- XRP price today trades near $2.36 after defending $2.28 support within a symmetrical triangle structure.

- Crypto lawyer Bill Morgan counters centralization claims, citing ETF filings that define XRP as decentralized.

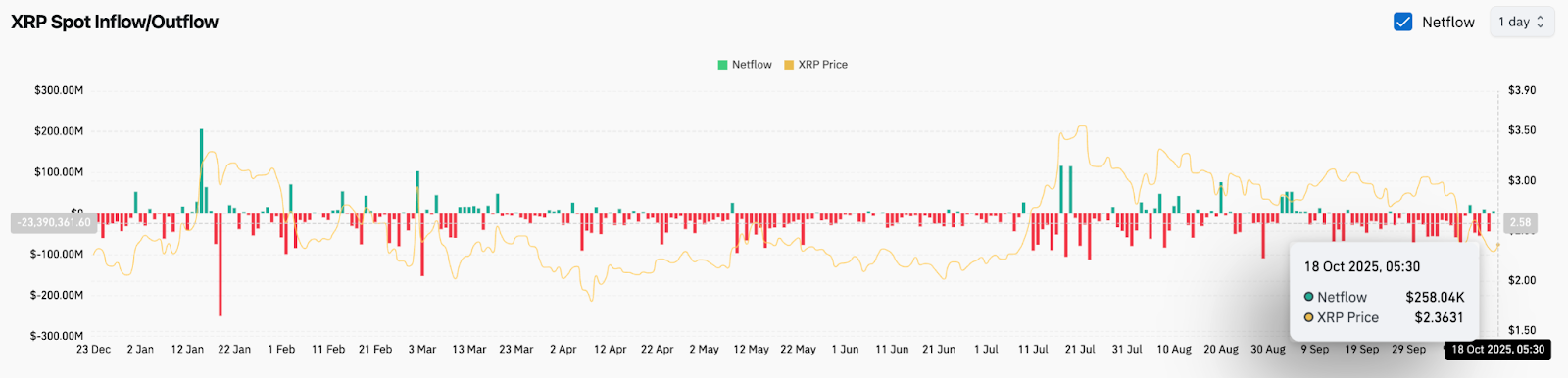

- On-chain flows turn positive with modest inflows, hinting at early stabilization after weeks of selling pressure.

XRP price today trades near $2.36, recovering from last week’s steep decline as buyers defend the long-term support line around $2.28. After dropping below key exponential moving averages (20-day at $2.61, 50-day at $2.77, and 100-day at $2.78), the token is now attempting to reclaim short-term momentum within its symmetrical triangle structure.

After heavy liquidations across the broader crypto market, sentiment around XRP is stabilizing. Analysts attribute part of this recovery to renewed confidence in the project’s decentralization status, following a public statement by crypto lawyer Bill Morgan countering claims that XRP is a centralized asset.

XRP Price Finds Balance After Steep Drop

The daily chart shows XRP bouncing from the lower trendline of its long-standing consolidation triangle. The 200-day EMA near $2.62 remains the key resistance ceiling. A decisive break above this level could open the way toward $2.77 and $2.95.

Momentum indicators suggest mixed conditions. The RSI sits at 35.05, reflecting weak but stabilizing momentum after oversold readings earlier in the week. Analysts say that the compression near $2.28 has historically preceded short-term recoveries, but stronger confirmation will require a daily close above $2.62.

Lawyer Counters Centralization Claims

Legal expert Bill Morgan reignited debate around XRP’s classification this week after responding to remarks from Cyber Capital founder Justin Bons, who described XRP as centralized and permissioned. Morgan rejected that view, citing filings from major asset managers that explicitly define XRP as decentralized.

According to Grayscale’s recent SEC filing, XRP operates on a peer-to-peer network of computers following cryptographic protocols, confirming its decentralized nature. Morgan also pointed to Bitwise and Franklin Templeton, both of which included similar language in their ETF documents describing the XRP Ledger as a shared public network akin to Bitcoin’s.

The discussion comes as the U.S. Securities and Exchange Commission continues reviewing several spot and futures XRP ETF applications. Morgan’s argument adds legal and reputational weight to XRP’s decentralization narrative, potentially strengthening the asset’s appeal among institutional investors.

On-Chain Flows Turn Slightly Positive

Exchange data from Coinglass shows a modest $258,000 net inflow on October 18, ending a multi-day sequence of outflows. While minor in scale, the uptick hints that sellers may be easing their pressure near current levels. Historically, small inflow upticks at structural supports have aligned with short-term recoveries for XRP.

Flows throughout 2025 have remained volatile, alternating between heavy distribution and brief accumulation phases. Analysts caution that a more meaningful bullish signal would require inflows above $10 million over consecutive days. Still, stabilization after persistent red readings marks an encouraging shift.

Technical Outlook For XRP Price

- Immediate resistance: $2.62–$2.77 zone

- Higher targets: $2.95, $3.10, and $3.35 if momentum strengthens

- Support levels: $2.28 and $2.10

- RSI: 35.05, showing room for recovery

Traders view $2.28 as the line separating stabilization from renewed selling. A sustained hold above this mark would likely encourage speculative entries ahead of potential ETF or regulatory headlines later in the quarter.

Outlook: Will XRP Go Up?

The near-term XRP price prediction points to cautious optimism. Community engagement has offered short-term relief, while technical compression signals a larger move ahead. As long as XRP price today holds above $2.28 and reclaims the $2.62 level, a rebound toward $2.95 remains plausible.

If resistance persists, sideways consolidation may continue into November. Analysts maintain that broader market stability and upcoming regulatory developments will determine whether this rebound evolves into a larger trend reversal. For now, XRP remains in a holding pattern — steady, patient, and waiting for its next catalyst.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.