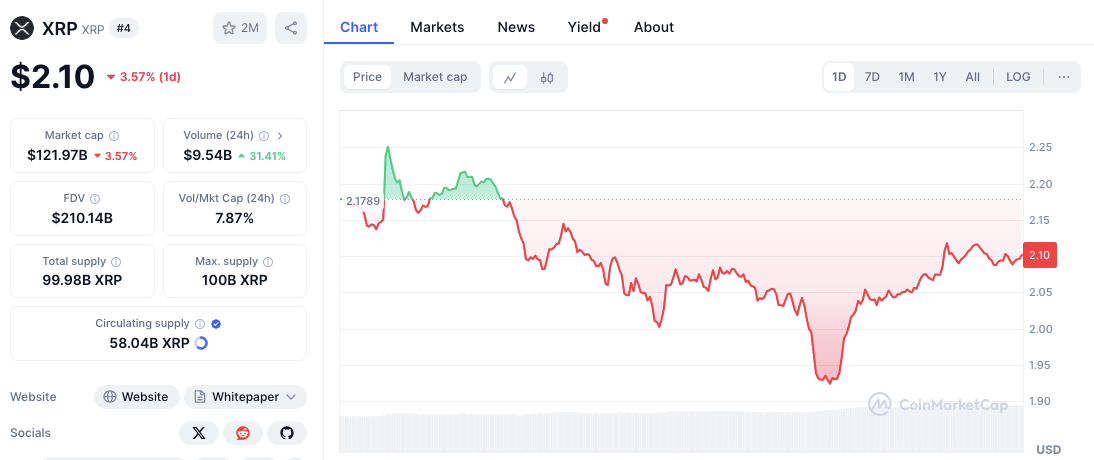

- XRP struggles below $2.15 resistance, with key support at $1.90–$1.95 holding firm.

- Increased trading volume suggests market uncertainty despite XRP’s brief rebound.

- RSI near oversold levels, but MACD signals ongoing bearish momentum for XRP.

The recent downturn in XRP’s price has sparked concerns among investors, particularly after a sharp 11% drop. As of press time, XRP is trading at $2.08, reflecting a 4.21% decline in the past 24 hours.

This downturn follows US President Donald Trump’s failure to provide clear plans regarding XRP’s inclusion in the nation’s digital asset stockpile.

While he confirmed the establishment of a Bitcoin reserve and an altcoin stockpile using seized assets, the absence of explicit mention of XRP has led to uncertainty in the market. With heightened trading activity and a noticeable dip, many investors are now questioning whether XRP can stage a recovery in the near future.

However, XRP possesses a unique attribute in the crypto space: regulatory clarity, thanks to its legal victory over the SEC. The question is: can this clarity act as a shield against broader market pressures, specifically looking ahead to March 12?.

XRP’s Price Action Shows Market Indecision

In the past day, XRP initially peaked at $2.1789 before facing selling pressure. The price later plunged below $2.00, hitting a low of around $1.90–$1.95. Still, it quickly rebounded above $2.00, suggesting buyers are active at lower levels.

In addition, trading volume surged by 32.37%, indicating more traders are reacting to price fluctuations. Despite this volatility, XRP remains at a pivotal point, and its next moves depend on whether it can sustain key support levels.

Related: XRP Search Popularity Surges in Korea, Doubling Bitcoin Searches but BTC Leads Mentions

Critical Support Zones Identified for XRP

Currently, XRP has two significant support levels. The first lies between $1.90 and $1.95, where the price recently rebounded. This range suggests strong demand and buying pressure at lower price points.

The second major support level is $2.00, a psychological threshold. If XRP falls below this mark again, it could trigger another wave of selling, potentially testing the lower range once more.

Resistance Points to Watch for XRP

Turning to resistance, the $2.15–$2.18 zone remains a crucial hurdle.

The price was rejected at this level previously, indicating that sellers are active in this range. Should XRP break past this resistance, it could aim for $2.20, which would mark a bullish reversal and pave the way for further gains.

Technical Indicators and Future Scenarios

Several technical indicators reflect the current bearish bias in the market. The Relative Strength Index (RSI) stands at approximately 40.97, indicating that XRP is nearing oversold conditions. However, it is not fully oversold yet, meaning further declines could still occur before a reversal happens.

The Moving Average Convergence Divergence (MACD) also signals ongoing bearish momentum. With the MACD line (-0.03193) below the signal line (-0.07539), sellers remain in control. That said, a bullish crossover could emerge if buying volume increases, potentially reversing the trend.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.