- XRP price today holds at $3.00, consolidating near the 20-day EMA with resistance at $3.20.

- SWIFT partnership talks fuel optimism as XRP emerges as a potential cross-border settlement asset.

- XRP price prediction targets $3.20–$3.60 if breakout holds, with support at $2.95 and $2.83.

XRP price today is trading at $3.00, holding just above the 20-day EMA near $2.96 while testing the $3.01–$3.05 resistance zone. Bulls are attempting to defend the breakout structure, but momentum remains fragile as derivatives flows show mixed conviction.

XRP Price Holds Trendline Support

The daily chart highlights XRP consolidating along the rising trendline from June, with immediate support at $2.95 and deeper protection at $2.83. Below this, the 200-day EMA near $2.59 remains the structural anchor.

Momentum indicators are balanced. The RSI hovers at 51, showing neutral conditions after cooling from overbought readings in late August. The price has also remained inside a broad descending channel since July, making $3.20 the key breakout level that must be cleared to confirm bullish continuation.

SWIFT Partnership Talks Fuel Optimism

Speculation intensified after reports that SWIFT is nearing an agreement to use XRP for cross-border settlements, with billions of tokens held in escrow as liquidity reserves. Traders view this as one of the most significant adoption narratives in recent years, potentially transforming XRP into a preferred bridge asset for institutional transfers.

The news provides a strong fundamental tailwind. However, the market response has been measured, suggesting that participants are waiting for official confirmation before committing larger inflows.

On-Chain Data Signals Cautious Positioning

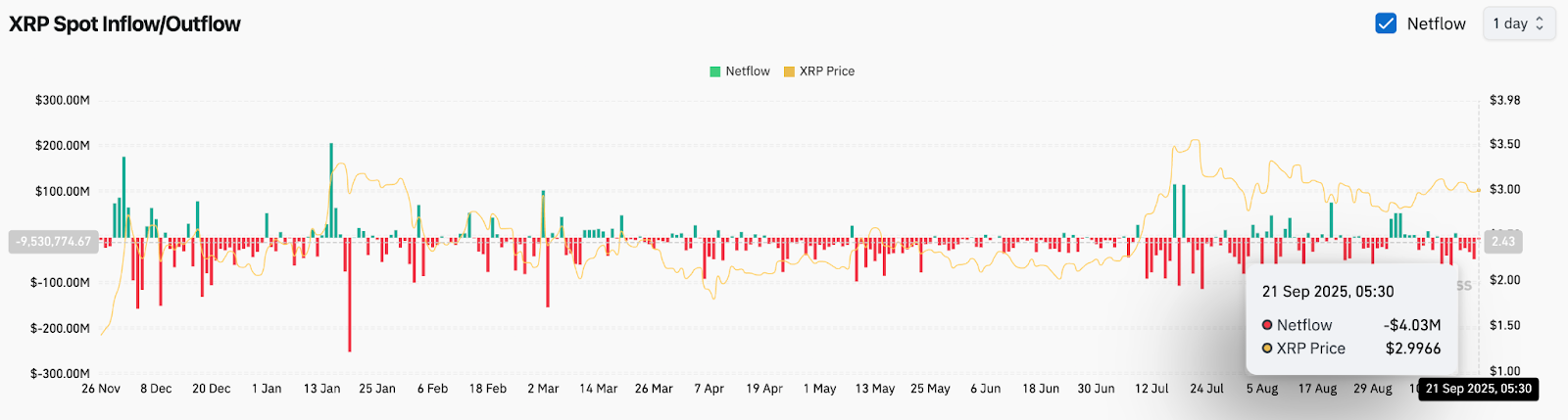

On-chain flows show mixed signals. Spot data recorded a net outflow of $4 million on September 21, suggesting that traders were securing profits near the $3.00 zone. Broader flows throughout September have alternated between mild inflows and persistent outflows, pointing to hesitation despite the SWIFT headlines.

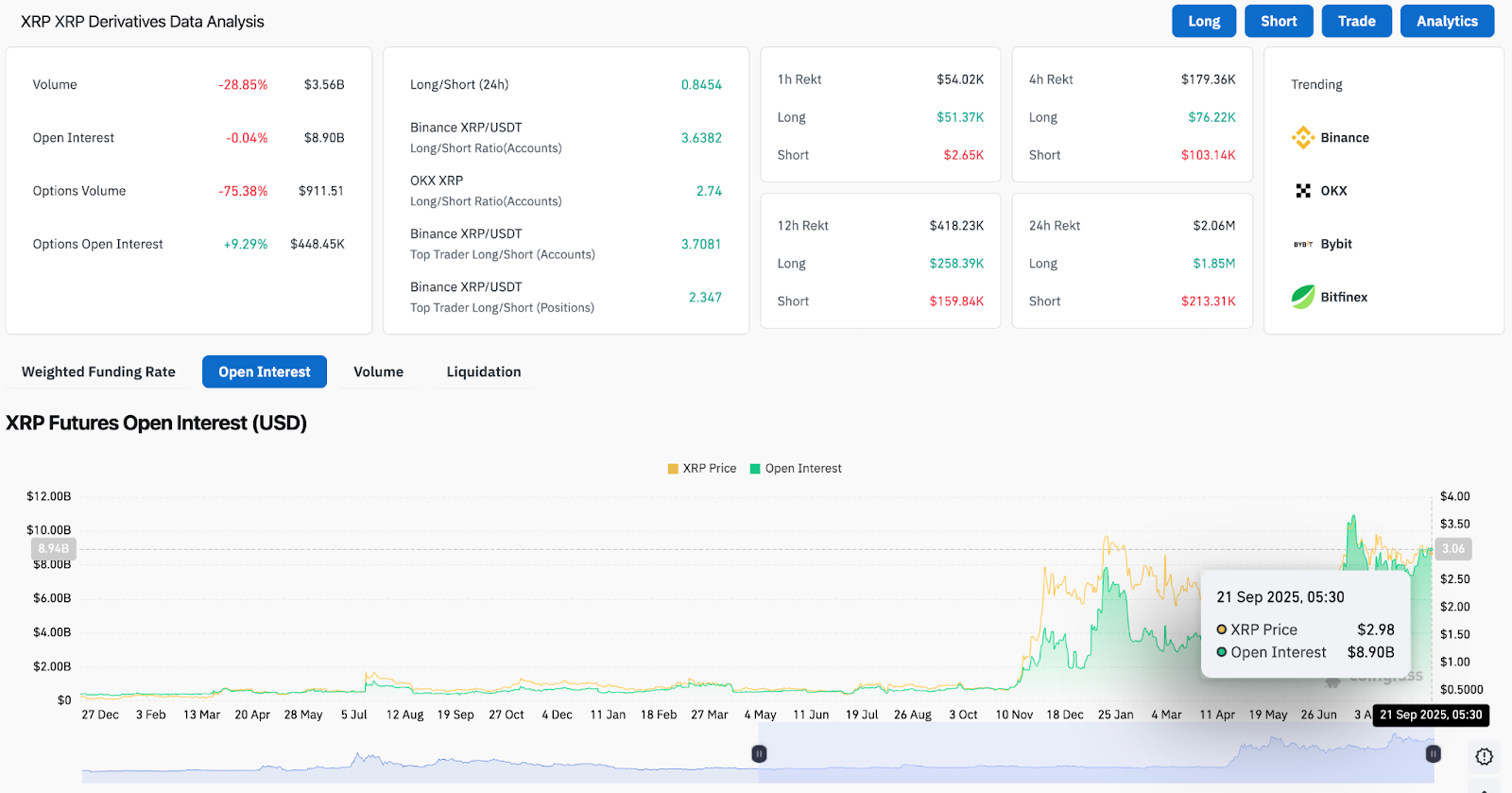

Derivatives positioning remains active. Open interest sits near $8.9 billion, little changed on the day. Long/short ratios across Binance and OKX skew bullish, with accounts leaning nearly 3.6:1 long on Binance. Options activity has collapsed, however, down 75% in volume, which highlights lower conviction from hedging participants.

Technical Outlook For XRP Price

XRP price prediction for the near term revolves around whether bulls can reclaim the $3.20 level.

- Upside levels: $3.20, $3.35, and $3.60 remain the immediate breakout targets if momentum accelerates.

- Downside levels: $2.95 and $2.83 are first-line supports, with $2.59 as the final defensive zone.

- Trend support: $2.83 continues to define the mid-cycle accumulation area.

Outlook: Will XRP Go Up?

The next move for XRP depends on whether buyers can sustain pressure above $3.00 and force a breakout over $3.20. On-chain data suggests cautious flows, while derivatives positioning leans bullish. The potential SWIFT deal adds one of the strongest adoption catalysts XRP has seen in years.

If confirmation arrives, a surge toward $3.60 is possible. Without it, XRP may remain trapped between $2.83 and $3.20 as traders await a decisive catalyst.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.