- XRP trades at $3.04, breaking trendline resistance with support at $2.92–$2.99.

- SEC delays Franklin Templeton’s XRP ETF review, shifting earliest approval to November 14.

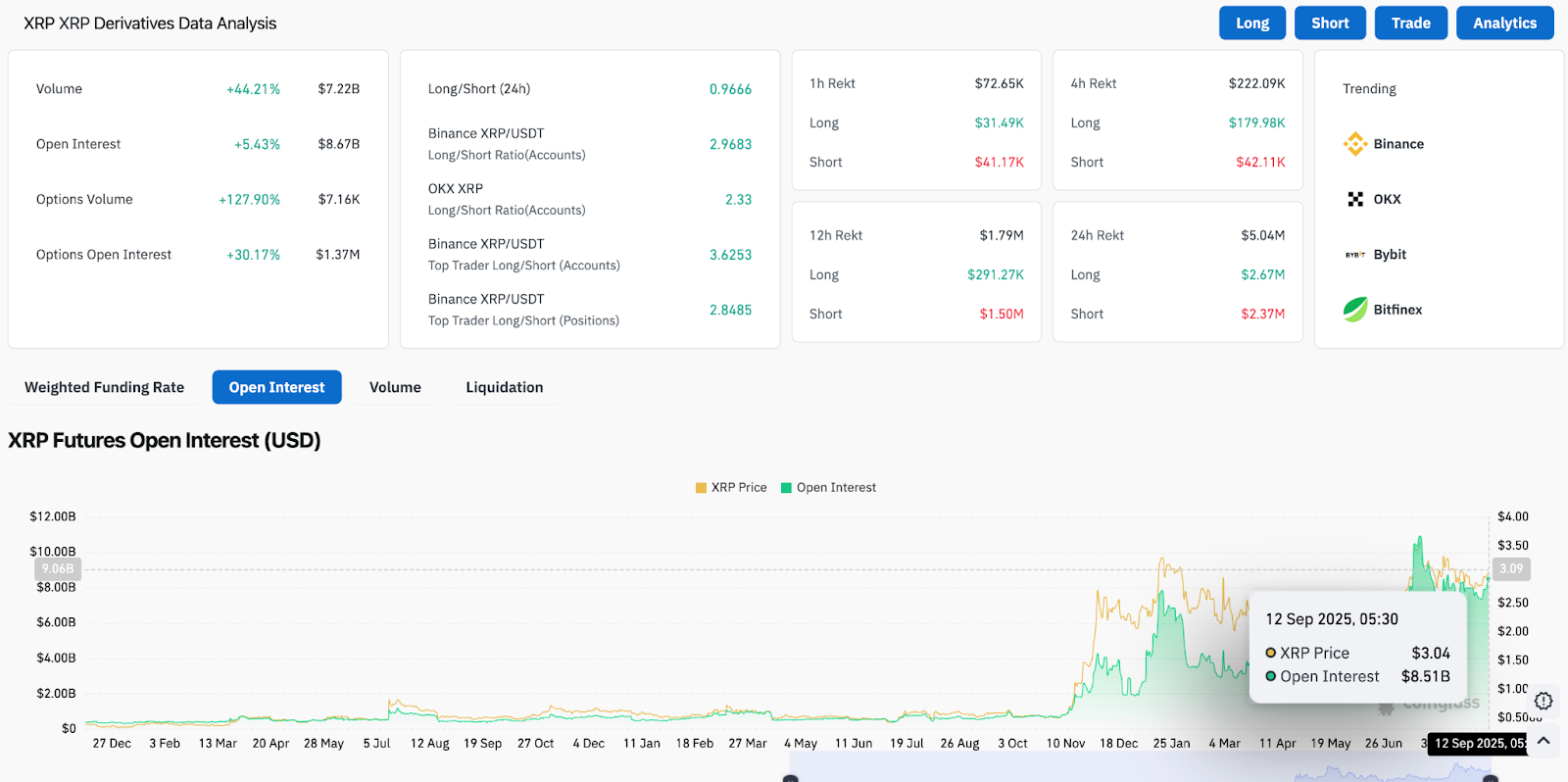

- Futures open interest hits $8.67B with long/short ratios above 2.9, signaling strong bullish positioning.

XRP price today is trading near $3.04, stabilizing after repeated defenses of the $2.92–$2.99 zone. The market faces tension between short-term ETF approval delays and strong derivatives demand, leaving traders focused on whether bullish positioning can lift price toward the $3.20–$3.30 range.

XRP Price Breaks Key Trendline Resistance

The 4-hour chart shows XRP closing above the long-standing descending trendline near $3.02, a structural shift that could set the stage for further gains. Price now sits within the upper half of its Bollinger Band range, reflecting renewed buying pressure.

Related: Ethereum (ETH) Price Prediction For September 13

Support is layered between $2.92 and $2.99, reinforced by the 20- and 50-period EMAs. A sustained hold above these levels would confirm a higher-low structure. On the upside, resistance lies near $3.18–$3.22, with a breakout potentially carrying price toward $3.30 and $3.50 in extension.

Failure to hold above $2.92 would re-expose the $2.77 pivot, which has acted as a critical accumulation zone since August.

SEC Delays XRP ETF But Optimism Remains

The U.S. Securities and Exchange Commission confirmed that it will delay Franklin Templeton’s $1.5 trillion XRP Spot ETF application, extending its review period by sixty days. The earliest potential approval date is now November 14, 2025.

While the delay disappointed investors who had expected a mid-September decision, analysts remain optimistic. Bloomberg’s ETF desk sees a 95% chance of approval before year-end, pointing to strong institutional appetite for Ripple-based products.

Ripple continues to advance its ecosystem despite regulatory headwinds. Following a $50 million settlement with the SEC earlier this year, the company has pursued a banking license, launched its RLUSD stablecoin initiative, and secured promotional partnerships with Mastercard and Gemini. These efforts highlight Ripple’s positioning as one of the most institutionally integrated crypto projects.

Futures Market Positions Heavily Favor Longs

Derivatives data shows a sharp uptick in trader participation. XRP futures open interest climbed 5.4% to $8.67 billion, while daily volume surged over 44% to $7.2 billion. Options markets also expanded, with open interest rising 30% and daily volumes jumping nearly 128%.

Long positioning remains dominant across major venues. On Binance, the long/short ratio exceeds 2.9, with top traders leaning 3.6 to 1 in favor of longs. OKX data shows a similar skew, suggesting that market participants are betting heavily on upside.

Related: Cardano (ADA) Price Prediction For September 12

Liquidation data indicates pressure on shorts, with $1.79 million cleared in the last 12 hours compared to $291,000 on the long side. This imbalance signals momentum favoring the bulls, though it raises risks of overleveraging if ETF delays extend uncertainty.

Technical Outlook For XRP Price

Momentum indicators show constructive signals. The RSI is hovering near 60, suggesting room for continuation before entering overbought territory. Bollinger Bands are widening after weeks of compression, a sign of pending volatility expansion.

Upside targets are clustered between $3.18 and $3.30, with $3.50 acting as the major breakout level. On the downside, $2.92 is the key short-term support, while losing $2.77 would weaken the bullish structure.

Outlook: Will XRP Go Up?

XRP’s near-term path hinges on whether strong derivatives demand can sustain momentum against ETF-related uncertainty. With futures open interest near $8.6 billion and long positions heavily skewed, the setup leans bullish.

If price clears the $3.18–$3.22 resistance band, analysts see a move toward $3.30 as highly probable, with $3.50 in focus if inflows accelerate. Conversely, failure to defend $2.92 would invite another consolidation phase.

Related: Shiba Inu (SHIB) Price Prediction For September 12

Overall, XRP remains positioned for upside as long as it holds above $2.92, with ETF developments likely to provide the next major catalyst into year-end.

XRP Price Forecast Table

| Indicator/Level | Bullish Scenario | Bearish Scenario |

| Key Support | $2.92 / $2.77 | Break below $2.77 exposes $2.60 |

| Key Resistance | $3.18 / $3.30 | Failure to clear $3.18 caps gains |

| RSI (4H) | Neutral at 60, room for upside | Reversal risk if RSI falls below 50 |

| Futures OI | $8.67B, strong long bias | Overleveraging risks sharp pullback |

| ETF Catalyst | 95% chance of approval by year-end | Delay to November caps sentiment |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.