- XRP consolidates above key EMAs, signaling early signs of bullish momentum buildup

- Rising open interest to $4.11B highlights increasing trader confidence in XRP upside

- Spot outflows near $11M show short-term caution despite improving market structure

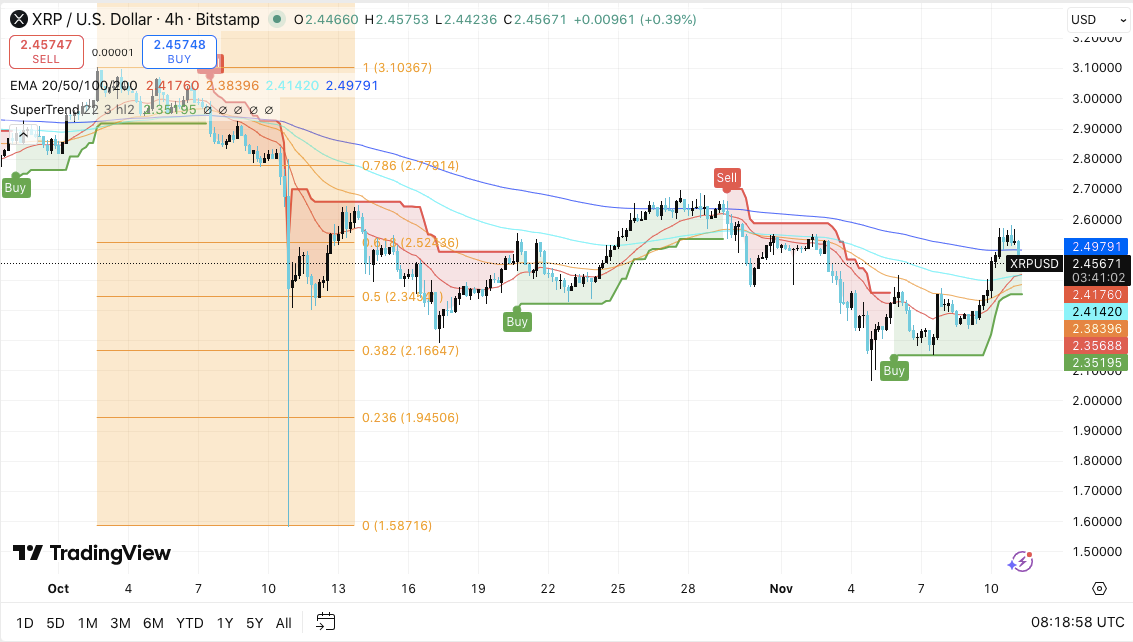

XRP is showing renewed strength as it attempts to regain momentum above the $2.45 mark. The token’s latest price movements reflect a growing recovery phase that started after a rebound from the $2.35 support zone.

Current trading near $2.47 indicates rising buying pressure, with the 200-EMA resistance at $2.497 acting as a key short-term barrier. Consequently, the market is closely watching whether XRP can sustain its upward trajectory and confirm a shift in trend momentum.

Strengthening Recovery and Technical Setup

The 4-hour XRP/USD chart highlights a period of consolidation, where the asset is building support above the $2.41 level. This area aligns with the 50-EMA, providing a foundation for potential bullish continuation.

If buyers defend this zone, the next upside target lies near the $2.52 Fibonacci 0.5 level. Sustained movement beyond this point may open the path toward $2.79, which corresponds to the 0.786 Fib extension.

Besides, technical indicators signal improving market sentiment. The SuperTrend recently flipped bullish after months of correction, suggesting that momentum is gradually shifting in favor of buyers.

The convergence of the 20, 50, and 100-EMA lines also indicates a possible cross, often associated with early trend reversals. Hence, holding above the $2.47–$2.50 range could validate the next leg of XRP’s uptrend.

Derivatives Data Points to Rising Confidence

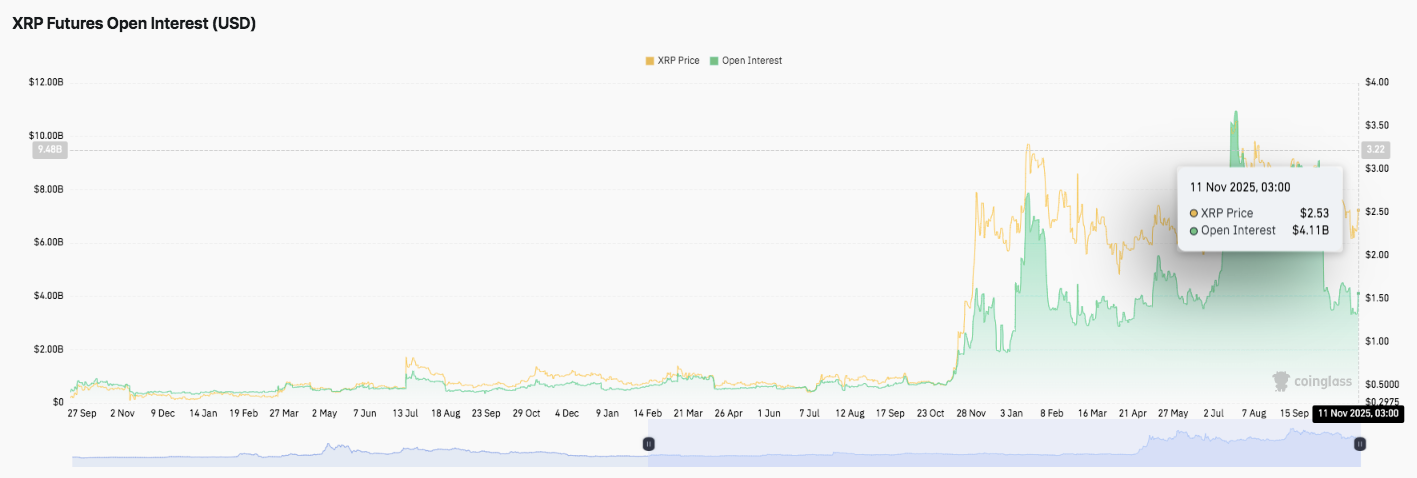

Market activity in XRP futures markets has grown significantly. Open interest surged to $4.11 billion on November 11, the highest level since midyear.

This rise reflects a clear increase in leveraged trading positions, which often precedes major price swings. Moreover, open interest expansion alongside steady price consolidation hints at building confidence among traders anticipating continued upside potential.

Earlier this year, XRP’s derivatives activity was relatively subdued, remaining below $2 billion until August. The sharp increase since September shows renewed liquidity and participation from speculative investors. Such growth in open interest typically strengthens short-term volatility and price action responsiveness.

Inflows Needed to Sustain Sentiment

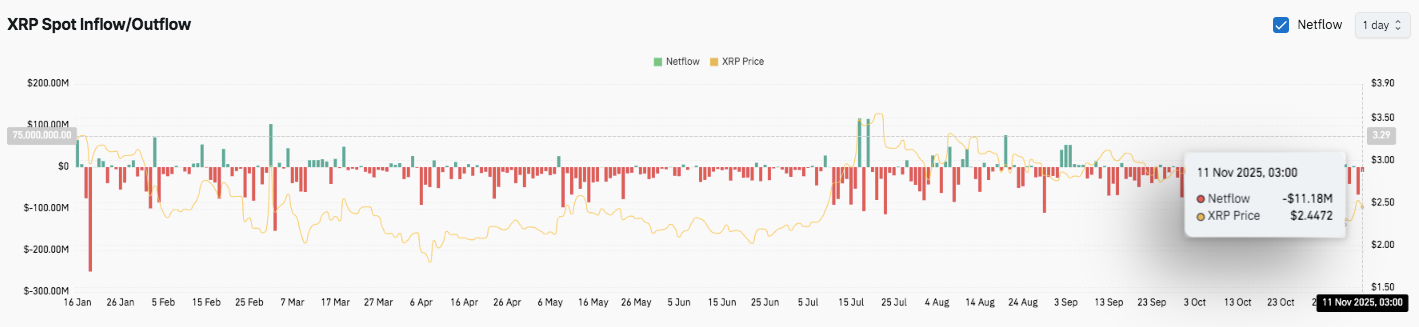

Despite the bullish technical structure, on-chain data shows persistent net outflows from XRP spot markets. Over $11.18 million in outflows were recorded on November 11 as the price hovered near $2.44.

This pattern signals profit-taking and short-term caution among investors. Sustained inflows will be essential to stabilize sentiment and confirm the continuation of the recovery.

Technical Outlook for XRP Price

Key levels remain well-defined heading into mid-November. On the upside, XRP faces resistance at $2.47, $2.52, and $2.79 as near-term hurdles. A breakout and sustained close above the $2.52 Fibonacci 0.5 level could confirm renewed bullish momentum, targeting $2.79 as the next objective.

Downside levels are equally crucial. Immediate support sits at $2.41 (50-EMA), followed by $2.35, where recent buying pressure emerged. Failure to hold this range could expose the price to $2.16, with a deeper decline potentially testing $1.94, the 0.236 Fib retracement.

Currently, XRP trades within a narrow recovery channel between $2.35 and $2.50. The technical structure shows the SuperTrend indicator turning bullish, while converging moving averages (20/50/100) signal a possible crossover ahead. This compression phase typically precedes volatility expansion, suggesting that a decisive move is imminent.

Will XRP Continue Its Recovery?

XRP’s short-term trajectory depends on whether buyers can defend the $2.35–$2.41 support cluster long enough to challenge resistance at $2.52. If bullish momentum continues with stronger inflows and open interest growth, the price could push toward $2.79 and possibly retest the $3.00 zone.

However, continued outflows and weak spot demand may limit upside attempts. A breakdown below $2.35 would likely shift control back to sellers, reopening the path to $2.16 or lower. For now, XRP remains in a pivotal zone, and the coming sessions will determine whether its recovery evolves into a broader trend reversal.

Related: Are XRP Bulls Faking the Rally? A $2 Dip Could Be Next

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.