- XRP price today holds near $2.45, with resistance capped at $2.62–$2.76 and critical support at $2.20.

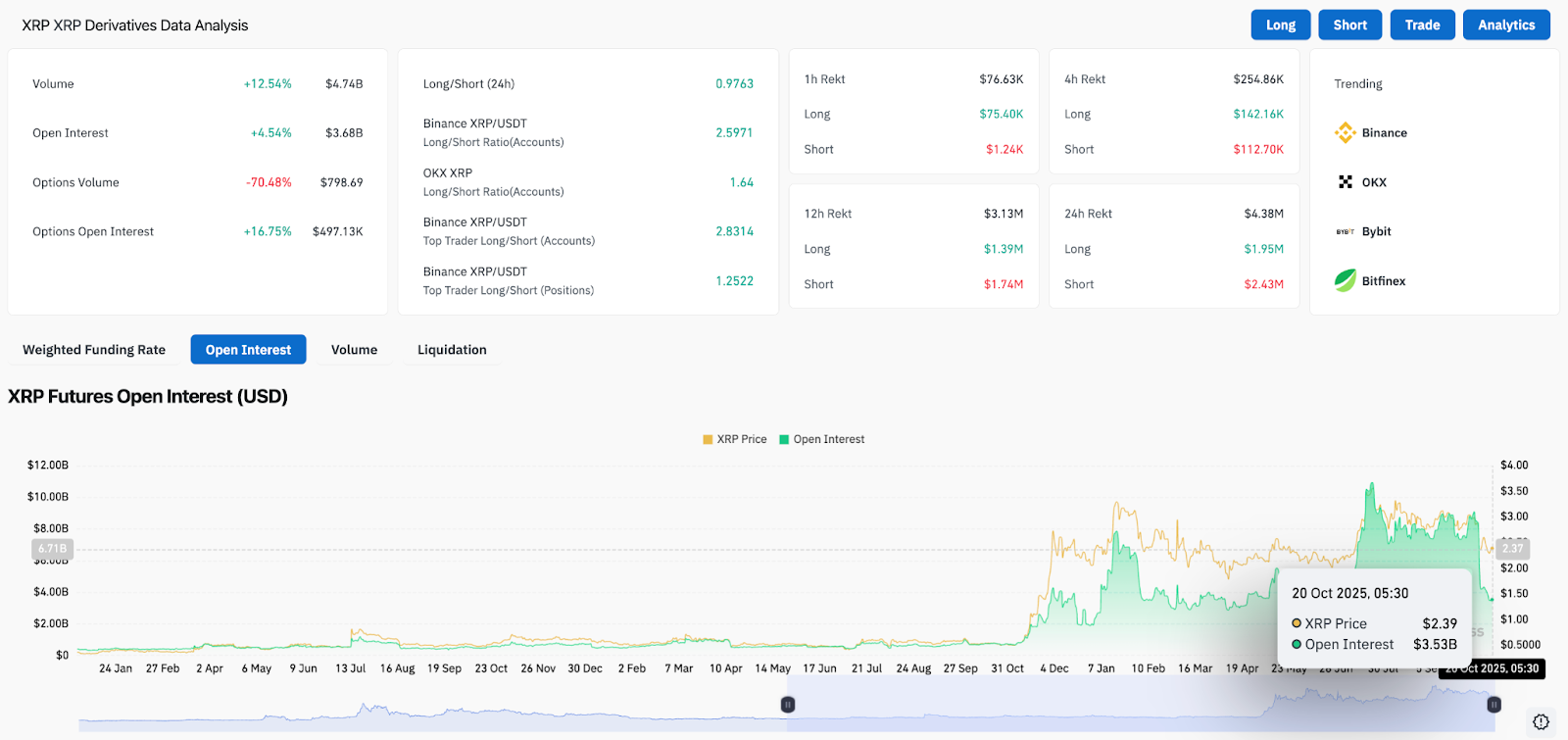

- Derivatives data shows mixed positioning, with futures volume up 12.5% but options activity plunging over 70%.

- A retiree’s $3M XRP loss via compromised hardware wallet adds security concerns to ongoing ETF uncertainty.

XRP price today trades near $2.45, recovering modestly after last week’s sharp selloff. Buyers are attempting to stabilize above the $2.35–$2.40 zone, but resistance remains heavy around the EMA cluster near $2.62–$2.76. With ETF delays weighing on sentiment and new security concerns rattling the community, traders are watching if XRP can avoid another drop toward $2.20.

Price Action Holds Below Key EMAs

On the daily chart, XRP remains locked under the descending resistance line from July highs. The 20- and 50-day EMAs sit tightly between $2.58 and $2.74, creating a ceiling that bulls must reclaim for momentum to shift.

Parabolic SAR dots above current price highlight continued downside pressure. The $2.20–$2.25 area, which cushioned last week’s flush, stands as critical support. A breakdown below that zone risks exposing the $2.00 handle, last seen in June.

Related: Bitcoin Price prediction: BTC Bulls Target Key Resistance Ahead of Fed Event

Derivatives Data Shows Mixed Signals

Futures activity picked up this week, with volume rising 12.5% to $4.74 billion and open interest climbing 4.5% to $3.68 billion, suggesting renewed speculative positioning. Options activity told a different story, plunging over 70%, though options open interest rose 16.7%, showing traders are holding rather than initiating fresh bets.

Funding ratios on Binance remain skewed long, with the account ratio near 2.6, underscoring persistent bullish bias among retail. But the long/short balance across venues has cooled, reflecting hesitation despite higher XRP price action.

Investor Security Breach Shakes Confidence

Adding to sentiment pressure, a North Carolina retiree claimed he lost $3 million in XRP after importing a hardware wallet seed into Ellipal’s mobile app, inadvertently converting his cold wallet into a hot one. On-chain analyst ZackXBT traced the stolen funds through multiple swaps into Tron before dispersal to OTC brokers, limiting recovery chances.

Ellipal emphasized its hardware wallets remain secure but said user error compromised the account. While isolated, the episode has fueled debate over wallet safety at a time when ETF uncertainty already clouds the outlook.

Related: Dogecoin Price Prediction: First Spot ETF Filing Puts $0.30 Dream Back On The Table

Technical Outlook Points To Range Trade

For now, the XRP price prediction remains range-bound. Bulls need a clean break above $2.76 to unlock targets near $3.00, where the descending trendline aligns with the 100-day EMA. Failure to reclaim this zone will keep XRP vulnerable to retests of $2.20 support.

Traders highlight that open interest remains firm above $3.5 billion, keeping XRP price volatility elevated. Any shift in spot inflows or ETF headlines could trigger a sharp directional move.

Outlook: Will XRP Go Up?

XRP price today shows signs of stabilization, but conviction remains thin. The bullish case requires buyers to hold $2.35 and reclaim the EMA cluster at $2.62–$2.76. That would open the door toward $3.00 and a possible reversal of October’s downtrend.

The bearish case centers on ETF uncertainty and weak inflows. A close below $2.20 could accelerate downside momentum, exposing $2.00 as the next magnet. Until ETF clarity emerges, the XRP price prediction skews toward consolidation with high volatility risk.

Related: Bittensor Price Prediction: TAO Targets $500 as Bullish Momentum Builds

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.