- XRP price today trades near $2.81 after breaking $2.90–$2.95 support with bearish momentum.

- On-chain data shows $13.8M in outflows, highlighting weak accumulation across spot markets.

- Futures open interest fell 12% to $7.76B as liquidations surged, increasing downside volatility risk.

XRP price today is trading at $2.81, sliding over 5% in the past 24 hours as sellers regained control. The move broke through the $2.90–$2.95 support zone, leaving the token vulnerable to further downside. Technical pressure has converged with weakening on-chain flows and a pullback in derivatives activity, clouding the short-term outlook.

XRP Price Breaks Below Support

The daily chart highlights a sharp rejection from the $3.20 zone, pushing XRP back into the lower end of its consolidation structure. The drop sliced through the 20 and 50 EMA levels near $2.95 and $2.86, leaving price to test deeper liquidity near $2.75.

Related: Cardano (ADA) Price Prediction For September 23

Momentum signals reflect the shift in sentiment. The RSI has dropped toward 39, tilting into bearish territory, while the MACD slope has steepened to the downside. If XRP loses the $2.75–$2.70 zone, the next key support rests at $2.59, where the 200 EMA sits. Bulls must reclaim $2.95 to revive confidence.

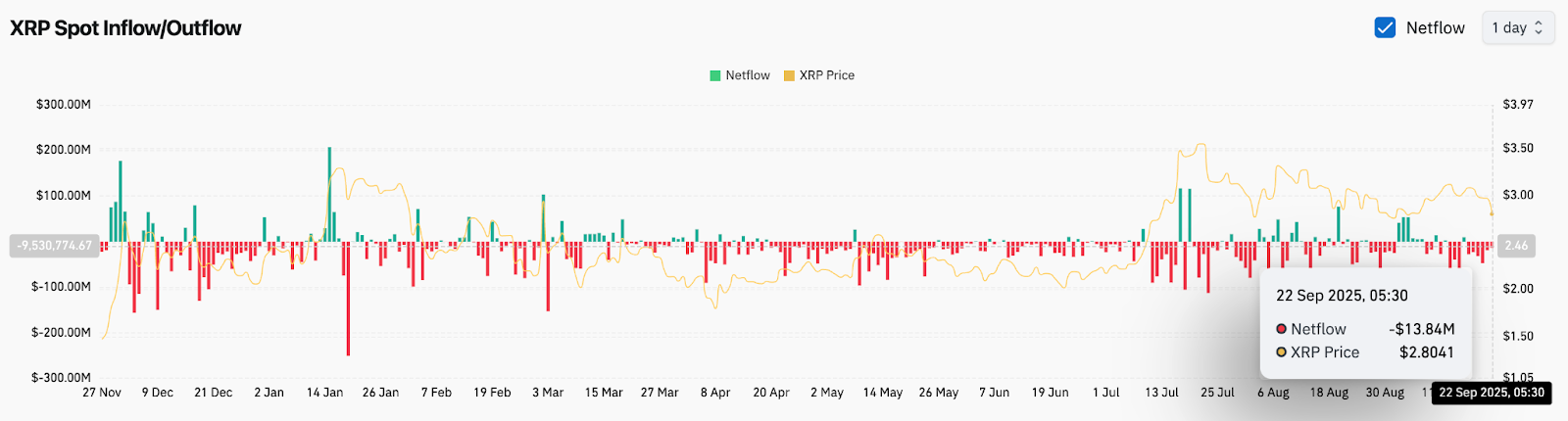

Outflows Show Bearish Bias

urOn-chain data reinforces the bearish narrative. Net flows recorded a $13.8 million outflow on September 22, marking yet another day of consistent selling pressure. Over recent weeks, green inflow bars have been limited, highlighting the lack of accumulation despite XRP’s repeated defenses above $2.80.

This trend signals investor caution, as outflows suggest reduced demand on spot markets. Without sustained inflows, upside momentum could remain limited even if broader crypto sentiment stabilizes.

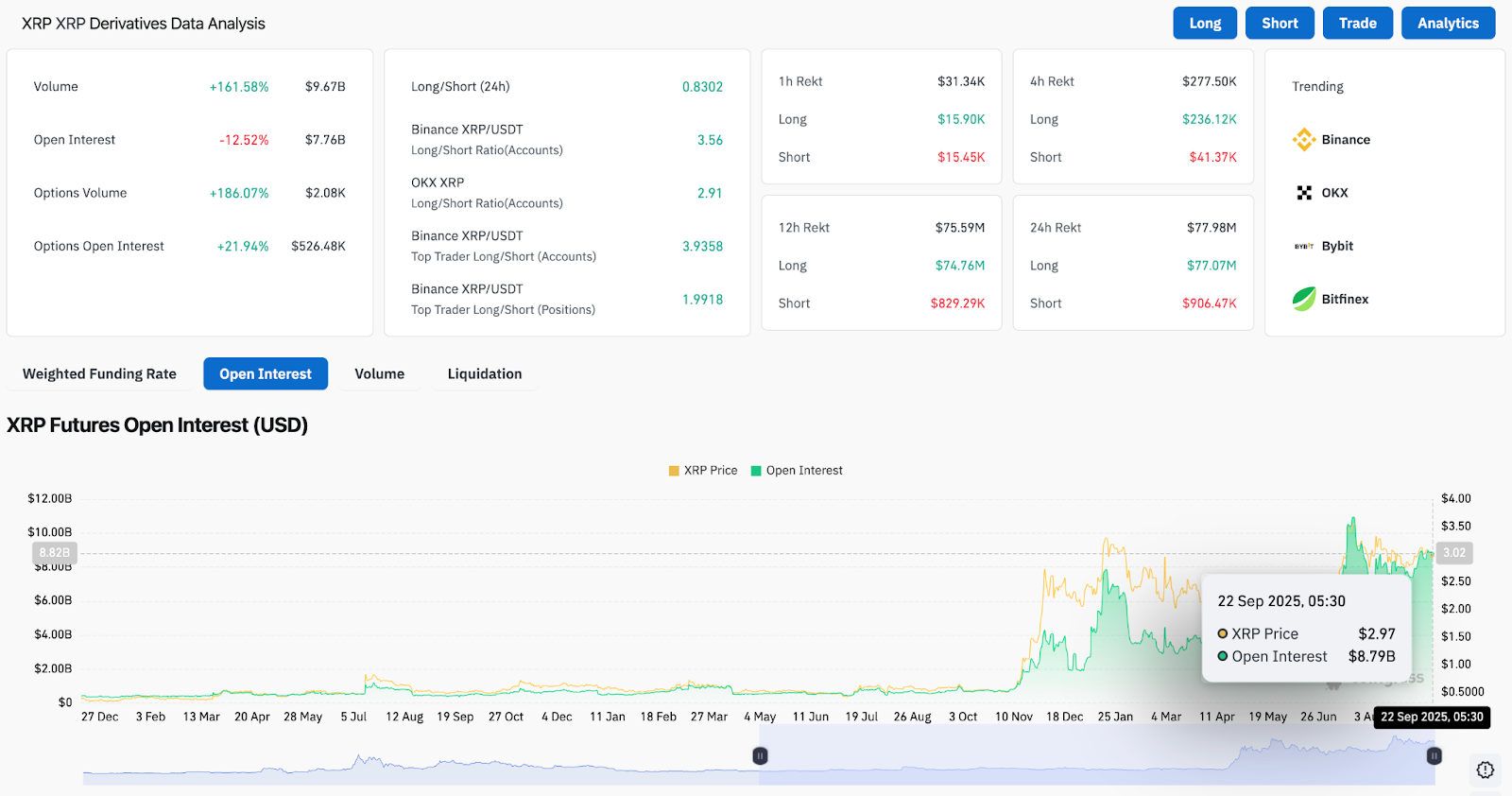

Derivatives Positioning Turns Defensive

The derivatives market reflected similar caution. XRP futures open interest dropped by 12.5% to $7.76 billion, signaling a broad reduction in positions. While 24-hour trading volume surged 161% to $9.6 billion, much of this was driven by liquidations. Data showed $77.9 million in positions wiped out in the last 24 hours, with shorts dominating at over $900 million compared to $77 million in long liquidations.

Related: Ethereum (ETH) Price Prediction For September 23

Interestingly, long/short ratios still lean heavily toward longs across major exchanges, with Binance accounts holding nearly four long positions for every short. This imbalance raises the risk of further liquidations if XRP breaks below $2.70, potentially accelerating downside volatility.

Technical Outlook For XRP Price

XRP price prediction for the short term hinges on whether bulls can defend the $2.75–$2.70 support cluster.

- Upside levels: A recovery above $2.95 would open a path toward $3.10 and $3.20. A stronger push could test $3.35 if momentum returns.

- Downside levels: A break below $2.70 could extend losses toward $2.59 and $2.45.

- Trend structure: As long as XRP stays above $2.59, the broader uptrend remains intact, but near-term sentiment is clearly tilted bearish.

Outlook: Will XRP Go Up?

The path forward for XRP is uncertain as technical and on-chain signals remain heavy. Persistent outflows, falling open interest, and rising liquidations point to fragile demand, even as oversold conditions could spark short-term bounces.

Related: Solana (SOL) Price Prediction For September 23

Analysts note that XRP must reclaim $2.95 quickly to neutralize downside risks. Without a swift rebound, the door opens for further tests of $2.70 and $2.59. For now, traders are bracing for volatility, with the $2.75 zone emerging as the key battleground between buyers and sellers.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.