear a spot XRP product, echoing the liquidity impact Bitcoin and Ethereum ETFs had on their respective rallies.

Market analysts suggest that if ETF headlines align with a technical breakout, XRP price action could quickly accelerate beyond $3.30. For now, the lack of regulatory confirmation keeps the news a bullish tailwind rather than a catalyst.

On-Chain Data Shows Ongoing Outflows

Spot exchange data from September 17 recorded $10.1 million in net outflows, signaling cautious accumulation despite uneven flows in recent weeks. While whales continue to reduce supply on exchanges, the magnitude of outflows has yet to show the kind of conviction seen earlier in the summer.

Related: Dogecoin Price Prediction: Can DOGE Break $0.28 After ETF Approval?

Open interest across futures markets has remained stable, indicating traders are hesitant to chase leverage at current levels. Without stronger inflows, analysts warn XRP price volatility may persist around the $3.00 mark, with swings on both sides of the range.

Supertrend And SAR Highlight Short-Term Pressure

The 4-hour chart shows XRP trading just under the Supertrend resistance at $3.11, with the Parabolic SAR also tilting bearish. This alignment underscores short-term pressure, even as price clings above $2.97 support. Bulls need to reclaim $3.11–$3.18 to flip the structure, otherwise sellers may continue to fade rallies.

Repeated demand has emerged around $2.94 and $2.82, but a failure to hold these zones could shift momentum back toward the $2.70 handle. Conversely, breaking $3.18 would likely attract momentum buyers, targeting $3.29 and $3.45 quickly.

Technical Outlook For XRP Price

Key levels shaping XRP price prediction:

- Upside targets: $3.18, $3.29, $3.45, and $3.66.

- Downside risks: $2.94, $2.82, and $2.57.

- Trend markers: Daily EMAs clustered at $2.94–$2.97 as immediate support.

Outlook: Will XRP Go Up?

The short-term direction for XRP hinges on whether buyers can overcome the $3.18 ceiling before bearish pressure forces a breakdown. On-chain data shows whales continue to accumulate through outflows, while Garlinghouse’s ETF comments have added a compelling long-term catalyst.

Related: Cardano (ADA) Price Prediction For September 18

Analysts remain cautiously optimistic as long as XRP defends $2.94. A breakout above $3.18 would validate bullish continuation toward $3.45, while losing $2.94 could shift sentiment back toward $2.82. For now, XRP remains in consolidation mode, awaiting either regulatory headlines or stronger capital inflows to drive the next decisive move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.