- XRP holds above $1.40 as Ripple CEO Brad Garlinghouse joins CFTC Innovation Advisory Committee, signaling regulatory normalization.

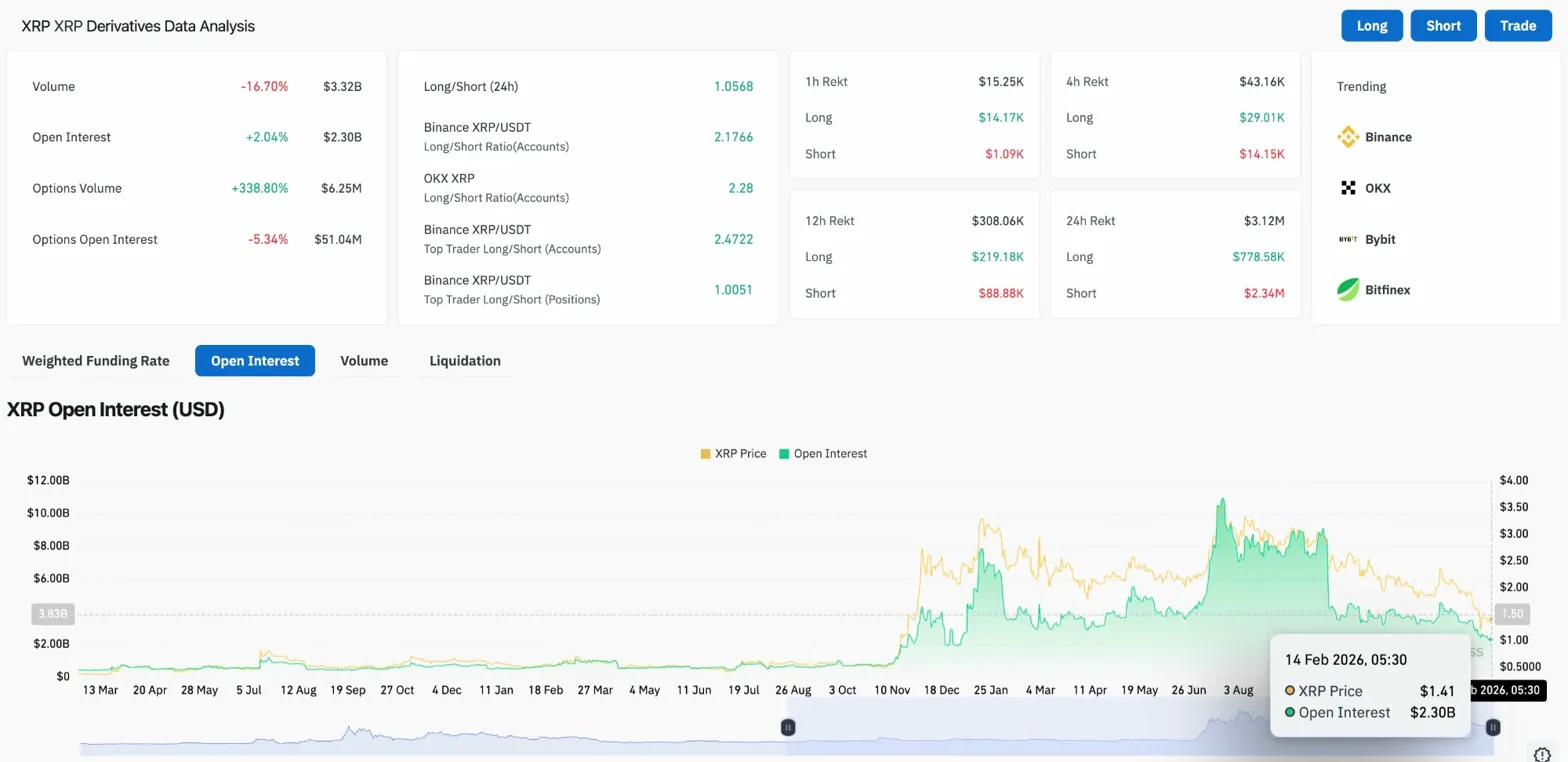

- Open interest rises 2.04% to $2.30B while options volume surges 338.80%, showing renewed trader interest despite price weakness.

- Price must reclaim $1.51 support to invalidate breakdown and target $1.76 resistance zone, analysts say.

XRP price today trades near $1.4085, up 0.16% in the past 24 hours as the token attempts to stabilize after breaking below key support levels. The move comes as Ripple CEO Brad Garlinghouse announced his appointment to the Commodity Futures Trading Commission’s Innovation Advisory Committee, a development that could shift regulatory sentiment.

Garlinghouse Joins CFTC Panel In Regulatory Milestone

Garlinghouse’s appointment to the CFTC Innovation Advisory Committee marks a significant milestone for Ripple and the broader XRP ecosystem. The same regulatory environment that challenged Ripple for nearly five years is now seeking industry input directly from the company’s leadership.

For XRP supporters, this signals growing regulatory normalization. Engagement with the CFTC may enhance Ripple’s credibility in US policy discussions and reduce the long-term legal overhang that previously weighed on price. Garlinghouse called the committee roster “the Olympics crypto roster,” highlighting the caliber of industry participants involved.

Constructive dialogue with regulators could ease uncertainty and provide clearer pathways for institutional adoption. However, the market has yet to price in the long-term implications of this development, with price action remaining focused on near-term technical levels.

Open Interest Climbs As Options Volume Surges

According to Coinglass, XRP’s open interest increased 2.04% to $2.30 billion, while volume dropped 16.70% to $3.32 billion. Options volume surged 338.80% to $6.25 million, suggesting traders are positioning for volatility ahead. Options open interest fell 5.34% to $51.04 million, indicating some options positions were closed despite the spike in trading activity.

Long/short ratios remain elevated at 2.18 on Binance and 2.28 on OKX, showing that leverage still skews bullish despite the 61% decline from the $3.56 all-time high. Top trader positioning shows $219.18 million in longs versus $88.88 million in shorts on 12-hour timeframes, indicating large accounts are positioned for recovery. The combination of rising open interest and options volume surge suggests traders are rebuilding positions after the recent selloff.

Price Breaks Below Multi-Month Descending Trendline

On the daily chart, XRP has broken decisively below the descending trendline that has guided price action since the July 2025 peak. Supertrend flipped bearish at $1.7407, confirming downside momentum. Parabolic SAR sits at $1.1673, marking the next major support zone if selling continues.

The chart shows:

- Clean breakdown below descending trendline from July highs

- Supertrend bearish, confirming sellers control momentum

- $1.40 psychological support under immediate pressure

- $1.51 former support now resistance

XRP dropped from above $2.40 in early January to a low near $1.15 on February 11, marking a 52% correction. The recent bounce to $1.40 represents a 22% recovery from those lows, but the structure remains decisively bearish. Analysts suggest XRP must reclaim $1.51 to invalidate the breakdown and target the $1.76 resistance zone.

A daily close above $1.51 would place XRP back above the recent support that broke, shifting momentum away from the bears. Until that happens, every bounce remains a relief rally inside a corrective phase. The $1.40 level is critical. Losing this support would expose $1.30 and eventually retest the $1.15 lows.

Range-Bound Trading Dominates Intraday Action

The 1-hour chart reveals XRP consolidating in the $1.35-$1.45 range after the sharp recovery from $1.15. RSI sits at 58.66, neutral and showing no strong directional bias. MACD remains positive but flat, with both lines converging near zero.

The structure shows:

- Price forming higher lows from the $1.15 base

- Resistance at $1.45 capping upside attempts

- Consolidation indicating indecision

Buyers are defending the $1.35-$1.40 zone, preventing an immediate retest of the lows. Sellers continue to reject price above $1.45, keeping pressure on any rally attempts. The tight range reflects market indecision as traders weigh the CFTC news against broader technical weakness.

A breakout above $1.45 with volume would place $1.51 back in range and signal the first sign of trend reversal. A breakdown below $1.35 would invalidate the recovery and send price back to test $1.30 support.

Outlook: Will XRP Go Up?

The next move depends on whether XRP can hold $1.40 and reclaim the $1.51 resistance zone.

- Bullish case: A close above $1.51 with strong volume would invalidate the breakdown and place $1.76 back in range. Reclaiming $1.76 would flip the structure and target $2.00 psychological resistance.

- Bearish case: A breakdown below $1.35 exposes $1.30, with further downside toward $1.15 if selling accelerates. Losing $1.35 would confirm the rally from lows was a dead cat bounce.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.