- XRP holds critical $2.16 support, key for maintaining mid-term bullish potential.

- Downward EMAs cap XRP, needing a breakout above $2.53 to confirm momentum.

- On-chain inflows signal cautious investor optimism amid ongoing consolidation phase.

XRP is consolidating near a vital support zone as market volatility cools after recent rejections from upper resistance levels. The token trades around $2.23, holding just above the 38.2% Fibonacci retracement at $2.16.

This level has become a critical pivot for maintaining its mid-term bullish potential. However, technical signals suggest mixed sentiment as XRP struggles to reclaim strength above its major moving averages.

Market Structure and Short-Term Outlook

The broader price action shows XRP forming a potential base pattern while staying capped under the 20 and 50 exponential moving averages. These moving averages, positioned at $2.27 and $2.36 respectively, continue sloping downward, reflecting a cautious trading environment. Besides, the 100 EMA at $2.43 remains a short-term ceiling, while a sustained breakout above the 200 EMA near $2.53 would be needed to confirm bullish momentum.

Consequently, traders view $2.16 as the first major support level, with $1.94 and $1.58 acting as deeper downside zones if selling pressure intensifies. On the other hand, reclaiming $2.36 and $2.43 could reignite buying interest, possibly targeting the next resistance near the $2.78 Fibonacci zone.

Futures and Market Sentiment Trends

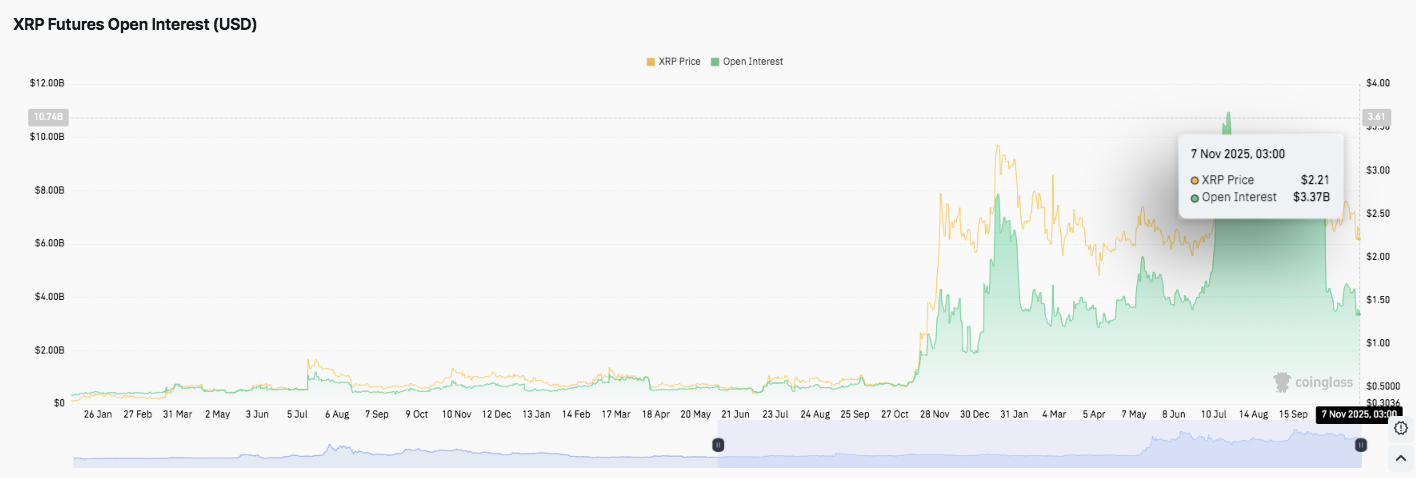

XRP’s derivatives data continues to reflect sustained investor engagement. Open interest peaked near $10.74 billion earlier in 2025 before easing to $3.37 billion as of November 7.

Despite the correction, this figure indicates ongoing participation in the futures market, hinting at traders’ expectations for higher volatility. Additionally, earlier spikes in open interest coincided with strong rallies, suggesting leveraged positioning during bullish phases.

Currently, the consolidation period shows lighter speculative activity but consistent derivative involvement. This dynamic signals that traders remain cautiously optimistic, waiting for clear confirmation before re-entering aggressively.

On-Chain Flows and Investor Behavior

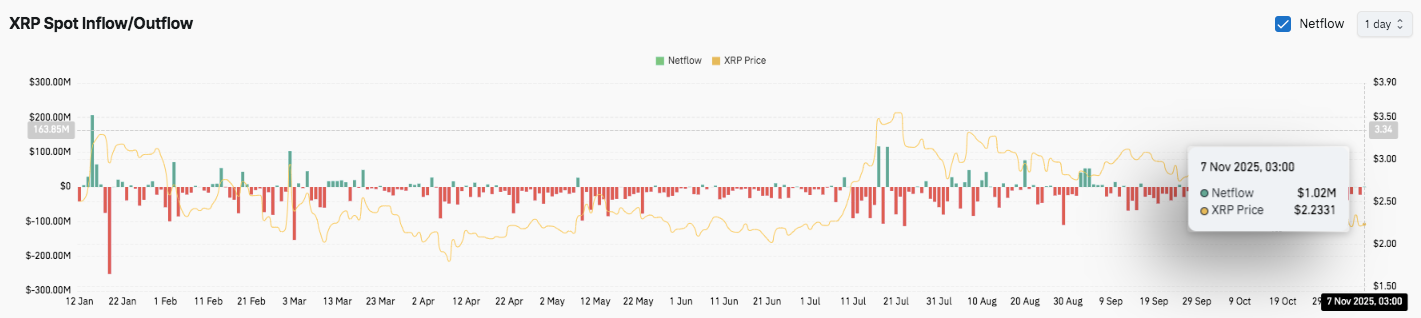

XRP’s on-chain data presents a fluctuating sentiment pattern. Heavy outflows between February and May suggested strong selling and profit-taking. However, a notable inflow surge in July aligned with a brief recovery toward $3.80. From August onward, netflows turned negative again, showing declining liquidity and fading accumulation.

Significantly, the latest inflow of $1.02 million on November 7 reflects tentative optimism. While small, it signals that some investors are cautiously re-entering the market near $2.23. Hence, the overall structure suggests XRP may remain in consolidation before a decisive breakout sets the next clear trend direction.

Technical Outlook for XRP Price

XRP continues to trade in a tight range near key technical levels as traders assess whether the current consolidation will lead to a breakout or deeper correction. The token hovers around $2.23, slightly above its immediate support at $2.16, which aligns with the 38.2% Fibonacci retracement level.

- Upside levels: $2.36, $2.43, and $2.53 serve as immediate resistance hurdles. A clean break above $2.53, coinciding with the 200 EMA, could spark a bullish extension toward $2.78 and $3.00, where previous rallies have paused.

- Downside levels: The first support lies at $2.16, followed by $1.94 and $1.58 if selling pressure intensifies. These zones remain crucial to preserving the long-term bullish structure.

The technical setup suggests XRP is forming a potential base pattern under major EMAs. Compression between $2.16 and $2.36 indicates volatility could soon expand. A decisive move above $2.53 may confirm a trend reversal, while failure to hold $2.16 could open the door for a deeper retracement.

Will XRP Rebound Soon?

The mid-term outlook depends on whether buyers can reclaim the 50 and 200 EMAs to restore bullish momentum. Sustained open interest around $3.37 billion suggests traders remain cautiously optimistic.

However, inflow data shows that accumulation remains modest. If inflows strengthen and XRP closes above $2.53, a climb toward $2.78–$3.00 appears likely. Conversely, a close below $2.16 may extend the correction to $1.94 or even $1.58. For now, XRP stands at a pivotal junction, with upcoming sessions expected to determine its next directional move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.