- XRP struggles at the $2.30 support level, and failure to hold it may lead to a decline to $2.20.

- RSI and MACD indicate bearish momentum, limiting chances of an immediate rebound.

- Futures trading declines, but options market surges, signaling potential volatility ahead.

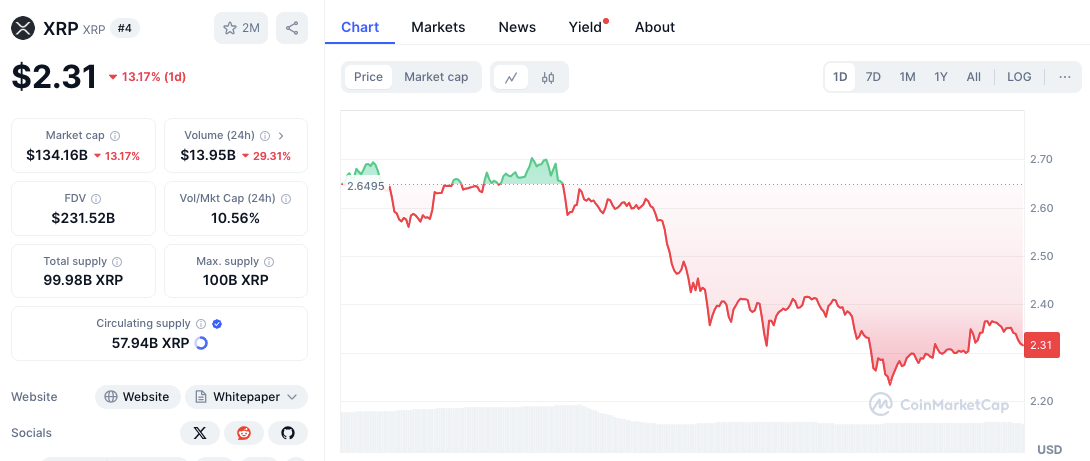

XRP has seen a sharp price decline, dropping 12.47% in the last 24 hours. The cryptocurrency is now trading at $2.32 after falling from a recent high of $2.6495. The downward trend is obvious, with lower highs and lower lows forming on the chart.

Besides, market volume has fallen by 27.96%, showing less trading activity. So then, traders are watching key support and resistance levels to figure out the next price move.

Key Support Levels for XRP in Focus

XRP is currently testing the $2.30 support level, which holds psychological significance. If this level fails to hold, the price could drop to $2.20, a potential support zone.

Moreover, $2.00 remains a strong support area where buyers might step in to prevent further decline. However, if XRP rebounds from $2.30, it could attempt a recovery towards higher resistance levels.

Resistance Levels Ahead for XRP Recovery

XRP faces resistance at $2.50, where selling pressure appeared before the recent drop. Beyond this, the price must break through $2.65, the latest peak, to start an uptrend.

Technical Indicators Suggest Bearish Momentum

Data from CoinMarketCap shows that $2.75 remains a strong resistance level, historically preventing further gains.

A successful move past these levels could signal renewed bullish momentum, drawing more buyers into the market.

RSI Shows Neutral to Bearish Momentum

The Relative Strength Index (RSI) is at 45.49, suggesting neutral to bearish momentum. An RSI below 50 indicates weak buying pressure, with possible support around 43.55, where previous rebounds occurred.

Furthermore, the Moving Average Convergence Divergence (MACD) indicator confirms a bearish trend. The MACD line (-0.07409) is below the signal line (-0.07797), signaling downward momentum. The negative histogram further supports the bearish outlook.

Mixed Signals from Derivatives Market

According to Coinglass data, XRP futures trading volume has dropped significantly, decreasing by 32.32% to $21.65 billion.

Also, open interest has decreased by 22.76% to $3.15 billion, showing reduced speculative interest. However, the options market paints a different picture. Options volume surged by 464.44% to $32.18K, while open interest increased by 296.88% to $2.97 million.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.