XRP price today is trading at $2.88, holding a fragile base above $2.84 support while pressing into short-term resistance at the 100-EMA. The setup has gotten a lot of attention again as traders weigh the October ETF decision window against technical compression. This could change the outlook for XRP.

XRP Price Holds At Key Support

On the 4-hour chart, XRP has been grinding higher off the $2.77–$2.84 accumulation range. Buyers have defended this zone repeatedly, with the 200-EMA at $2.82 acting as a backbone for bullish sentiment. Overhead, immediate resistance aligns at $2.92–$2.93, where the 100-EMA and trendline converge.

Momentum indicators show that things are getting stronger. RSI has gone above 59, which means that bullish momentum is getting stronger. At the same time, MACD is flattening, which means that the market may be moving from a neutral bias to a positive momentum. A decisive break above $2.93 would expose the broader downtrend line near $3.10, setting the stage for a retest of $3.20.

On-Chain Flows Show Net Inflows

Exchange flow data recorded a $9.28 million net inflow on September 8, the first meaningful positive print after weeks of muted activity. While modest compared to summer’s peaks, it signals that traders are beginning to re-accumulate ahead of potential ETF catalysts.

That said, inflows remain well below the $50 million threshold that typically confirms strong conviction. Active address counts have also plateaued, suggesting broader participation is still hesitant. Analysts caution that without sustained inflows, XRP’s ability to break resistance may be limited.

Derivatives Data Reflects Cautious Optimism

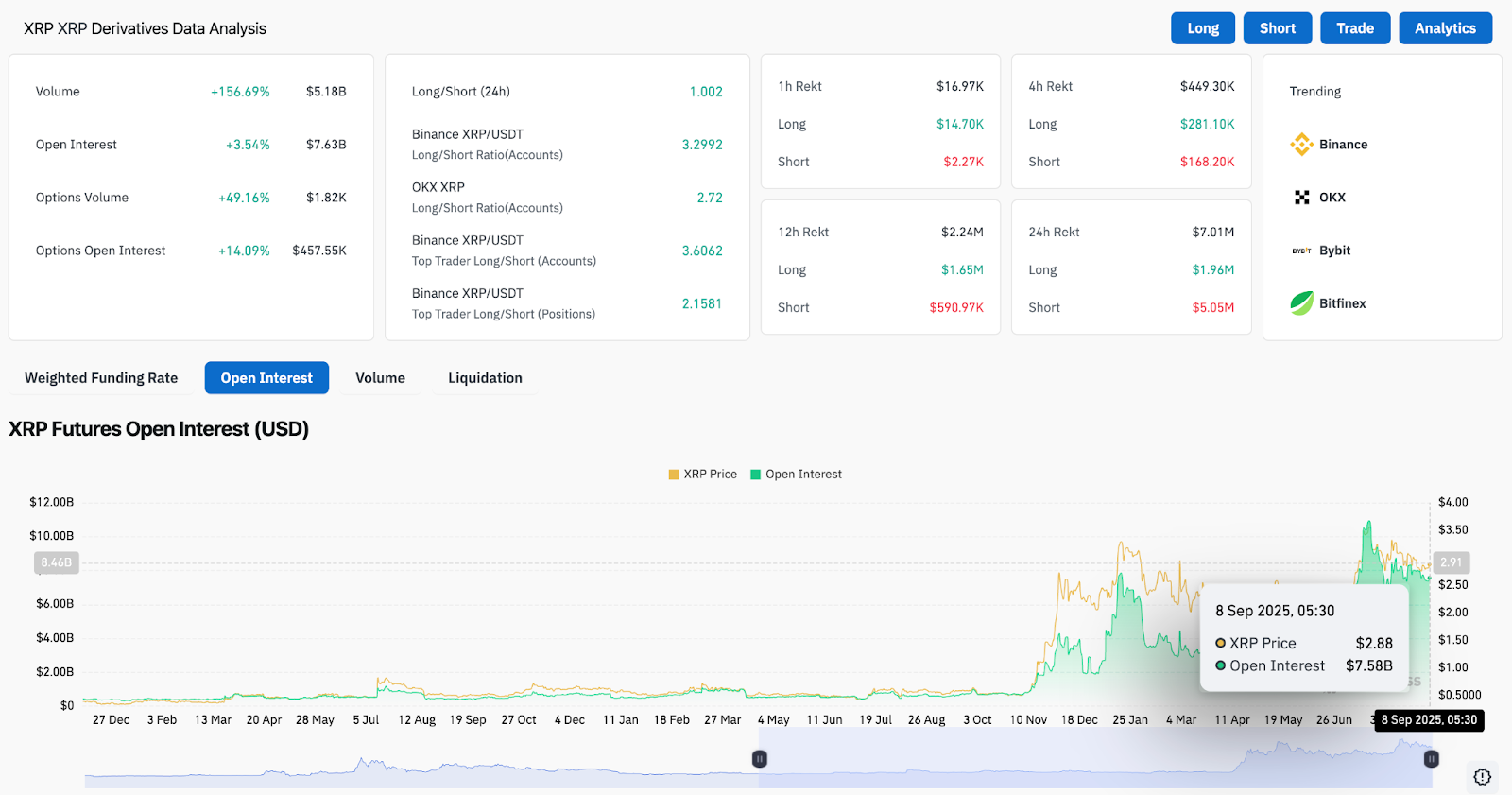

Derivatives markets provide a mixed but slightly bullish picture. XRP futures open interest climbed to $7.58 billion, up 3.5% in 24 hours, signaling renewed speculative activity. Options volume spiked by nearly 50%, while funding rates remain balanced, indicating no extreme leverage imbalances.

Long-short ratios across major exchanges show traders leaning long, with Binance’s top traders holding a 3.29 ratio in favor of longs. This tilt suggests that while conviction is rising, positioning remains vulnerable to forced liquidations if XRP rejects resistance zones.

Supertrend And SAR Highlight Breakout Levels

Daily indicators highlight the importance of $2.91–$3.18. The Supertrend remains bearish below $3.18, keeping downside risk in play until bulls reclaim this threshold. Parabolic SAR dots are clustered just above current levels, suggesting XRP is on the cusp of a potential bullish flip if price extends higher.

Failure to clear these markers could send XRP back to the $2.82 and $2.77 support levels, where bulls must defend structure to prevent deeper losses toward $2.70.

Technical Outlook For XRP Price

- Upside levels: Breakout above $2.93 could trigger momentum toward $3.10, followed by $3.20 and the key $3.35 zone.

- Downside levels: Losing $2.82 would re-expose $2.77 support, with risks extending to $2.70 if pressure escalates.

Outlook: Will XRP Go Up?

XRP price sits at a pivotal point where ETF speculation, rising inflows, and improving technicals converge. The short-term bias leans bullish as long as the $2.82–$2.84 zone holds, with potential to target $3.20 if momentum builds.

However, without stronger inflows or ETF clarity, consolidation may persist. Traders will watch closely whether October’s ETF decisions provide the spark for XRP’s next sustained rally.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.