- XRP eyes $3 target as bullish momentum strengthens above key EMA support zones.

- Open interest surge to $4.4B signals rising speculation amid market optimism.

- Exchange data shows strategic accumulation despite mild profit-taking trends.

XRP is showing renewed bullish signs as it attempts to reclaim higher ground after rebounding from its October 11 low near $1.58. The token has gradually climbed within an emerging uptrend, with buyers strengthening their position across key technical zones. This recovery comes amid improving market sentiment, signaling growing interest from traders expecting a broader move toward the $3 region.

Building Momentum Above Crucial Support

The 4-hour chart reveals XRP’s steady recovery supported by rising moving averages. The 20-EMA has crossed above the 50-EMA, indicating momentum is building in favor of bulls.

Price action remains near the 200-EMA around $2.63, a crucial level to confirm trend continuation. If XRP sustains closes above this level, a clear reversal could unfold, pointing to medium-term strength.

Key Fibonacci retracement zones between $2.16 and $2.78 are shaping the next direction. The 0.618 Fib level near $2.52 has turned into short-term support, while $2.78 now acts as immediate resistance. A move above this barrier may extend the rally toward $3.00 and $3.10. Conversely, failure to hold $2.52 could trigger a pullback toward $2.34 or even $2.16.

Related: Ethereum Price Prediction: Derivatives Spike 69% as ETH Coils Below Breakout Trigger

Open Interest Signals Rising Speculative Activity

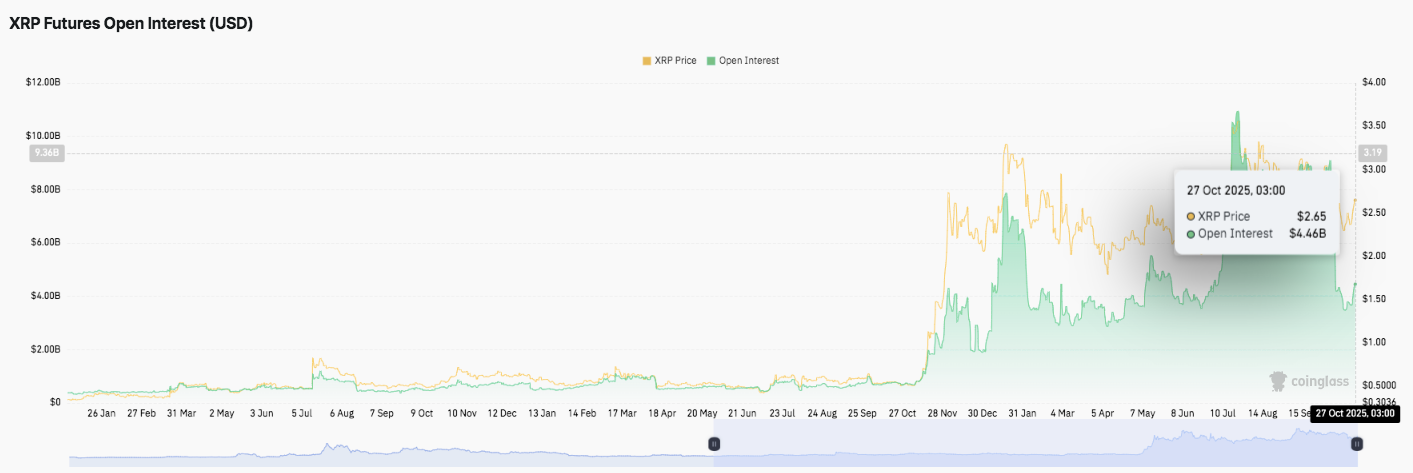

Open interest in XRP derivatives has climbed sharply, reflecting growing speculative participation. After months below $2 billion, it surged past $4.4 billion by late October 2025 as prices approached $2.65.

This increase suggests traders are positioning for volatility, aligning with the renewed optimism seen across the broader crypto market. However, sharp expansions in open interest often precede profit-taking phases, requiring traders to stay cautious.

Moreover, this sustained buildup underscores stronger liquidity and confidence in XRP’s ongoing recovery. The data indicates that leveraged traders are re-engaging after a prolonged period of low activity earlier in the year.

Spot Data Hints at Cautious Accumulation

Exchange inflow and outflow patterns show that outflows have dominated most of 2025, suggesting continued selling pressure. Still, the recent $21.7 million net outflow recorded on October 27 indicates profit-taking rather than panic exits. This behavior points to strategic accumulation as traders lock in gains and await new entry points.

Related: Bitcoin Price Prediction: BTC Bulls Regain Control Despite Mt. Gox Repayment Delay

Technical Outlook for XRP Price

Key levels remain clearly defined heading into November as XRP attempts to regain its bullish footing after rebounding from the $1.58 low. The token trades within a mid-term ascending channel, reflecting gradual recovery and growing market participation.

- Upside levels: $2.52 and $2.57 serve as immediate support for buyers, while the next resistance hurdles are $2.78 and $3.10. A confirmed breakout above $2.78 could extend gains toward $3.00 and the $3.10 yearly high.

- Downside levels: $2.34 and $2.16 act as key defensive zones for bulls. A breakdown below these levels could expose XRP to renewed selling pressure, signaling a potential retest of the $2.00 psychological area.

- EMA resistance: The 200-EMA near $2.63 remains a decisive ceiling to flip for sustained bullish momentum. Holding above this level would reinforce market confidence and confirm trend continuation.

The technical structure suggests XRP is consolidating below the $2.78–$2.80 resistance cluster, forming a base for its next move. Historical trading behavior around these levels shows accumulation phases often precede strong breakouts. Hence, sustained closes above $2.63 could trigger a volatility expansion similar to past rallies.

Will XRP Continue Its Recovery?

XRP’s short-term trajectory depends on whether buyers can defend the $2.52–$2.57 support zone long enough to challenge $2.78 resistance. A successful breakout could open a path toward $3.00 and beyond, confirming bullish control. However, failure to maintain support risks a retracement to $2.34 or even $2.16.

Additionally, derivatives data indicates growing speculative demand, with open interest surpassing $4.4 billion in late October. This rise reflects renewed optimism but also implies possible short-term volatility if sentiment turns. Spot inflows and outflows remain balanced, signaling cautious accumulation rather than aggressive profit-taking.

For now, XRP stays in a pivotal zone. Momentum indicators favor continuation if the 200-EMA flips into support. Traders remain watchful for a decisive close above $2.78, which could reignite medium-term bullish momentum toward the $3.10 target.

Related: Solana Price Prediction: $66M Outflows Hit as Derivatives Surge Ahead Of $225 Target

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.