- XRP drops 2.86% to $1.9279, breaking the $2 psychological support that has anchored price action since December.

- Glassnode data shows short-term holder cost basis falling below the 6-12 month cohort, a pattern last seen before XRP’s 60% crash in 2022.

- Whale outflows continue at $20 million per day as holders who entered above $2 face mounting pressure to sell.

XRP price today trades near $1.9279 after breaking below the critical $2 psychological support. The move triggers a structural shift that on-chain analytics firm Glassnode warns resembles the setup before XRP’s 60% crash in early 2022.

Glassnode Flags 2022 Pattern Repeating

The current market structure mirrors a bearish formation last seen nearly four years ago. According to Glassnode, the short-term holder cost basis has dropped below the realized cost basis of the 6-12 month cohort.

This divergence matters. Investors active in the 1-week to 1-month window are now accumulating XRP at prices below where medium-term holders bought. That creates psychological pressure on those who entered at higher levels, increasing the likelihood of capitulation if sentiment worsens.

In February 2022, XRP traded around $0.80 when this same pattern emerged. The broader market downturn that followed triggered a 60% crash to lows near $0.30 as investors and whales exited positions.

The parallel does not guarantee a repeat, but it highlights the risk facing XRP holders who bought during the rally above $2.

$2 Break Triggers Realized Losses

The $2 psychological level has served as a major support zone influencing holder behavior. Glassnode data shows that every time price retested this level, XRP holders triggered between $500 million and $1.2 billion in weekly realized losses.

With the level now broken, that selling pressure has room to accelerate. Holders who accumulated between $2 and $2.50 face the choice of selling at a loss or waiting for a recovery that may not come.

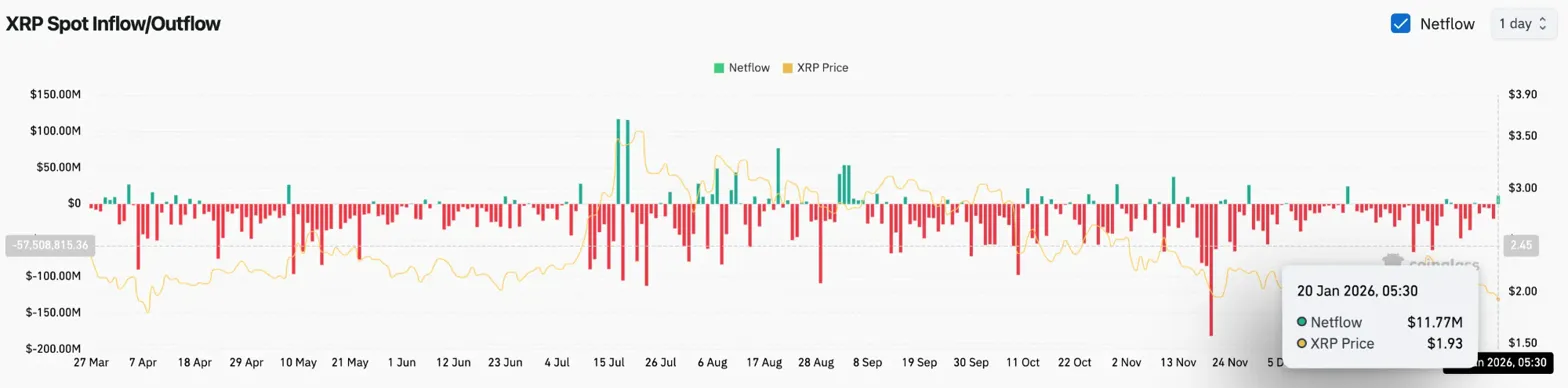

The XRP Whale Flow 30-day moving average remained negative during the recent rebound, indicating continued distribution from large holders. While selling pressure has eased from its peak, outflows still average around $20 million per day.

Spot Inflows Provide Limited Support

Exchange flow data shows some buyers stepping in despite the selloff. Coinglass recorded $11.77 million in net inflows on January 20, meaning coins are moving off exchanges into private wallets.

The accumulation is modest relative to the selling pressure from whales and medium-term holders. When on-chain metrics diverge from price action, the larger flow typically wins. In this case, whale distribution outweighs spot accumulation.

The inflow does suggest that some traders view current prices as opportunity. Whether that bid holds against continued selling will determine if XRP stabilizes or extends lower.

Price Breaks Below All Four EMAs

On the daily chart, XRP now trades below the 20, 50, 100, and 200-day EMAs for the first time since the October rally began. The EMA stack has flipped entirely bearish, with all four averages sloping downward.

Key levels now:

- Immediate resistance: $2.04 (20 EMA)

- Secondary resistance: $2.06 (50 EMA)

- Major resistance: $2.18 to $2.31 (100/200 EMA cluster)

- Supertrend resistance: $2.2386

- Current support: $1.80 demand zone

- Breakdown target: $1.60 to $1.50

The Supertrend indicator flipped bearish at $2.2386 and now acts as overhead resistance. The descending trendline from the October high continues to cap rallies, compressing price toward the $1.80 demand zone.

Intraday Momentum Approaches Oversold

Shorter timeframes show the intensity of recent selling. On the 30-minute chart, price crashed from $2.10 to a low of $1.85 before bouncing to current levels.

RSI sits at 33.05, approaching oversold territory. MACD remains bearish but the histogram is beginning to contract, suggesting that selling momentum may be exhausting. Such readings often precede short-term bounces before the trend resumes.

Any relief rally faces resistance at $2.00. Reclaiming this level with conviction would invalidate the breakdown and signal that buyers are defending the structure.

Outlook: Will XRP Follow The 2022 Playbook?

The setup demands caution. On-chain metrics, whale flows, and technical structure all point to elevated downside risk. The 2022 parallel does not guarantee a repeat, but the conditions that preceded that crash are present today.

- Bullish case: Price bounces from the $1.80 demand zone and reclaims $2.00. A close above $2.04 would signal exhaustion selling and target a retest of $2.18.

- Bearish case: A daily close below $1.80 confirms the breakdown and targets $1.60. If the 2022 pattern repeats with similar magnitude, XRP could test $1.00 to $1.20.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.